With Bitcoin's dominance slipping and whispers of a selective altseason growing louder, traders are seeking an edge. Snorter’s AI trading bot could be that advantage – helping retail investors sniff out winning plays before the market catches on.

For months, traders have been shouting “ALTSEASON IS HERE” every time Bitcoin’s dominance wobbles. This weekend, Bitcoin’s share of the market dropped below 60% – its lowest level since February – rekindling hopes that capital is rotating toward altcoins.

ETH is edging close to new all-time highs, and a handful of altcoins look ready to break out, but according to analysts, this isn’t going to be the kind of altseason where everything pumps in unison.

Instead, the rally is shaping up to be more selective, driven by strong narratives like artificial intelligence, real-world assets, and innovative DeFi applications.

Institutional inflows are also reshaping the market. Pension funds, banks, and corporate treasuries are targeting liquidity-rich, compliance-friendly assets – leaving most smaller altcoins to fend for themselves.

That means retail traders won’t be able to rely on a “rising tide lifts all boats” scenario. Timing and selectivity will matter more than ever, and spotting narrative-driven winners early could be the difference between a portfolio that thrives and one that flatlines.

A Selective Altseason Favors Tools That Spot Winners Early

Jag Kooner, head of derivatives at Bitfinex, warns that this cycle’s rally will be “more selective” due to massive token oversupply – a problem amplified by platforms like Pump.Fun churning out tens of thousands of meme coins daily.

Meanwhile, large institutions are largely ignoring illiquid microcaps, instead focusing on high-quality plays.

This mix of selective retail hype and institutional conservatism has created a competitive environment where finding the right entry points is more complex than ever. It’s precisely the type of market where a tool like Snorter’s AI trading bot could prove invaluable, giving everyday traders professional-grade analysis without needing a Bloomberg terminal.

Snorter’s AI Trading Bot: Designed for the Hunt

The $SNORT token powers Snorter Bot, a Telegram-based AI trading bot built for the current market reality – one where speed, security, and selectivity rule. Instead of sifting through endless tokens manually, users get a streamlined, all-in-one trading interface with features built to sniff out winners early.

Snorter Bot offers:

· Copy trading to mirror proven traders’ moves in real time.

· MEV protection to shield users from sandwich attacks and front-running.

· Automated token sniping with built-in tax handling, letting users grab fresh listings the moment liquidity drops.

· 85% detection accuracy in beta security tests for identifying honeypots and rug-pulls – a critical safety net in a market flooded with low-effort launches.

The bot’s swap function runs through a private Solana RPC infrastructure, ensuring fast execution at a competitive 0.85% fee – a rate lower than most alternatives. For meme coin hunters navigating this selective altseason, it’s a way to find gold in a saturated field.

$SNORT Tokenomics: Scarcity Meets Utility

The $SNORT token has a fixed supply of 500 million – no minting, no inflation – a model designed to preserve scarcity and potentially boost long-term value. Token allocations include:

· 25% to product development for continuous upgrades.

· 20% to marketing to fuel user growth and demand.

· 20% to exchange liquidity for smooth post-listing trading.

· 10% each for airdrops and community rewards to strengthen network effects.

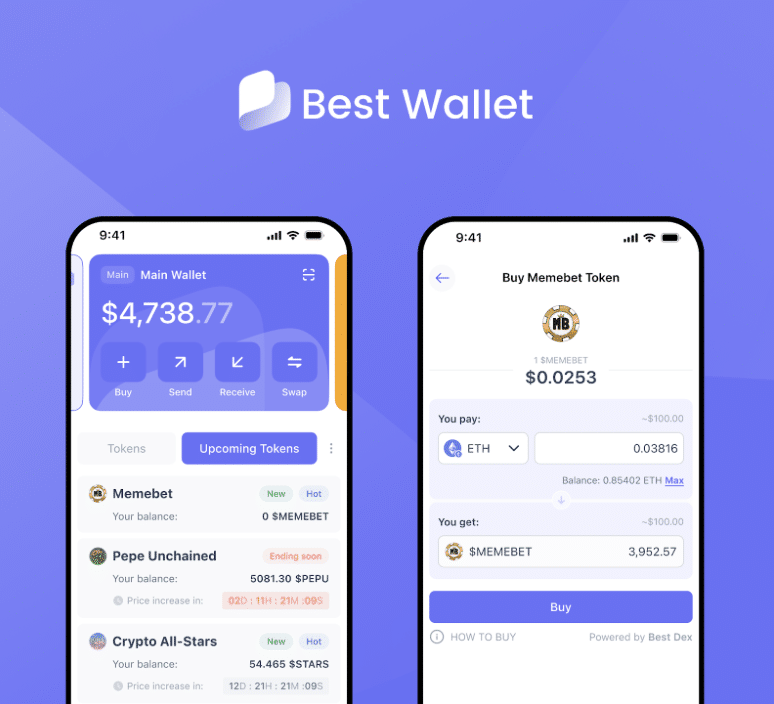

With the presale already raising over $2.6 million and the final price set at $0.1053, the current $0.0999 level could be among the last chances to buy before listings.

Why This Could Be a Gold Rush Moment

In traditional altseasons, retail hype alone could drive outsized returns. This time, the combination of institutional caution and token oversupply makes it harder for newcomers to find legitimate breakouts.

That’s why analysts say tools like Snorter’s AI trading bot – with its rapid token scanning, security filters, and automated entry – can tilt the odds back toward retail traders.

If the bot expands beyond Solana (planned in stage 3 of its roadmap), it could capture cross-chain traders and expand the user base significantly. For $SNORT holders, that means more demand for the token’s utility and governance features.

The potential upside mirrors the kind of selective gold rush expected: fewer winners, but bigger gains for those who identify them early.

Factors That Could Influence $SNORT’s Price

Several factors could shape $SNORT’s performance after listing. Strong presale momentum often fuels impressive market debuts, though it can also set the stage for sharp corrections in the days that follow. A successful push for Tier-1 exchange listings could significantly enhance the token’s visibility and liquidity, strengthening its position among traders.

Long-term growth will depend on the team’s ability to deliver on its roadmap, with milestones such as multi-chain expansion expected to provide a solid foundation for sustained adoption.

In a crowded trading bot market, staying ahead with cutting-edge AI-driven features will be essential to stand out. While a broader meme coin rally could lift $SNORT alongside other winners, the ever-present volatility of the crypto market remains a key risk to watch.

Is $SNORT the Right Play for This Cycle?

For traders preparing for a selective altseason, $SNORT offers a blend of meme coin appeal and real-world utility. It’s not a passive bet on the whole market rising – it’s a targeted play on having better tools than the competition.

POWER YOUR TRADES – UNLIMITED SNIPES, COPY TRADING, FRONT‑END MEV DEFENSE WITH $SNORT!

In a cycle where timing matters, and institutional money won’t touch most microcaps, having an AI trading bot in your pocket could be the edge retail needs to compete. The gold rush may not lift all boats, but it will reward those who bring the right tools to dig.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Cryptocurrencies are volatile assets; always do your own research before investing.