The past month offered another harsh reminder of the crypto industry’s Achilles heel: security. According to blockchain analytics firm PeckShield, hackers and scammers drained more than $163 million from the market in August 2025.

That figure represents a 15% rise from July’s $142 million in losses and underscores how lucrative targeting centralised exchanges and wealthy investors has become.

At the center of these breaches were two headline-grabbing incidents.

A social engineering scam saw one Bitcoiner lose 783 BTC – worth $91 million at the time – while Turkish exchange BtcTurk suffered a $50 million breach, its second in just over a year.

Why Crypto Hacks Are Surging Again

The trend isn’t entirely surprising. Crypto hack activity often spikes when asset prices are rising, making exploits more lucrative. Both Bitcoin and Ethereum set fresh all-time highs in August, providing fertile ground for attackers.

While the overall number of monthly hacks is down compared with previous years, criminals are going after fewer but higher-value targets. Five major incidents accounted for 99% of total August losses, with BtcTurk’s breach and the $91 million Bitcoin scam making up the bulk.

Smaller players weren’t spared either. Decentralised platforms such as ODIN·FUN, BetterBank.io and CrediX Finance reported losses of $7 million, $5 million and $4.5 million respectively. Collectively, these episodes highlight that hot wallets and centralised custodians remain prime targets.

Security experts point to two drivers behind the surge. The first is institutional pressure, as more capital flows into crypto and the incentive to breach exchanges grows. The second is technological lag, since attackers are adapting faster than defenses, even as firms invest heavily in audits and AI-powered monitoring.

The result is a persistent environment where confidence can be shaken overnight. For retail users, that raises a critical question: if exchanges aren’t secure enough, where should funds be stored?

Enter Best Wallet: Building a Safer Standard

This is where projects like Best Wallet come into the conversation. Unlike traditional custodial exchanges that pool assets in hot wallets, Best Wallet positions itself as a non-custodial, security-first alternative.

Users retain full control of their private keys while relying on institutional-grade protections under the hood.

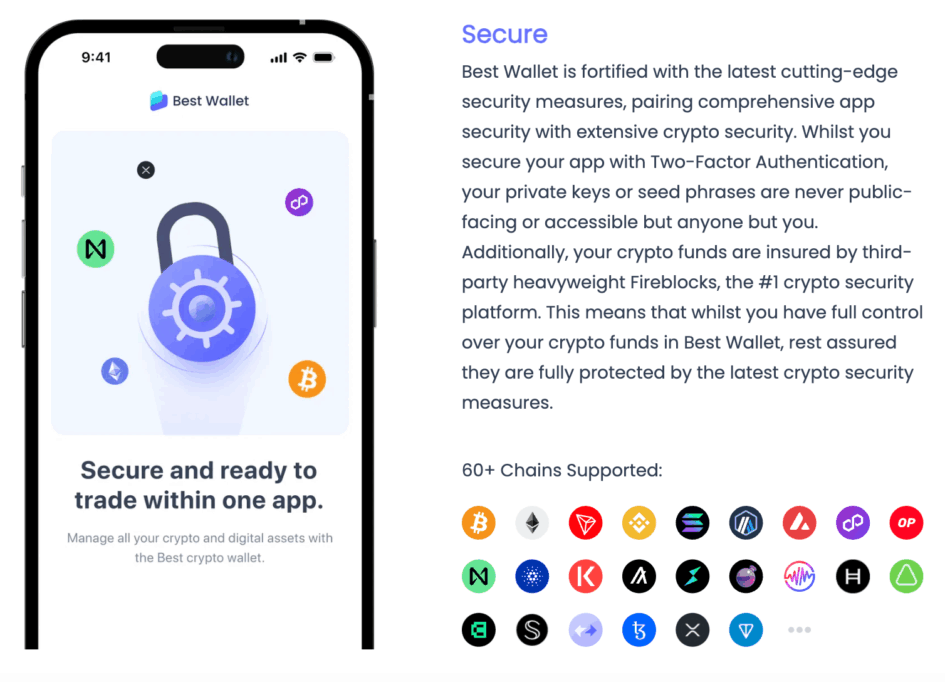

One of its key features is the adoption of Fireblocks MPC-CMP technology, a multi-party computation system trusted by hedge funds and major banks. This ensures that even if one part of the infrastructure is compromised, attackers cannot access user funds without breaching multiple independent layers simultaneously.

Best Wallet also doubles down on usability. With cross-chain swaps across 60+ blockchains, integrated DeFi and dApp access and real-time portfolio analytics, it aims to replace the fragmented experience of juggling different wallets and dashboards.

The Presale Momentum Behind $BEST

Security may be the primary hook, but Best Wallet also has financial traction. Its native token, $BEST, has raised more than $15.4 million in its presale, with investors drawn to both its functionality and rewards.

Holding $BEST offers reduced transaction fees inside the wallet, early access to presales via the in-app launchpad, boosted staking rewards and governance rights on future development. At its current presale price of $0.025575, $BEST is pitched as a way to align incentives between the platform’s growth and its user base.

Why Security Innovation Matters Now

The timing of Best Wallet’s emergence is notable. Crypto’s mainstream adoption is accelerating, with Circle, Finastra and Mastercard actively integrating stablecoins like USDC into global payment systems.

As stablecoins edge closer to everyday banking, the pressure for wallets to meet institutional-grade standards grows.

The industry has seen wallets like MetaMask dominate historically, but many have lagged behind in security upgrades. With hacks siphoning billions annually, retail investors are demanding wallets that feel as robust as online banking apps.

Best Wallet is not alone in trying to fill that gap, but its focus on presale participation and multi-chain interoperability gives it a distinct pitch: it isn’t just safe storage, it’s also a gateway to opportunity.

The Trade-offs: Promise and Perils

Still, caution is warranted. Best Wallet is a young project – it launched in 2024 and remains in phase 2 of a 4-phase roadmap. Its website lacks transparency around the team and there’s no live customer support.

For some, that raises concerns about whether the platform can truly deliver on its security promises at scale.

That said, its choice of non-custodial architecture aligns with best practices in crypto safety. By removing the centralised honeypot of exchange hot wallets, it lowers the attack surface dramatically.

What the August Hacks Tell Us

The lessons from August are straightforward. Centralised exchanges remain high-value targets and even established platforms like BtcTurk are vulnerable.

Social engineering attacks are evolving, meaning individuals must remain vigilant even if their technical security is strong. Retail and institutional users alike need safer custody solutions as crypto’s role in global finance expands.

In that context, Best Wallet highlights a broader trend toward non-custodial solutions. It may not be a silver bullet, but it represents a shift away from trusting centralised entities and toward putting security back in the user’s hands.

A Safer Path Forward?

Crypto hacks are not going away. If anything, the $163 million lost in August underscores that the stakes are rising as adoption grows. The next wave of users – drawn by stablecoin integration, ETFs and institutional capital – will demand solutions that don’t just store tokens, but actively protect them.

Best Wallet is one contender aiming to set that standard. By combining modern security protocols with presale access and DeFi functionality, it appeals to both safety-conscious investors and opportunistic traders.

The question now is whether it can scale fast enough to keep up with rising demand and whether its non-custodial model can withstand the sophisticated attacks that continue to plague the industry.

PROTECT YOUR INVESTMENTS WITH BEST WALLET

In an environment where a single crypto hack can erase hundreds of millions overnight, wallets that prioritise user control and institutional-grade safeguards may indeed prove to be the safer way forward.

Disclaimer: This content is for informational purposes only and does not constitute financial advice. Cryptocurrency investments are highly volatile and you should do your own research before investing.