The REX-Osprey Dogecoin ETF smashed first-hour expectations with $6 million in turnover, putting regulated meme exposure on center stage. Here’s what that means for DOGE and why traders are suddenly debating whether Maxi Doge could be the next big meme coin to benefit from ETF-driven attention.

A blockbuster debut for DOJE and a new test for meme-coin market structure

The first U.S. Dogecoin ETF didn’t tiptoe onto the tape – it sprinted.

Within the opening hour on Sept. 18, the REX-Osprey fund (ticker: DOJE) turned over roughly $5.8–$6 million, handily beating typical day-one ETF volumes and “destroying” the $2.5 million over/under line set by Bloomberg’s Eric Balchunas. DOGE itself was last seen near $0.25, after an early pop faded.

Context matters: unlike spot Bitcoin ETFs registered under the 1933 Securities Act, DOJE arrived via the Investment Company Act of 1940 – a path some expected might blunt enthusiasm.

Instead, the opener suggests there’s durable retail demand for meme-coin exposure in a brokerage-friendly wrapper. Issuers clearly smell opportunity too: REX filed for a “DOJE Growth & Income” strategy the same day, while Tidal Financial lodged new applications for leveraged crypto index ETFs aimed squarely at alt-season rotations.

Whether DOJE sustains this pace is an open question, but the debut resets expectations for how far “ETFization” can stretch, from blue-chip crypto toward speculative corners historically driven by community narratives.

Why an ETF Changes the DOGE Conversation and Why Ceilings Still Matter

Bringing DOGE into the ETF fold confers three practical benefits: regulated access, easier portfolio plumbing and potential liquidity depth across traditional brokerages. It also nudges Dogecoin’s reputation away from “pure meme” toward “speculative asset with institutionalised rails,” a psychological shift that often broadens the buyer base.

Yet there’s a structural cap to how much a Dogecoin ETF can do on its own. At a $37B+ market value, DOGE already sits in large-cap territory. Big numbers cut both ways: they dampen volatility, but they can also limit upside unless new capital arrives in size. That helps explain why DOGE’s post-headline lift stalled below the technically important $0.30 zone before dropping to $0.25; the trade now needs follow-through, not just first-day curiosity.

This is where the market’s attention often pivots. When a large-cap catalyst hits, some participants harvest gains and start scanning for the next big meme coin with a smaller float and a cleaner runway – typically projects that rhyme with the leader but promise earlier-stage torque.

Why Maxi Doge is Suddenly on Traders’ Dashboards

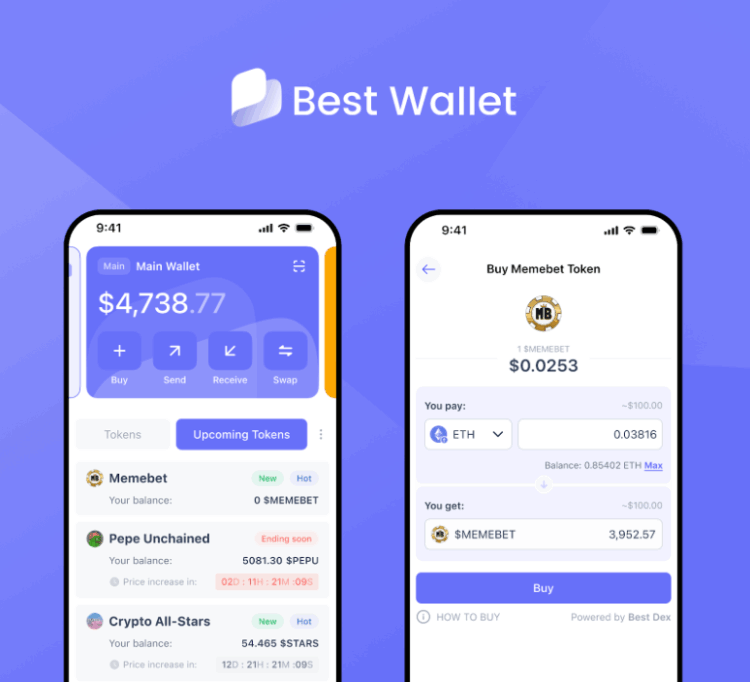

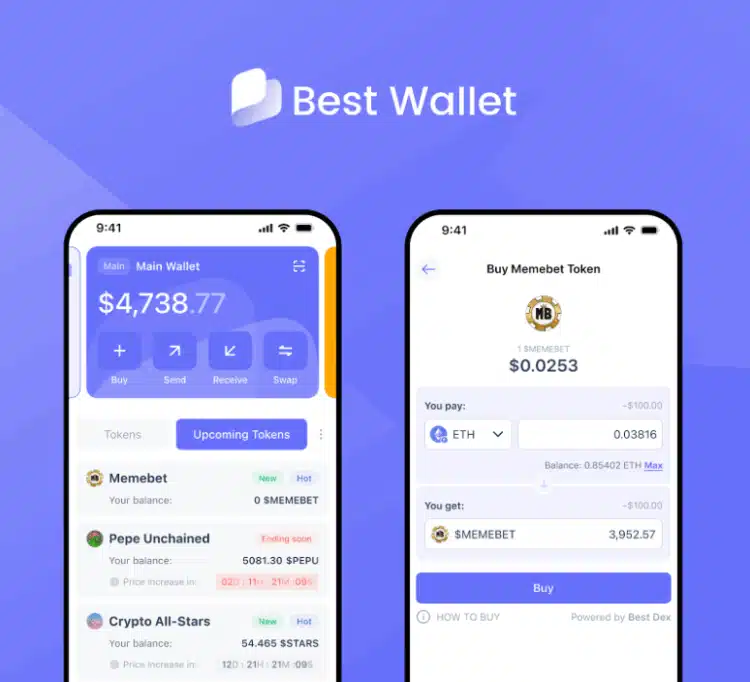

Enter Maxi Doge ($MAXI). While established dog-themed tokens like SHIB and BONK bounced on the DOJE reveal, the day after saw a familiar pattern: majors cooled; presales with strong narratives drew fresh inflows.

