Nigeria is once again in the spotlight, this time for two defining trends shaping its financial future: a newly revised GDP figure that reflects a more vibrant economy than previously recorded, and a nationwide surge in cryptocurrency adoption.

As the country modernises its financial systems, innovative crypto projects like Bitcoin Hyper ($HYPER) are capturing the attention of investors looking to hedge against inflation, fiat volatility and institutional limitations.

This timely convergence of macroeconomic shifts and blockchain adoption poses a central question: could Nigeria be on the path to becoming the richest country in Africa? If so, is crypto the vehicle that could drive it there?

Nigeria’s Economic Revision Puts It in Africa’s Top Four

According to the National Bureau of Statistics (NBS), Nigeria’s economy grew by 3.13% year-on-year in real terms in Q1 2025, up from 2.27% in the same period the year before.

The upward revision in GDP – now at 372.8 trillion naira ($243 billion) – follows methodological changes that factor in informal sectors of the economy. While this new figure places Nigeria behind South Africa, Egypt and Algeria, it confirms the country’s recovery efforts under President Bola Tinubu’s administration.

Tinubu’s sweeping reforms, including the floatation of the naira, removal of fuel subsidies and addressing persistent dollar shortages, aim to restore macroeconomic stability. However, despite these efforts, inflation and devaluation continue to challenge the average Nigerian’s purchasing power.

With traditional banking systems still reeling from regulatory constraints and low trust, many Nigerians have turned to cryptocurrency as a more stable financial alternative.

Crypto’s Rise in Nigeria: From Curiosity to Necessity

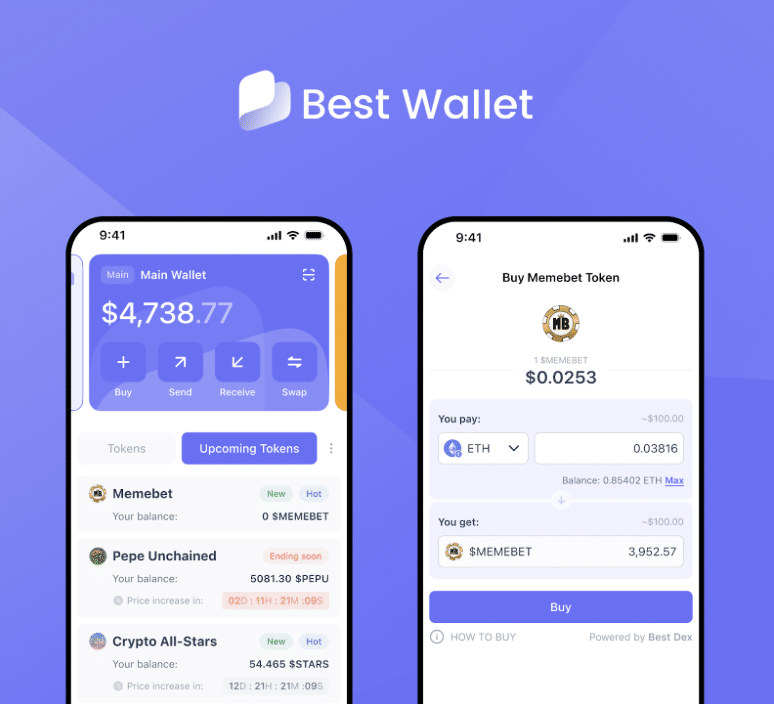

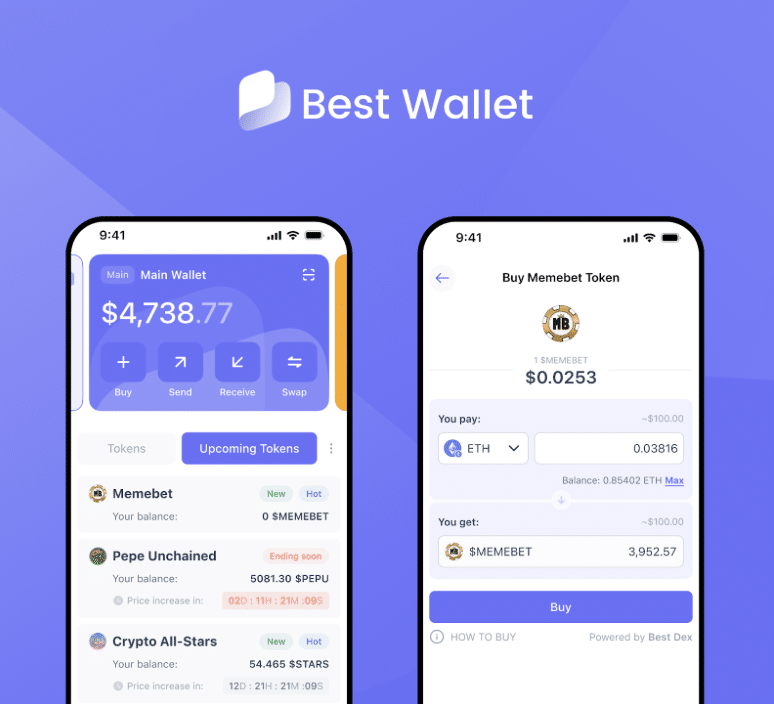

Nigeria’s crypto story isn’t just about speculation – it’s about survival and adaptation. Whether through peer-to-peer (P2P) trading platforms like Paxful and KuCoin or via apps that facilitate crypto-to-fiat conversion like Breet, Nigerians are finding creative ways to incorporate digital assets into their daily lives.

