Bitcoin has once again been compared to gold, with forecasts suggesting it could climb as high as $350,000, but while the debate continues, new projects like Bitcoin Hyper are reshaping how Bitcoin might be used andwhere investors are looking for the next big move.

Bitcoin’s reputation as “digital gold” has been reinforced by fresh analysis comparing its market capitalisation to that of gold. With gold valued at nearly $24 trillion and Bitcoin at around $2.4 trillion, the disparity is clear. Analysts argue that if Bitcoin were to capture even 30 per cent of gold’s market share, its price could surge to roughly $350,000 per coin.

This comparison is not just theoretical. Gold has once again hit historic highs, trading above $3,500 per ounce and Bitcoin has followed suit, climbing to $115,537.

Historically, Bitcoin’s price action has lagged gold’s, only to outperform months later. For instance, after gold peaked in 2011, Bitcoin gained 145 per cent within a year. A similar trend in 2020 saw Bitcoin climb more than 300 per cent after gold touched $2,070.

Robert Kiyosaki, the bestselling author of Rich Dad, Poor Dad, has been one of the most vocal proponents of this bullish thesis. He describes Bitcoin as a hedge against economic instability and a superior store of value compared to traditional assets. He has also claimed that large institutions are deliberately holding Bitcoin’s price down to accumulate at lower levels, but he maintains that $350,000 remains within reach by 2025.

Other long-time advocates such as Jeremie Davinci echo this optimism, pointing to the cost of mining Bitcoin as a key metric. Historically, Bitcoin has often traded at five times its mining cost during bull markets and by that measure, $350,000 is not far-fetched.

The Problem With Bitcoin’s Network

Despite the optimism, Bitcoin’s limitations are becoming more evident. It is still the most traded digital currency in terms of volume, but its technology is showing strain under global demand. The network averages around seven transactions per second, with fees that can spike dramatically during busy periods.

These weaknesses mean that while Bitcoin is increasingly valued as a store of wealth, it struggles as a medium of exchange. The original peer-to-peer vision set out in Satoshi Nakamoto’s whitepaper remains largely unrealised. Competing blockchains like Ethereum and Solana have taken the lead in programmability, decentralised applications and DeFi.

This tension creates an opening for new solutions designed to extend Bitcoin’s functionality without undermining its security. That is where Bitcoin Hyper enters the discussion – a project positioning itself as the best crypto to buy now for those who believe Bitcoin needs a performance upgrade.

Enter Bitcoin Hyper: A Layer-2 Solution

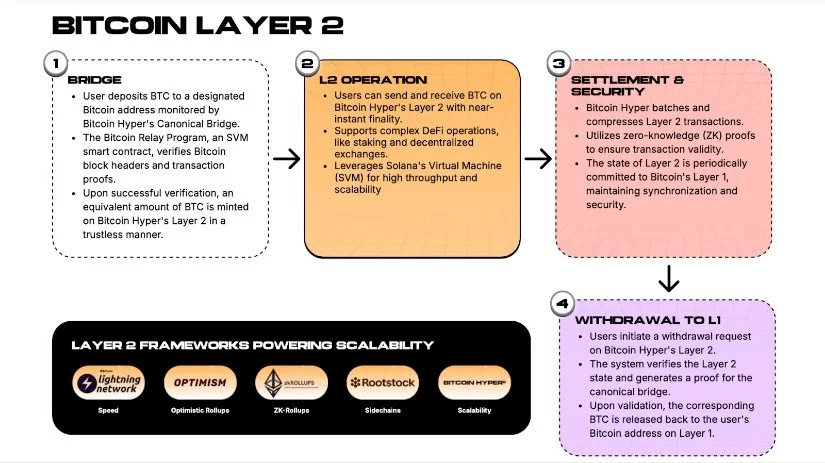

Bitcoin Hyper is a new Layer-2 project designed to scale Bitcoin to modern blockchain standards. By using a Canonical Bridge in combination with the Solana Virtual Machine (SVM), it allows users to transfer their Bitcoin onto a faster, more flexible network. Once on Bitcoin Hyper, transactions can reach speeds of over 65,000 per second – a dramatic leap from Bitcoin’s single-digit throughput.

