Dogecoin Mining Basics in 2025

Dogecoin mining has evolved since its early days, with Scrypt ASICs and mining pools now dominating the scene, but as DOGE’s mainstream appeal grows, newcomers like Maxi Doge are seizing the spotlight with presale momentum, staking rewards and a playful take on meme culture.

Dogecoin mining remains the process of validating Scrypt-based blocks on the merged Litecoin–Dogecoin network and receiving DOGE as a block reward. Because Litecoin and Dogecoin share the same proof-of-work algorithm, modern miners can earn both coins simultaneously, with most pools paying rewards directly in DOGE.

When it comes to hardware, serious miners use ASICs such as the Bitmain Antminer L7, capable of 9,500 MH/s, or the more modest Goldshell Mini-DOGE PRO at 205 MH/s.

These purpose-built machines dominate profitability in 2025. While GPUs and DIY rigs can still run open-source mining software, electricity costs almost always outweigh the returns.

For software, options range from beginner-friendly MultiMiner to command-line veterans like CGMiner and BFGMiner. More advanced miners rely on Hive OS, a dedicated Linux system that lets users manage multiple ASICs from a single dashboard.

Cloud mining remains another avenue, where hash power is leased from providers like NiceHash. While this approach removes the hardware burden, contracts often cost more than direct mining revenue, so careful profitability checks are essential.

Mining Pools and How Rewards Work

Solo mining Dogecoin is virtually impossible today due to the scale of network difficulty. Instead, most miners join pools such as F2Pool, ViaBTC, or LitecoinPool, which aggregate work from thousands of participants to discover valid blocks every 2.5 minutes.

Here’s how the flow works: ASICs solve Scrypt puzzles and send shares to the pool; the pool logs these contributions and when a block is found, Litecoin’s blockchain records it. Dogecoin’s auxiliary chain recognises the block and distributes 10,000 DOGE to the pool. Rewards are then divided among miners based on contributed hash rate, minus a 1–2% pool fee.

To receive rewards, miners need a Dogecoin-compatible wallet. Popular options include the Dogecoin Core wallet, Exodus, or hardware wallets like Ledger.

Steps to Mine Dogecoin:

1. Mining Dogecoin can be broken down into a clear sequence:

2. Buy Dogecoin Mining Hardware: Select an efficient ASIC like the Antminer L7 or Mini-DOGE PRO.

3. Download and Configure Software: Flash the ASIC with manufacturer firmware or install Hive OS. Enter pool details, worker name and secure credentials.

4. Join a Pool: Sign up with a trusted pool, link your wallet address and set your payout preferences.

5. Connect Hardware: Point your ASIC’s stratum address to the pool and start hashing.

6. Set Up a Wallet: Paste your DOGE wallet address into the pool’s dashboard to receive automatic payouts.

7. Start Mining: Monitor pool dashboards for shares and earnings, adjusting fan profiles and power settings for efficiency.

Profitability and Challenges

Mining profitability depends on several variables: electricity cost, ASIC efficiency, network difficulty, pool fees and DOGE’s market price. With current difficulty rates, an Antminer L7 can theoretically mine the equivalent of one Dogecoin in 0.008 seconds, but in practice, payouts are bundled and distributed periodically by pools.

Profitability calculators such as CoinWarz remain essential tools, as electricity costs above $0.08 per kWh can quickly wipe out gains. Many hobbyists still mine DOGE at a small loss, treating it as a long-term bet on appreciation rather than immediate profit.

Enter Maxi Doge – Dogecoin’s Playful Heir

While mining DOGE has matured into an industrial-scale pursuit, the meme coin sector itself is evolving. Enter Maxi Doge ($MAXI) – a gym-bro inspired, high-octane meme token positioning itself as Dogecoin’s “younger cousin”.

Maxi Doge’s presale has already raised over $2.3 million, with individual whales committing more than $30,000. Unlike mining, which demands ASICs and electricity bills, $MAXI is accessed through a simple presale website, allowing buyers to join with Ethereum or stablecoins via a connected wallet.

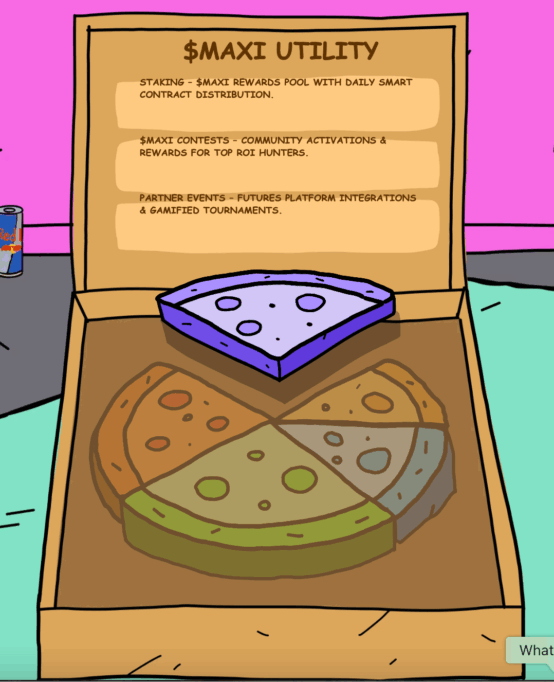

The token combines playful branding with functional tokenomics. It has a fixed supply, audited contracts and staking rewards estimated at 144% APY. Over 5.3 billion $MAXI tokens are already staked, underscoring strong early community commitment.

