New York’s financial regulator has mandated banks to adopt blockchain analytics, marking a historic moment for the convergence of traditional finance and crypto, but what does this mean for everyday users? The rise of compliance-first apps like Best Wallet may offer some clues.

The New York State Department of Financial Services (NYDFS) has issued a clear directive: all state-chartered banks and foreign branches must integrate blockchain analytics into their compliance programs.

The move represents one of the strongest acknowledgements yet that cryptocurrency is not a niche concern but a systemic feature of modern finance.

Superintendent Adrienne Harris emphasised that the evolving digital asset landscape demands smarter tools to counter risks such as money laundering, sanctions violations and illicit transfers. By embedding blockchain analytics into risk management, banks are expected to demonstrate they can identify and mitigate threats as effectively in crypto markets as they do in fiat.

This isn’t an entirely new direction. NYDFS first introduced similar requirements for licensed crypto firms in 2022. Extending them to banks signals that regulators see crypto as fully intertwined with the mainstream economy. Tools like Chainalysis or Elliptic, once associated mostly with exchanges, are now a baseline expectation for legacy financial institutions.

Why Compliance Could Drive Adoption

The NYDFS notice is not introducing brand-new law but clarifying expectations. Analysts view this as a significant step because compliance frameworks often set the foundation for adoption. By making blockchain analytics mandatory, regulators are effectively signalling to institutions that digital assets must be taken seriously.

This clarity could extend far beyond New York. Other US regulators are likely to use the NYDFS approach as a blueprint, meaning blockchain analytics may become a standard across the country’s banking sector. Banks that fail to integrate these tools risk scrutiny, fines and reputational damage.

For customers, this raises new questions about how their crypto interactions are monitored. Screening wallets, verifying fund origins and flagging transactions linked to high-risk tokens is no longer just an exchange issue – it’s a mainstream banking requirement. That shift brings with it a demand for retail-friendly tools that can keep users safe in an environment where compliance matters as much as convenience.

Blockchain Analytics Meets Everyday Finance

Blockchain analytics offers transparency that legacy systems can’t easily replicate. By tracing transactions through public ledgers, institutions can assess counterparties, identify suspicious flows and build stronger protections against fraud.

But there’s another side to the story. As banks adopt blockchain intelligence, retail users also need wallets that help them stay ahead of regulatory and security expectations. This is where applications like Best Wallet come into play – crypto tools designed not just for ease of use but for compliance and protection.

Best Wallet as a Security-First Alternative

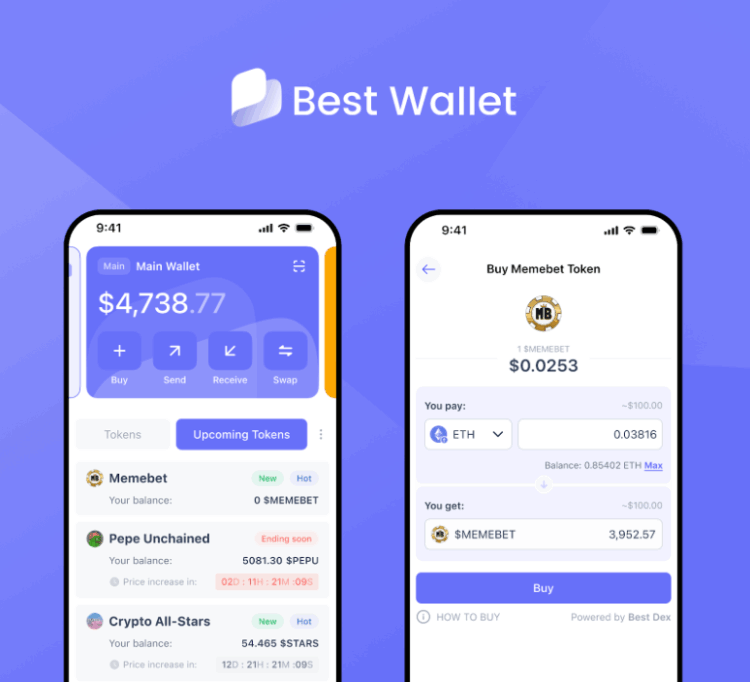

Best Wallet has emerged as one of the most talked-about crypto wallets of 2025. Unlike early wallets such as MetaMask that prioritised functionality but left security gaps, Best Wallet integrates institutional-grade protection. Built on Fireblocks’ MPC (multi-party computation) technology – the same infrastructure used by banks – the app provides a security foundation aligned with the regulatory demands now shaping finance.

