Bitcoin has once again beaten the S&P 500, with ETF inflows and institutional buying fuelling optimism for the next rally. Now, all eyes are on Bitcoin Hyper: a Layer 2 crypto that brings Solana-speed transactions, DeFi capabilities and high staking rewards to the Bitcoin network. Could it be the breakout altcoin of 2025?

Bitcoin’s recent price action has been nothing short of a rollercoaster. The cryptocurrency initially dipped after Congress passed a law regulating stablecoin circulation and US stock indices began to slide from record highs. This break pushed Bitcoin below the lower boundary of its $116,000 to $120,000 consolidation range, prompting fears of a deeper correction.

Just when it seemed bears were firmly in control, the equity markets staged a comeback. The S&P 500 – fresh from a month of record-setting gains – rebounded, bringing Bitcoin along for the ride. July was already a strong month for both assets, with Bitcoin-focused ETFs attracting $6 billion in inflows, marking the third-best performance on record for such funds. Ether ETFs also joined the rally with $5.4 billion in inflows.

The tide shifted at the start of August, however. Demand for digital assets began to cool. Coinbase’s Bitcoin premium slipped into negative territory for the first time since May, a signal of waning US investor appetite. Futures markets echoed the slowdown, with open interest in Bitcoin and Ethereum contracts falling by 13% and 21% respectively. Coinglass data showed that $800 million in long positions across the crypto market were liquidated on the last day of July alone.

Yet not everyone was retreating. Institutional treasuries continued to add Bitcoin aggressively. In just one week between July 28 and August 3, Michael Saylor’s firm acquired over 21,000 BTC – worth roughly $2.46 billion – its third-largest purchase ever. This brought its total reserves to more than $71 billion, purchased at one of the highest average prices in its history.

Where Bitcoin goes next will depend heavily on two factors: whether the S&P 500 can sustain its record-breaking performance and whether ETF inflows keep pace. Should equity strength falter, Bitcoin could retest lower ranges, but if bullish momentum holds, there’s room for fresh highs – and for projects that enhance Bitcoin’s capabilities to shine.

The Case for Bitcoin Layer 2 Solutions

Even with its dominance, Bitcoin faces long-standing limitations in speed, scalability and programmability. Unlike Ethereum, it lacks native smart contract support, making it less practical for DeFi, NFTs and other high-throughput blockchain applications.

That’s where Bitcoin Hyper ($HYPER) comes in – a new Layer 2 crypto designed to bring modern blockchain capabilities to the Bitcoin network. Built using the Solana Virtual Machine (SVM), Bitcoin Hyper promises sub-second transaction speeds, extremely low fees and full compatibility with dApps, all while maintaining Bitcoin’s security through zero-knowledge proofs (ZK proofs).

How Bitcoin Hyper Works

At its core, Bitcoin Hyper is an overlay network that processes transactions off-chain and then settles them back to the Bitcoin mainnet. Using a canonical cross-chain bridge, users can deposit native BTC and receive wrapped tokens on the Hyper network. These tokens can then be traded, staked, or used in DeFi protocols at near-instant speeds.

The integration of SVM enables developers to deploy sophisticated applications, just as they would on Solana, but with the security and liquidity of Bitcoin behind them. ZK proofs are used to confirm transaction validity before final settlement, ensuring that Bitcoin Hyper doesn’t compromise on trustlessness.

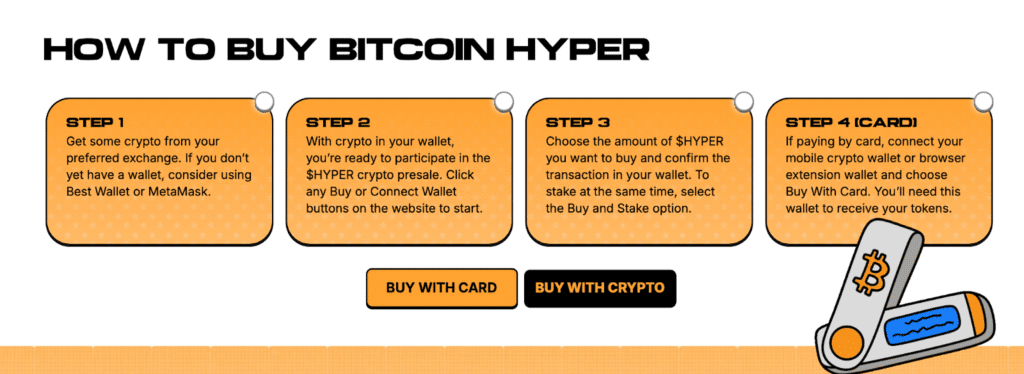

The $HYPER token is the engine of the ecosystem. It’s used for transaction fees, governance, staking and accessing exclusive platform tools. Early buyers in the ongoing presale can stake their tokens immediately, with current rewards at 153% APY – an attractive incentive for long-term holding.