The key innovation lies in its use of zero-knowledge proofs and rollups. Transactions are bundled, processed off the main Bitcoin chain and periodically committed back to it for security. This approach means users get instant, low-cost transactions without sacrificing Bitcoin’s decentralised and secure foundation.

The native $HYPER token powers this ecosystem, used for transaction fees, staking and governance. Developers can also leverage the SVM to port existing Solana-based applications directly onto Bitcoin Hyper, enabling NFTs, DeFi protocols and gaming dApps to flourish within the Bitcoin economy.

Presale Momentum and Market Context

Bitcoin Hyper’s presale has already raised more than $17 million, reflecting both whale interest and retail enthusiasm. Investors have been drawn by the combination of utility, timing and staking rewards – currently offering an annual yield above 65 per cent during the presale phase.

These figures place it among the most successful public raises of 2025. The fact that such momentum is building during a period of heightened debate around Bitcoin’s future price only strengthens the perception that Bitcoin Hyper could benefit directly from renewed market optimism.

The broader macroeconomic environment adds to this. With the Federal Reserve signalling further rate cuts, risk assets such as Bitcoin have already begun to rise. If historical patterns hold, the next twelve months could see Bitcoin climb substantially. For high-beta plays like Bitcoin Hyper, which mirror Bitcoin’s direction but offer greater upside due to smaller market caps, the impact could be even more dramatic.

Analyst and Whale Interest

Crypto analysts have taken note of Bitcoin Hyper’s rapid progress. Some, including contributors to 99Bitcoins, have suggested that it could deliver 100x returns from presale levels if adoption accelerates. Their reasoning is simple: Layer-2 solutions are highly leveraged plays on their underlying Layer-1 blockchains.

Institutional interest also appears to be building. Reports show five-figure and six-figure purchases of HYPER tokens, with one whale recently investing over $160,000.

$HYPER is a credible new entrant. It has technical foundations, its audited contracts and its growing staking pool as signs of a project with staying power, rather than just speculative hype.

Why Bitcoin Hyper Could Be the Best Crypto to Buy Now

The combination of Kiyosaki’s $350K Bitcoin forecast and Bitcoin Hyper’s technological promises illustrates two sides of the same story.

On one hand, Bitcoin remains a leading store of value with potential for huge price appreciation. On the other, its network limitations could prevent it from fulfilling the broader role many believe it is destined for.

Bitcoin Hyper sits at the intersection of these dynamics. It enhances Bitcoin’s scalability and programmability, effectively extending the asset’s use case beyond digital gold. If Bitcoin does climb towards $350,000, a scalable Layer-2 like Bitcoin Hyper could see amplified gains as traders and developers seek a faster way to engage with the Bitcoin ecosystem.

This dual positioning – as both an innovation and a high-beta bet on Bitcoin – is why many consider HYPER the best crypto to buy now.

Bridging Prediction and Innovation

Predictions of Bitcoin at $350,000 highlight the enduring belief in its role as a global store of value. Figures like Robert Kiyosaki may be controversial, but their arguments resonate with a growing number of investors who see Bitcoin as the hedge of the digital age.

At the same time, projects like Bitcoin Hyper show that innovation around Bitcoin is far from over. By tackling the very problems that critics point to – slow speeds, high fees, lack of programmability – Bitcoin Hyper could ensure that Bitcoin remains relevant as both a store of value and a functioning financial system.

BE PART OF THE L2 REVOLUTION OF BITCOIN WITH $HYPER

Whether or not Bitcoin reaches $350,000, the search for the best crypto to buy now will always lead to projects that combine strong fundamentals with real-world solutions. Bitcoin Hyper, with its bold Layer-2 vision, may well be one of those projects.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Cryptocurrency markets are highly volatile and involve significant risk. Always conduct your own research and consult with a licensed financial advisor before making any investment decisions.