Bitcoin’s trillion-dollar trajectory in 2025 is being driven by institutional flows, regulation and macro tailwinds, but while capital cements Bitcoin’s role as a reserve asset, Bitcoin Hyper is emerging as the key to unlocking utility, speed and programmability across the network.

Bitcoin’s journey toward a $1 trillion market cap has long been symbolic of its struggle for legitimacy in global finance. In 2025, that test has evolved.

The conversation is no longer about whether Bitcoin can achieve this milestone but how it will sustain it. Also, whether institutional adoption, regulatory clarity and macroeconomic shifts will be enough to transform Bitcoin from a speculative asset into a foundational reserve.

The numbers tell a story of resilience. As of Q3 2025, Bitcoin trades in the $115,000–$118,000 range, with analysts noting consolidation rather than exhaustion.

Indicators like the Crypto Fear & Greed Index at 43 point to moderate bullish sentiment. At the same time, the Relative Strength Index sits at 60, while the Stochastic Oscillator edges toward overbought levels, hinting at potential consolidation.

Institutional participation is absorbing much of the volatility. Spot ETFs, led by BlackRock’s $86.79 billion IBIT fund, have poured $20 billion into Bitcoin this year alone.

Corporate treasuries, from MicroStrategy’s 629,376 BTC holdings to Japan’s Metaplanet’s latest additions, signal a shift in Bitcoin’s positioning as a balance-sheet cornerstone.

Even U.S. regulation is bending in Bitcoin’s favor: the BITCOIN Act of 2025 and new provisions for 401(k) allocations are opening unprecedented pools of capital.

This combination of regulatory progress, macro tailwinds and institutional flows has created a market less prone to retail panic and more anchored in structural demand.

Yet, the trillion-dollar milestone, while impressive, also exposes Bitcoin’s limitations.

Institutional Flows Meet Bitcoin’s Bottlenecks

The promise of Bitcoin as “digital gold” has always hinged on scarcity and security, but those same features leave Bitcoin ill-suited for the demands of modern digital finance.

Processing only around seven transactions per second, the network often buckles under congestion, making payments expensive and limiting adoption in emerging applications like decentralised finance (DeFi), NFTs, or programmable money.

As institutional inflows normalise Bitcoin as a store of value, the market has begun asking: what about utility? Capital inflows can cement Bitcoin’s price, but without scalability and flexibility, its role may be capped as a reserve asset, not a usable one.

That’s where Bitcoin Hyper enters the picture.

Bitcoin Hyper: A Layer 2 Built for Utility

Bitcoin Hyper ($HYPER) is one of the most notable projects tackling Bitcoin’s structural limitations head-on. Launched as a Layer 2 solution, Bitcoin Hyper brings scalability, speed and programmability to the Bitcoin ecosystem.

By integrating the Solana Virtual Machine (SVM), Bitcoin Hyper enables Bitcoin users to tap into smart contracts, DeFi protocols, NFTs and other Web3 applications – capabilities historically absent from the Bitcoin network. Its Canonical Bridge ensures seamless movement between Bitcoin Hyper and the Bitcoin mainnet, allowing BTC holders to deploy assets on Layer 2 and return them at any time, backed 1:1.

This dual architecture transforms Bitcoin from a static store of value into a programmable digital asset capable of handling thousands of transactions per second at near-zero fees.

Why Bitcoin Hyper Matters Now

The timing of Bitcoin Hyper’s rise is significant. With Bitcoin already absorbing record levels of institutional capital, the next phase of growth depends not only on holding value but on extending utility. In that sense, Bitcoin Hyper isn’t competing with Bitcoin; it’s unlocking the next chapter of its lifecycle.

Think of it as a multi-lane expressway built alongside Bitcoin’s secure but congested main highway. Institutional investors may rely on Bitcoin as a hedge or treasury asset, but developers, traders and users need the speed and programmability Bitcoin Hyper provides.

The project has already raised more than $12.1 million in presale funding, reflecting broad confidence in its model. A staking program offering 92% APY adds incentives for long-term commitment, while tokenomics allocate significant resources to development and marketing.

Unlike speculative altcoins, Bitcoin Hyper is presenting itself as a utility-driven extension of the most established digital asset in the market.