A Presale Defying Market Trends

While some altcoins are struggling to gain traction amid cooling market sentiment, Bitcoin Hyper’s presale has surged ahead, raising $7.2 million so far. Tokens are currently priced at $0.012525, but with each presale phase lasting only three days (or until sold out), the price is set to increase soon. The final listing price is fixed at $0.012975, giving early entrants a built-in price advantage before exchange trading begins.

The speed of fundraising suggests investors are betting on more than just hype. Bitcoin Hyper has already launched its developer network, complete with Solana CLI support, smart contract testing tools and a live blockchain explorer. These tangible milestones reduce the risk often associated with early-stage crypto projects, many of which remain purely conceptual for months or years.

Why This Layer 2 Crypto Could Matter in the Next Rally

History shows that during Bitcoin-led bull runs, Layer 2 solutions often capture significant investor interest. Ethereum’s Layer 2s like Arbitrum and Optimism surged in value during the last cycle by offering scalability and lower fees. Bitcoin Hyper could follow a similar trajectory, especially as more traders and institutions seek ways to use Bitcoin beyond simple value storage.

If Bitcoin continues to attract ETF inflows and the S&P 500 maintains its bullish bias, market confidence could push Layer 2 adoption to new levels. For Bitcoin Hyper, this means more liquidity, faster ecosystem growth and a higher potential valuation.

The project’s roadmap outlines a mainnet launch later in 2025, complete with BTC deposits and withdrawals, DeFi integrations and NFT marketplace support. From there, the team plans to expand exchange listings and roll out DAO governance by early 2026, giving token holders a direct say in the project’s direction.

Key Advantages for Investors

Bitcoin Hyper offers multiple potential advantages for investors looking for the next big Layer 2 crypto:

· It combines Bitcoin’s security with Solana-level performance, unlocking new use cases for BTC.

· The presale offers high staking rewards from day one, incentivizing holding and reducing early sell pressure.

· Its early technical delivery and working developer network make it more than just a whitepaper project.

· It has a clear exchange listing plan, with Uniswap confirmed and centralised exchange talks reportedly underway.

Risks to Consider

As with any early-stage crypto, there are risks. Bitcoin Hyper’s long-term success depends on the timely delivery of its Layer 2 features and sustained market interest. Any sharp downturn in Bitcoin’s price or broader crypto sentiment could slow adoption.

Additionally, while ZK proofs and SVM integration are proven technologies, their implementation on Bitcoin is still a novel approach that must prove itself at scale.

Outlook: Bitcoin Hyper in a Bullish Macro Environment

With Bitcoin once again outperforming the S&P 500 despite regulatory headwinds, the market is reminded of crypto’s resilience. Institutional inflows, particularly into Bitcoin ETFs, suggest continued appetite for blockchain exposure. If this demand persists and equities remain firm, the next leg of the bull cycle could see Bitcoin Hyper positioned as a standout Layer 2 crypto.

By bridging Bitcoin to high-speed, low-cost applications, it offers a value proposition that aligns with current market trends – combining infrastructure utility with investment potential.

For investors seeking exposure to the Bitcoin ecosystem without relying solely on BTC’s price movement, Bitcoin Hyper provides a compelling alternative. As the presale races toward its conclusion, the window to buy before the listing narrows.

INVEST IN BITCOIN HYPER TO BENEFIT FROM BITCOIN

Bitcoin may be the headline act in crypto’s ongoing rivalry with the S&P 500, but the supporting cast of infrastructure projects could deliver some of the most explosive gains.

Bitcoin Hyper, with its blend of speed, scalability and staking incentives, has all the hallmarks of a Layer 2 crypto that could thrive in the next market rally.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Crypto investments are risky and volatile. Always do your own research before investing.