Nearly $100,000 in fresh whale orders hit Bitcoin Hyper within hours, nudging its viral raise beyond $18 million. With Q4 historically kinder to risk and altseason talk re-emerging, we unpack whether HYPER’s Bitcoin Layer-2 approach offers real utility – or just timely hype.

September’s drawdown left even large-caps nursing losses, but it also reset positioning. As investors scan for the best crypto to buy into Q4, they’re weighing two realities.

First, Bitcoin’s dominance remains intact, supported by ETFs and corporate treasuries. Second, activity continues to leak to faster execution environments where fees are minimal and block times are measured in milliseconds, not minutes. That tension – sound base-layer security versus modern throughput – sets the stage for projects trying to fuse both worlds.

Whales Signal Conviction As Presale Crosses $18M

Into that reset, wallets with deep firepower have started probing Bitcoin Hyper. In the span of two hours, one address placed an $87,000 buy and another followed with roughly $12,700, pushing the presale beyond $18 million.

Big accounts typically avoid illiquid presales; they prefer BTC and ETH for clean entry/exit. When they do step in early, it’s usually because they see asymmetric payoff – either from product-market fit, credible execution, or both. The inflows don’t guarantee outcomes, but they do raise the project’s signal amid a noisy pipeline ahead of Q4.

Bitcoin’s Bottleneck: Dominance Without Daily Usability

Bitcoin’s store-of-value thesis is proven; its network throughput isn’t. Ten-minute blocks and single-digit transactions per second leave little room for everyday payments, on-chain markets, or rapid-fire consumer apps. DeFi and NFTs flourished where execution was faster; meme markets did too.

The result is a paradox: BTC commands the deepest trust and balance sheets, yet much of crypto’s day-to-day experimentation happens elsewhere. If altseason materialises, capital typically rotates first to majors, then to high-beta names with usable rails. The open question: can BTC capture some of that activity without compromising its settlement guarantees?

Inside The Bitcoin Hyper Design

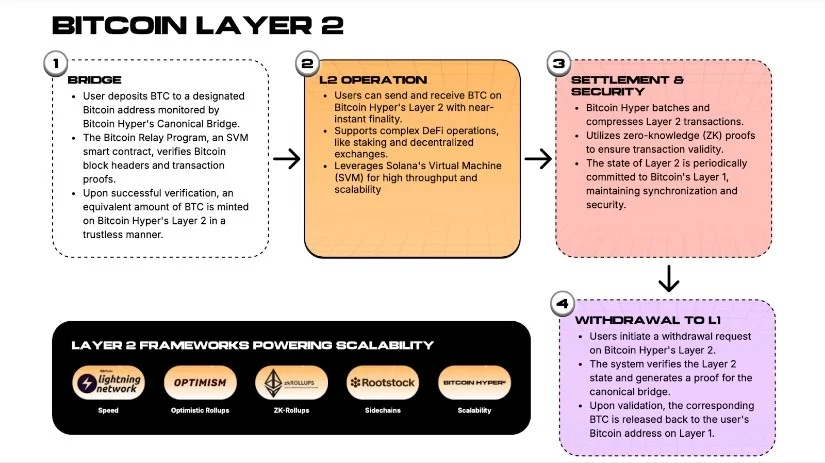

HYPER’s pitch is straightforward. Treat Bitcoin Layer-1 as the settlement anchor and add a high-throughput execution layer on top. Users bridge BTC into a canonical contract; a wrapped asset mints on the Hyper chain, which runs with Solana Virtual Machine (SVM) performance characteristics – sub-second confirmations and negligible fees.

Batches of transactions post back to Bitcoin using zero-knowledge proofs, aiming to preserve base-layer integrity while delivering modern UX. When users exit, BTC unlocks on Layer-1. In theory, that unlocks payments, DeFi, gaming and even meme culture – all denominated in and secured by, Bitcoin.

Design choices matter here. SVM compatibility lowers the barrier for thousands of developers already fluent in Rust/Solana tooling. A canonical bridge, rather than a loose sidechain custodian, reduces trust assumptions and ZK commitments are meant to bind fast execution back to Bitcoin’s finality. On-paper, that’s a path for BTC to become programmable capital, not just vaulted capital.