Proof in the Numbers

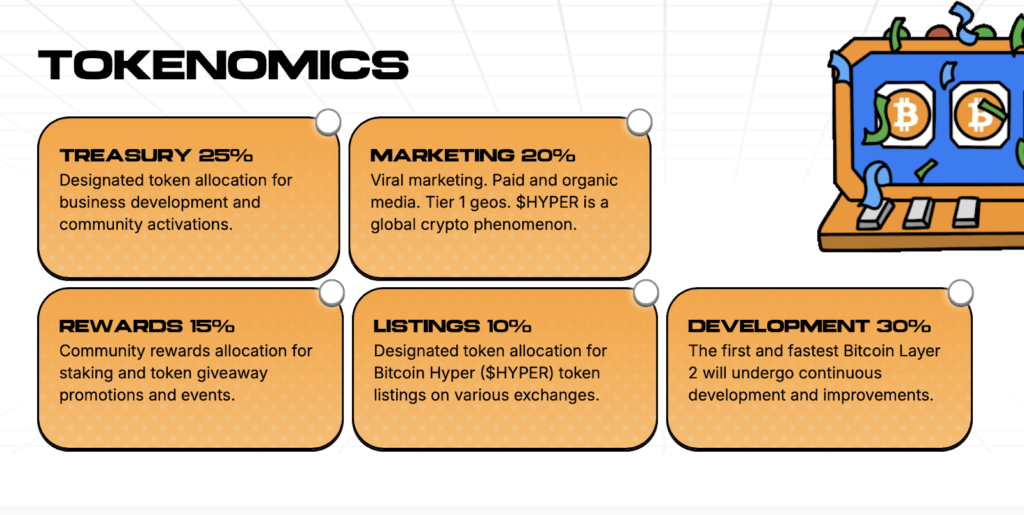

The presale trajectory itself illustrates market appetite. Initial pricing began at $0.0115, with current token prices climbing to $0.012805. With 21 billion tokens in total supply, allocations have been structured to fund long-term sustainability: 30% for development, 25% for treasury, 20% for marketing, 15% for rewards and 10% reserved for exchange listings.

By surpassing the $11 million milestone, Bitcoin Hyper has secured a war chest large enough to execute its roadmap. Audits from SolidProof further strengthen investor confidence by verifying the smart contract’s transparency.

Upcoming exchange listings in Q4 2025 aim to expand access, while a phased roadmap includes DAO governance, extending decision-making power to the community. This blend of institutional-grade security and grassroots participation positions Bitcoin Hyper as both credible and scalable.

Linking Back to Bitcoin’s Trillion-Dollar Milestone

The intersection of these two stories – Bitcoin’s trillion-dollar market cap and Bitcoin Hyper’s presale success – reflects the broader evolution of crypto in 2025.

On one side, Bitcoin is cementing its status as a foundational reserve asset, with institutional adoption, regulatory clarity and corporate treasury integration driving structural demand. On the other, Bitcoin Hyper is ensuring that Bitcoin’s growth story doesn’t stop at price milestones but extends into practical utility.

The combination of these forces signals a future where Bitcoin is not just held but actively used – whether for DeFi, NFTs, or cross-chain applications – without compromising the security of the original network.

The Real Utility Test

Bitcoin’s trillion-dollar market cap in 2025 underscores its legitimacy as a cornerstone of global finance, but its limitations in speed and programmability mean its future as a utility asset depends on innovation beyond its base layer.

This is where Bitcoin Hyper comes into focus. By marrying Bitcoin’s unmatched security with Solana-like speed and programmability, it is positioning itself as the engine for a trillion-dollar utility market. Its presale momentum, technical architecture and roadmap suggest it could play a pivotal role in defining how Bitcoin evolves from digital gold into a dynamic force for global digital finance.

JOIN BITCOIN HYPER PRESALE: PRICES RISING SOON

The lesson for investors and observers alike is clear: Bitcoin’s price story may be stabilising, but its utility story is only just beginning and in that narrative, Bitcoin Hyper could be the project that finally unlocks Bitcoin’s full potential.

Disclaimer: Crypto assets are highly volatile. This is not financial advice — do your own research before investing.