The wallet is non-custodial, meaning users retain full control of their keys. It also offers advanced safeguards, including biometric login and phishing site protection. The internal Best Wallet team verifies each listed token, an important step in preventing users from interacting with scam contracts – an increasingly relevant feature as regulators spotlight illicit flows.

By aligning its model with compliance expectations, Best Wallet positions itself as more than just a convenience tool. It could represent the retail counterpart to the institutional blockchain analytics now being mandated for banks.

Beyond Safety: Usability and Innovation

Best Wallet doesn’t stop at compliance. It also aims to simplify the user journey. Unlike traditional presale participation, which requires navigating external sites and connecting wallets, Best Wallet allows users to buy presale tokens directly within the app. This reduces risk while making the process more accessible.

Features like multi-chain support, staking integration and portfolio organisation let users segment long-term holdings from active trades. Upcoming features include a debit card with cashback rewards, reflecting a push to make crypto spending as seamless as using fiat.

The Best Wallet Token ($BEST) powers the ecosystem. Holders gain reduced fees, governance rights, early access to new presales and staking rewards. With over $16 million raised in its ongoing presale and a growing user base, $BEST is attracting attention not just as a utility token but as an investment in the wallet’s growth trajectory.

How Compliance Shapes Market Winners

The overlap between banks adopting blockchain analytics and retail wallets like Best Wallet is no coincidence. Both respond to the same pressure: a financial system where transparency, risk management and user protection are paramount.

For banks, compliance is non-negotiable. For retail users, safety and legitimacy are increasingly crucial in an environment where scams and hacks still make headlines. A wallet that can deliver both security and convenience – while embedding features regulators want to see – has a strong chance of thriving.

Market Implications

New York’s guidance signals more than just regional oversight. By requiring banks to adopt blockchain analytics, regulators are effectively normalising compliance standards that ripple into retail markets. This shift strengthens the case for consumer-facing tools that align with institutional expectations.

Rather than stifling innovation, regulatory tightening often professionalises the crypto sector, creating conditions for products and services to scale responsibly. Wallets such as Best Wallet are well positioned to benefit from this environment, as adoption is increasingly shaped by the same frameworks that institutions must follow.

Risks and Considerations

Despite the optimism, challenges remain. Futures-based ETFs, presales and high-yield staking programmes carry risks ranging from regulatory intervention to technical vulnerabilities. For wallets, the need to maintain user trust is paramount. Any lapses in security or token vetting could undermine credibility.

For banks, blockchain analytics is a step forward, but integrating these tools into legacy systems is complex and resource-intensive. Smaller institutions may struggle to keep pace and inconsistencies in adoption could create uneven protection for customers.

A Convergence of Regulation and Retail

The NYDFS decision to force banks into blockchain analytics is a landmark moment for financial regulation in the US. It signals that crypto is no longer peripheral – it is central to the future of banking oversight.

At the same time, retail tools like Best Wallet reflect how this shift translates for everyday users. By embedding compliance-aligned features alongside accessibility and innovation, Best Wallet stands out as a potential leader in the next wave of adoption.

BE AT THE FOREFRONT OF THE NEXT WAVE OF CRYPTO ADOPTION WITH BEST WALLET

The message is clear: blockchain analytics is no longer optional for banks and secure wallets are no longer optional for individuals. Together, these developments point to a more transparent, regulated and user-centric future for digital assets – one where compliance doesn’t just constrain, but actively drives adoption.

Disclaimer: This article is for news and analysis, not investment advice. Cryptoassets are volatile and unregulated in many jurisdictions. Never invest money you can’t afford to lose.