Poland’s Warsaw Stock Exchange has launched its Bitcoin BETA ETF, but attention is shifting to Bitcoin Hyper – a new Layer-2 promising speed, programmability and big growth potential.

The Warsaw Stock Exchange (GPW) made history this September with the launch of Poland’s first Bitcoin ETF. Managed by AgioFunds TFI SA, the Bitcoin BETA ETF tracks Bitcoin futures contracts listed on the Chicago Mercantile Exchange (CME). Rather than holding spot Bitcoin, it provides investors with regulated exposure to derivatives markets, reflecting a cautious but deliberate step into digital assets.

Poland’s Financial Supervision Authority (KNF) approved the ETF prospectus on 17 June 2025, leading to the issuance of two series of investment certificates. To ensure stability, Dom Maklerski Banku Ochrony Środowiska S.A. was appointed as market maker, maintaining orderly spreads and sufficient liquidity.

One innovation is the ETF’s FX hedge, designed to offset fluctuations between the U.S. dollar and Polish zloty. For Polish investors, this reduces currency risk, making the product more accessible in a volatile global environment.

With this, Poland becomes part of a growing club of nations offering regulated crypto access, joining the U.S., Germany and others in opening traditional rails for Bitcoin exposure.

The debut comes at a time of heightened interest in ETFs. GPW now lists 16 exchange-traded products spanning local indexes like WIG20 and global benchmarks such as the Nasdaq-100 and DAX. According to Kazimierz Szpak, CEO of BETA TFI SA, the Bitcoin ETF caters to the demand for transparent and regulated access to new asset classes.

Why Futures-Based ETFs Are Both a Bridge and a Limit

The launch is undoubtedly a milestone, but futures-based Bitcoin ETFs are not a perfect proxy for owning Bitcoin itself. Rolling contracts can create performance drags and fees add up over time. By design, investors in Poland are getting exposure to the idea of Bitcoin within a regulatory framework, not the asset’s full utility.

That duality underscores an important trend: institutionalisation opens doors, but it rarely captures the grassroots innovation driving crypto’s evolution. Futures ETFs lower barriers for risk-averse investors, but they don’t address Bitcoin’s technical bottlenecks – slow throughput, high fees during congestion and limited programmability.

That is where the conversation naturally extends from Poland’s regulated debut to Bitcoin Hyper ($HYPER), a project that aims to give Bitcoin the missing features needed for a modern, app-driven ecosystem.

Bitcoin Hyper: A Layer-2 Built for Scale

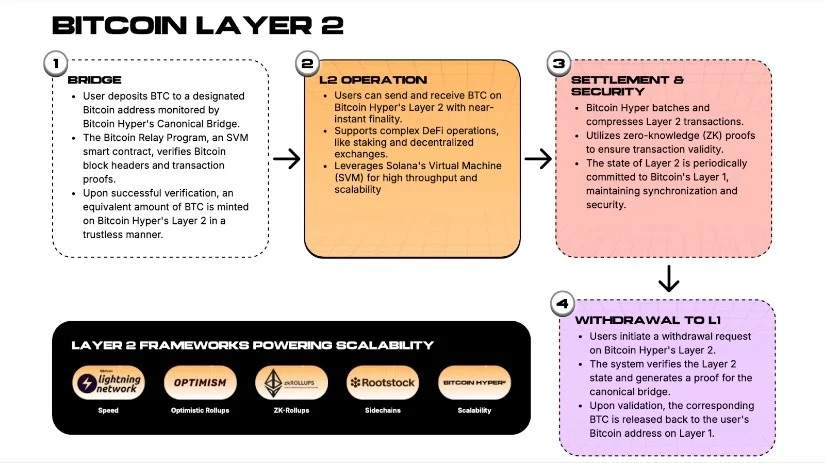

While the ETF launch is a financial milestone, Bitcoin Hyper is being framed as a technological breakthrough. Positioned as the first ZK-rollup Layer-2 for Bitcoin, it promises to boost throughput from Bitcoin’s current 7 transactions per second to thousands.