With nearly 54% of the population aged between 15 and 65, the country has a ready-made demographic for crypto adoption. Google Trends has repeatedly shown Nigeria as one of the most crypto-curious nations, especially during global market dips.

The regulatory picture remains complex. While the Central Bank of Nigeria (CBN) banned commercial banks from engaging in crypto transactions, the Securities and Exchange Commission (SEC) published a detailed framework in 2022 to regulate digital asset providers. Exchanges can now operate if they obtain a Virtual Asset Service Provider (VASP) license, offer transparency and meet strict financial benchmarks.

Despite the regulatory friction, the demand for digital assets has never been stronger – pushing projects like Bitcoin Hyper ($HYPER) to the center of attention.

Bitcoin Hyper: A Scalable Crypto for a Scalable Economy

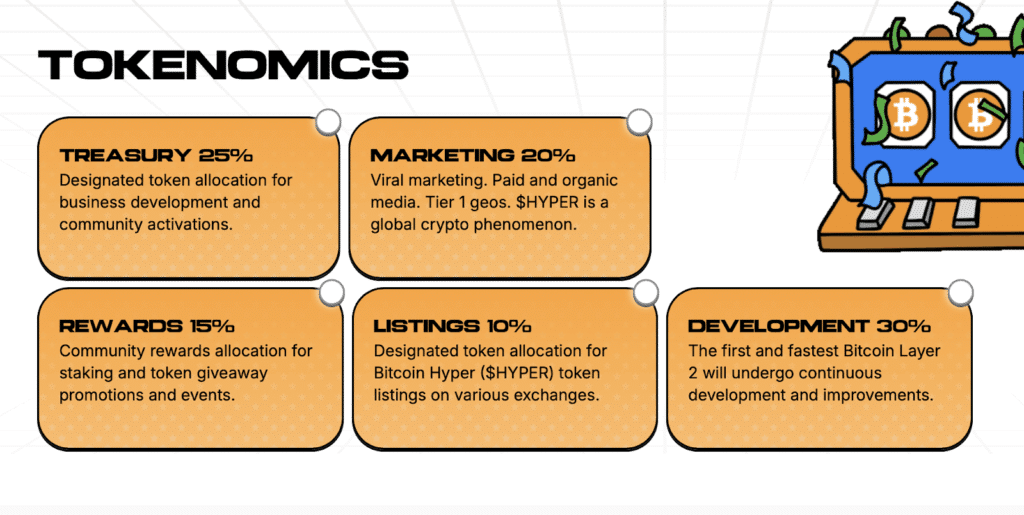

As millions of Nigerians seek better alternatives to hedge against naira depreciation and financial instability, Bitcoin Hyper presents itself as a unique opportunity. Unlike traditional layer-1 chains or even Ethereum-based layer-2 solutions, Bitcoin Hyper is a true Bitcoin Layer-2 network powered by ZK-rollups and built with Solana Virtual Machine (SVM) technology.

This allows Bitcoin Hyper to scale efficiently without compromising on the security and decentralisation of the original Bitcoin blockchain. Every transaction is verified using cryptographic proofs and finalized on the Bitcoin layer, ensuring speed and integrity.

At a time when Bitcoin itself faces limitations in terms of transaction speed and fees, Bitcoin Hyper is positioning itself as the next frontier for DeFi, smart contracts and even meme coin creation, but anchored to the world’s most secure blockchain.

$6 Million Raised: A Testament to Growing Investor Trust

The $HYPER presale has now surpassed $6.2 million in total contributions, with $1 million raised in the past week alone. This surge is particularly notable against the backdrop of Nigeria’s increasing crypto activity.

As more individuals look for alternative financial instruments, presale projects like Bitcoin Hyper offer a low-barrier entry to a high-potential ecosystem.

The presale is structured with tiered pricing, rewarding early adopters with better entry points and higher potential returns. For investors facing unstable fiat conditions or limited access to traditional investments, $HYPER provides a compelling alternative.

Crypto analyst Borch Crypto summed it up perfectly by noting that Bitcoin isn’t for DeFi, whilst Bitcoin Hyper is. This makes Bitcoin Hyper more accessible to retail traders.

Why Bitcoin Hyper Could Resonate Deeply With Nigerians

Nigeria’s challenges – like inflation, capital controls and a largely unbanked population – mirror the very problems that Bitcoin Hyper aims to address. With scalability, decentralization and practical use cases baked into its architecture, $HYPER could become an integral part of Nigeria’s evolving digital economy.

Moreover, the project’s emphasis on accessibility aligns well with Nigeria’s booming peer-to-peer market. From cross-border remittances to localized DeFi applications, the infrastructure being built by Bitcoin Hyper offers an escape hatch from centralized inefficiencies.

As Nigeria prepares for potential crypto taxation and regulation under new finance legislation, legitimate and well-structured crypto projects like $HYPER may gain even more ground in terms of trust and adoption.

A Nation on the Verge of Financial Reinvention?

While Nigeria may not yet hold the title of the richest country in Africa, its rising GDP and unprecedented crypto engagement suggest that it is on a transformative path. The intersection of economic reform and grassroots crypto innovation could well be the lever that tips the scales.

Projects like Bitcoin Hyper are not just speculative tokens; they represent a vision for a more inclusive, efficient and secure financial ecosystem – one that is increasingly resonating with Nigerian investors, traders and everyday citizens.

In a country where banking infrastructure has left many behind and inflation continues to erode traditional wealth, crypto may well be the bridge to financial freedom and if that’s the case, $HYPER might just be leading the charge.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct your own research before making any investment decisions.