Roadmap and Utility Beyond Memes

Maxi Doge isn’t just about memes. Its roadmap includes listings on both decentralised (DEX) and centralised (CEX) exchanges, integrations with futures trading platforms and weekly trading competitions that distribute crypto rewards. This dual focus – fun plus function – mirrors Dogecoin’s original rise but adds new layers of participation.

YouTuber Crypto Tech Gaming has called MAXI “a presale to watch,” citing its potential to rally after listings. The presale price of $0.000258 is scheduled to rise in the next round, adding urgency for early adopters.

How to Buy Maxi Doge

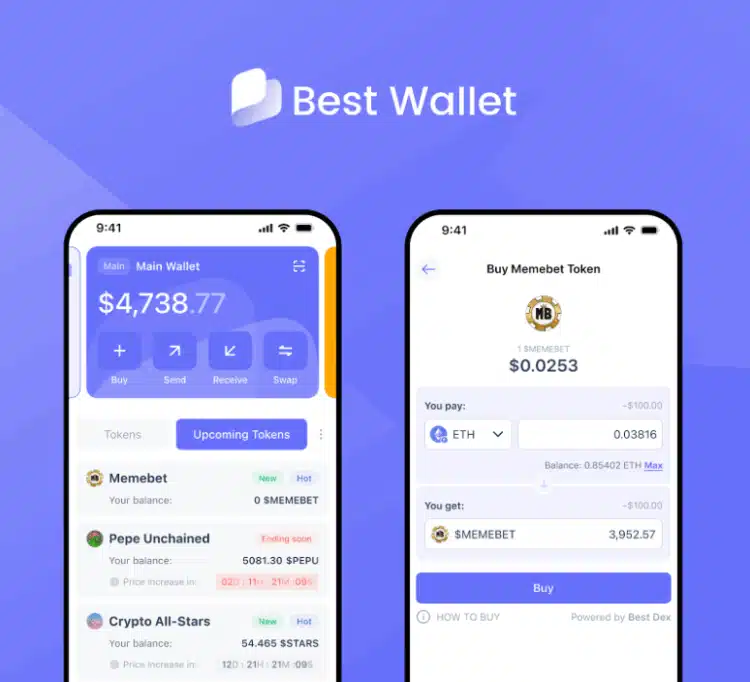

Buying MAXI requires an Ethereum-compatible wallet. Options include Best Wallet, a beginner-friendly app with watchlists and scam filters, or established tools like MetaMask.

Once the wallet is funded with ETH, USDT, or USDC, users connect to the Maxi Doge presale site, swap tokens and later claim MAXI after the presale concludes.

Best Wallet is highlighted by the project as a simple entry point, especially for first-time buyers. Beyond presales, it also provides token alerts, portfolio views and scam detection – features particularly useful in meme coin markets.

Should You Buy $MAXI?

Maxi Doge exists in the same volatile territory as all meme coins. Its strengths lie in community energy, audited contracts, staking mechanics and a roadmap that blends speculation with utility, but like Dogecoin before it, MAXI’s value will be driven as much by hype and meme culture as by fundamentals.

For those who missed Dogecoin’s early days, MAXI presents a chance to ride a new meme narrative, but the same rule applies: never invest more than you can afford to lose, especially in high-risk sectors like meme tokens.

Mining or Meme Coins?

Learning how to mine Dogecoin offers an entry into one of crypto’s most enduring meme coins, but the barriers to profitability are high in 2025. Expensive ASICs, electricity costs and industrial-scale mining pools mean it’s no longer a casual hobby for most.

At the same time, projects like Maxi Doge represent the next frontier in meme-driven speculation. With a strong presale, staking rewards and an evolving roadmap, MAXI is already attracting attention as a possible successor to DOGE’s meme crown.

PUMP HARD WITH MAXI DOGE BEFORE YOU LOSE OUT

In many ways, the two stories reflect crypto’s split personality: Dogecoin mining rooted in proof-of-work infrastructure and Maxi Doge thriving in the freewheeling culture of presales and social-driven hype. Together, they highlight how crypto continues to blend old mechanics with new memes and why both remain central to the market’s unpredictable energy.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments are highly volatile and carry significant risk. Always do your own research before investing.