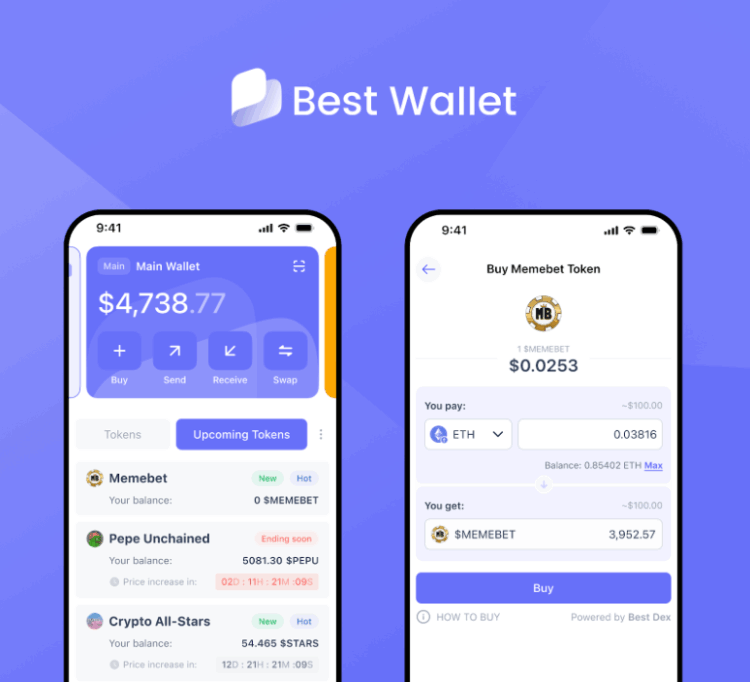

At its core, Bitcoin Hyper uses rollups to batch transactions off-chain, committing proofs back to Bitcoin’s base layer for security. A canonical bridge allows users to transfer BTC in and out, converting it into wrapped Bitcoin (WBTC) usable across dApps, DeFi protocols and even NFTs.

Crucially, Bitcoin Hyper isn’t limited to payments. By integrating a Solana Virtual Machine (SVM) environment, it opens the door for developers to port Solana projects directly into Bitcoin’s ecosystem. That means dApps, gaming projects and smart contracts can operate on a Bitcoin-secured Layer-2 – a functionality long missing from the network.

Presale Momentum and Whale Interest

Investors are taking notice. The Bitcoin Hyper presale has already raised $17.4 million, making it one of the largest public raises in 2025. Daily inflows of $200k–$300k show steady retail engagement, while whales have also moved in: recent on-chain data shows purchases of $17,600 and $18,000 in single transactions.

The project’s staking mechanism adds further appeal. Offering 66% APY, it incentivises long-term holding, with over 792million HYPER tokens already locked. This may well be a sign of community conviction, reducing short-term sell pressure when the token eventually lists.

Market commentators have gone further. Umar Khan of 99Bitcoins suggested HYPER could achieve 100x gains once live, while Alessandro de Crypto described it as the best way to capitalise on Bitcoin’s upcoming cycle: “Bitcoin is in the calm before the storm – HYPER could be the engine of its next phase”.

FED Cuts and European Adoption

Both Poland’s ETF launch and Bitcoin Hyper’s rise are happening against a favourable macro backdrop. The U.S. Federal Reserve recently cut rates for the first time in 2025, with futures markets pricing in two more cuts before year-end. Historically, rate-cut cycles have triggered strong inflows into risk assets, particularly crypto.

For Bitcoin, lower rates often mean more liquidity and renewed speculative appetite, but instead of piling into an already $2.3 trillion market cap, many traders are targeting Layer-2 projects that promise asymmetrical returns. That dynamic helps explain Bitcoin Hyper’s explosive presale momentum.

Poland’s ETF meanwhile highlights Europe’s role in legitimising Bitcoin in traditional finance. By hedging currency exposure and offering local brokerage access, the ETF bridges a demographic that has been hesitant to buy crypto directly.

Together, both developments signal the convergence of institutional and retail narratives: regulated access on one side, frontier innovation on the other.

Risks and Realities

Neither development is without caveats. For Poland’s ETF, futures-based exposure means tracking error, roll costs and fee drag – issues that long-term investors will need to weigh. For Bitcoin Hyper, the risks are inherent to any presale: execution risk, security vulnerabilities and the challenge of building a developer ecosystem from scratch.

Moreover, while analysts project 10x–100x returns for HYPER, such forecasts are speculative. Crypto remains volatile and even projects with promising tech can falter without adoption.

Poland’s ETF and Bitcoin Hyper Mark Different Frontiers

Poland’s Bitcoin ETF is a landmark for European finance – a sign that digital assets are no longer fringe but increasingly woven into regulated markets. For investors who prefer local exchanges and FX hedging, it’s a gateway that wasn’t available before.

Bitcoin Hyper, by contrast, represents the other end of the spectrum: an attempt to push Bitcoin’s functionality into a new era of speed, programmability and real-world applications. Its presale success reflects not just appetite for risk but recognition that Bitcoin needs scaling solutions to stay competitive.

Together, they illustrate the two tracks of crypto’s evolution in 2025: one regulatory, cautious and institution-facing; the other experimental, high-risk and community-driven.

INVEST IN BITCOIN HYPER – INVEST IN BITCOIN’S FUTURE

Whether Poland’s ETF proves sustainable, or Bitcoin Hyper fulfils its 10x ambitions, both underline a simple truth – Bitcoin’s story is still being written and the next chapters will be shaped at both the exchange and the protocol level.

Disclaimer: This article is for news and analysis, not investment advice. Cryptoassets are volatile and unregulated in many jurisdictions. Never invest money you can’t afford to lose.