Maxi Doge’s raise pushed beyond $2.4 million, with at least one $30k+ ticket noted, as traders looked for high-beta vehicles that could benefit from meme-sector mindshare without carrying DOGE’s large-cap gravity.

The pitch is simple and loud by design. Maxi Doge leans into a “gym-bro, high-leverage” identity – a tongue-in-cheek evolution of the Shiba Inu brand that celebrates risk-on culture. Under the hood, the team outlines fixed supply, third-party audits and an early staking program that has drawn billions of tokens into the pool, with a dynamic APY that has hovered in the 137% range during presale.

The roadmap sketches DEX first, then CEX outreach, plus integrations aimed at enabling high-multiple futures exposure around the token – a narrative that resonates with speculators hunting outsized moves.

None of that makes $MAXI destiny, but it does explain why the project has moved quickly from obscurity to watchlist: it captures the energy released when a headline-maker like a Dogecoin ETF reminds the market that memes still move money.

What the DOJE Launch Signals for the Rest of 2025’s Meme Cycle

ETF debuts don’t operate in a vacuum. DOJE’s first session arrived amid a broader expansion of crypto product design: more levered choices, alt-inclusive baskets and income strategies. If issuers continue down this road, we’ll likely see two parallel flows:

Core exposure via ETFs to anchor portfolios and perimeter bets in small caps, where community and catalysts can still 10x a thesis – or unwind it just as fast.

That barbell suits retail behavior in a liquidity upswing: own the benchmark meme through a familiar wrapper and speculate at the edges where reflexivity lives. For projects like Maxi Doge, the practical question is whether they can convert attention into sustained community activity – trading contests, transparent treasury use (e.g., the MAXI Fund), road-tested token mechanics – rather than a one-week pop.

The Maxi Doge case, in full: narrative, mechanics and the risk ledger

The next big meme coin label gets thrown around too easily. To assess MAXI on its merits, three pillars matter:

1. Narrative fit. Maxi Doge doesn’t abandon the Doge canon; it reframes it for 2025’s high-octane, trader-meme culture. That coherence – the “younger cousin on 1,000x caffeine” motif – helps compress awareness cycles. Memes aren’t just marketing; they’re distribution.

2. Early-stage structure: Presales introduce pricing asymmetry, but they also demand discipline. MAXI’s fixed supply and audit disclosures reduce, not remove, typical presale risks. Staking during presale can deepen holder stickiness ahead of the first listing – though APYs this high are, by definition, temporary and will compress as participation scales.

3. Execution path: The promised push toward futures integrations would, if realised, reinforce the brand’s core proposition, but integrations are partner-dependent and listing timelines are rarely linear. Deliverables and transparency in the first 90 days post-DEX tend to define whether a meme coin sustains or fades.

On the risk side, nothing about meme coins changes the old rules. Presales carry contract and counterparty risk; liquidity can vanish; social sentiment whipsaws; and leverage, if and when it’s available, magnifies both sides of the trade. The same moderation that applies to DOGE ETF exposure – position sizing, scenario planning – applies doubly in micro-cap land.

How The Retail Playbook is Evolving After DOJE

One immediate effect of the Dogecoin ETF is educational. When a meme coin shows up in a brokerage account, it inevitably draws in new eyes – some of whom will want direct exposure to the token economy that underlies the ticker. In past cycles, that curiosity translated into on-chain exploration and, often, into newly created communities around emerging projects.

That recursive loop is already visible: DOGE’s warm reception reignited scanning for small-cap canine plays; Maxi Doge’s raise accelerated; and analysts who follow presales began debating whether MAXI could stage a credible run if its post-listing roadmap lands on time. It’s not a foregone conclusion, but it is the market we’ve seen before: catalysts at the top, torque at the edges.

What DOJE Got Right and What Maxi Doge Still Has to Prove

DOJE’s first-hour print wasn’t just big; it was symbolic. It told us that regulated wrappers can translate meme demand into measurable, tradable flows. It also reminded us that the next big meme coin conversation never really stops – it only rotates.

For Dogecoin, the ETF raises the bar: more mainstream rails, more scrutiny and a higher standard for holding breaks above key levels like $0.30. For Maxi Doge, the presale momentum and community engagement are necessary conditions – not sufficient ones. Execution across listings, competitions and any promised integrations will decide whether $MAXI becomes a cycle character or a headline cameo.

PUMP HARD WITH MAXI DOGE BEFORE YOU MISS OUT

As Wall Street and Web3 inch closer, the opportunity and the responsibility – expands. ETFs may standardise access, but they don’t erase risk. Micro-caps may offer upside, but they demand caution. Somewhere between those poles sits the modern meme-coin portfolio: a little bit institutional, a little bit degenerate and always one news cycle away from a new leader.

Disclaimer: This article is for news and analysis, not investment advice. Cryptoassets are volatile and unregulated in many jurisdictions. Never invest money you can’t afford to lose.