Why Timing Into Q4 Matters

Seasonality isn’t destiny, but Q4 has historically supported risk, with October and November frequently ranking among crypto’s best months. If flows stabilise after September’s cleanse, the market’s next phase often rewards credible utility plus velocity. That is precisely the window projects like Bitcoin Hyper hope to occupy: a Bitcoin-native venue with Solana-style speed, arriving as traders speculate about a fresh altseason.

Presale mechanics reinforce the narrative – HYPER’s price steps upward as milestones are met, the raise has already topped $18 million and whales have started leaning in. Momentum can be fickle, but timing plus architecture is why HYPER is now showing up on “best crypto to buy before Q4” shortlists.

Staking, Fees and The Token’s Economic Role

The token isn’t presented as a vanity chip. HYPER is slated to pay gas on the execution layer, secure staking and govern protocol upgrades. Early buyers cite current staking rewards alongside utility as reasons they’re allocating in presale rather than waiting for listings.

Importantly, demand drivers would need to be organic to persist: real dApps, real transaction volume and real BTC bridged. If builders ship payments, AMMs, lending and consumer apps that actually use the rails, HYPER’s fee and staking loop can become self-reinforcing rather than purely incentive-driven.

How HYPER Fits A Diversified Playbook

A common Q4 framework mixes core BTC/ETH with selective high-beta exposure. In that lens, Bitcoin Hyper can function as a thematic satellite position: a bet that BTC utility, not just custody, will matter this cycle.

It also complements a practical constraint. Many funds and sophisticated retail want Bitcoin’s settlement assurances but won’t sacrifice user experience to get it. If Hyper bridges the gap without introducing fatal trust assumptions, it captures flows that otherwise land on non-BTC rails.

That’s why some investors call HYPER “Bitcoin 2.0” – not because it replaces BTC, but because it tries to extend it into domains where speed and fees decide adoption.

What The Whale Prints Actually Mean

Do nearly $100,000 in back-to-back buys prove product-market fit? No. They show risk appetite and attention. In presales, early size often seeks a liquidation pathway after listings; equally, it can be a leading indicator of a project graduating from retail fad to broader speculation.

Here, the sequence matters: a $87,000 order followed by a $12,700 top-up suggests more than a random punt. Combined with a total raise above $18 million and daily inflows measured in hundreds of thousands, the pattern is consistent with institutional-style tickets testing depth ahead of altseason chatter.

Risks And What To Watch Next

No Layer-2 is immune to execution risk. Bridges are attack surfaces; ZK systems must be audited and performance-tuned; staking economics can wobble if emissions outpace real usage. Liquidity at launch matters: tight books can turn enthusiasm into volatility.

There’s also a category risk – Bitcoin scaling efforts have a mixed history and “sidechain” has been a dirty word when custodial trust was too high. For HYPER to justify the “best crypto to buy” label rather than merely the “loudest presale,” watch four things: audited bridge contracts, a clear path to mainnet with sequencer transparency, third-party dApps committing to launch and evidence of actual BTC bridging (not just paper TVL). If those boxes get ticked, whale interest becomes a thesis, not just a tape print.

The Macro Tailwind: Scarcity Meets Utility

Corporate and government BTC balances have grown alongside ETF adoption, reinforcing the scarcity narrative, but scarcity alone doesn’t drive transactions. If Bitcoin Hyper succeeds in making BTC usable – for coffee at the counter, for order-book trading, for consumer apps – demand could expand from “hold” to “use”.

That doesn’t just help HYPER; it could deepen Bitcoin’s role as both settlement asset and activity hub. In that world, Q4 isn’t only about rotating into altseason; it’s about capital rewarding infrastructure that compresses the distance between trust and throughput.

JOIN THE $HYPER PRESALE BEFORE ITS PRICE RISES SOON

Whales nibbling a presale, an $18-million-plus raise and an architecture that tries to graft Solana-grade speed onto Bitcoin’s security make Bitcoin Hyper hard to ignore. Whether it’s truly the best crypto to buy before a potential Q4 altseason depends on what ships next: audited bridges, live dApps and measurable BTC flowing across the canonical link.

If those arrive on schedule, $HYPER graduates from momentum trade to infrastructure bet. If not, it becomes another presale that popped on promise and faded on delivery.

For investors building a disciplined Q4 plan, that’s the line to watch – because in this market, the difference between a great story and a great outcome is always execution.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments are highly volatile and carry risks. Always do your own research before investing.