As crypto adoption surges across Europe, wealthy nations like Luxembourg and Ireland are harnessing digital assets not just for growth. For economic reinvention, powered by platforms like Best Wallet.

The European crypto boom is gaining unstoppable momentum, with retail traders at its core.

As regulatory frameworks mature and economic strategies evolve, countries like Luxembourg, Ireland and Norway are not only becoming global fintech leaders – they’re also leading the charge toward a digitised financial future.

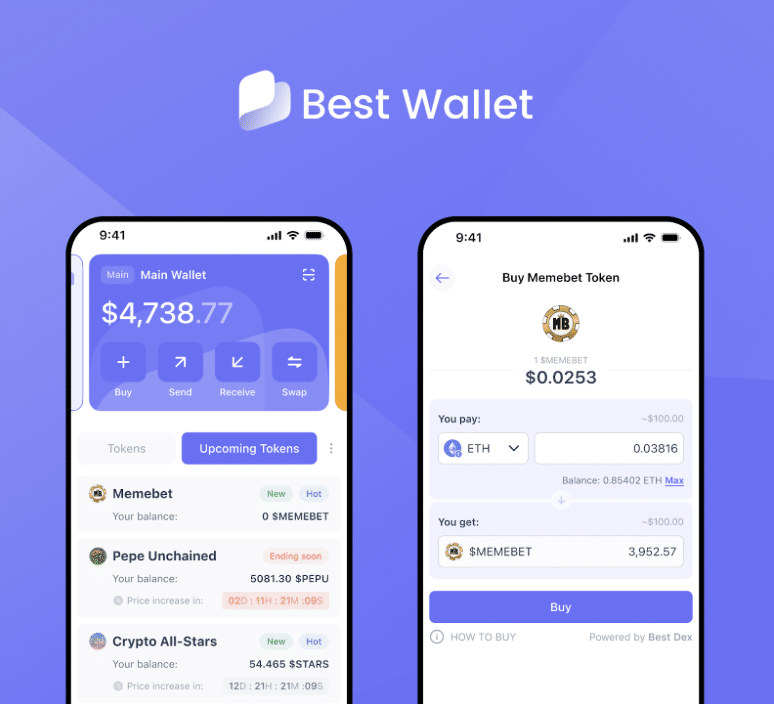

At the heart of this transformation is a new generation of tools empowering everyday investors to ride the wave. One standout platform is Best Wallet, which is fast becoming a favorite among retail traders in the region.

But this isn’t just about speculative hype. Backed by groundbreaking policy shifts and robust infrastructure, Europe’s wealthiest nations are adopting crypto not just as an asset class, but as an economic accelerator.

Europe’s Crypto Ownership Is Surging and So Is Its Wealth

A recent study by Apex Protocol highlights just how quickly crypto is integrating into Europe’s financial mainstream. Between 2023 and 2024, crypto ownership in Europe surged by over 60%, with Luxembourg leading the pack at a jaw-dropping 854% growth rate. Other nations like Slovenia, Ireland, Norway and Cyprus aren’t far behind, all posting triple-digit growth figures in digital asset adoption.

What’s notable is that this explosion in crypto ownership is mirroring trends in national wealth. Luxembourg, Ireland and Norway are also ranked as the three richest countries in Europe by GDP per capita (PPP), with figures exceeding $100,000 annually. In many of these nations, crypto is more than an investment – it's becoming a foundation for modern personal finance.

As the numbers grow, so too does the infrastructure required to support millions of new digital asset holders. This is where Best Wallet comes in – bridging traditional finance with decentralised tools for a new era of investing.

Best Wallet: The Retail Trader’s Secret Weapon

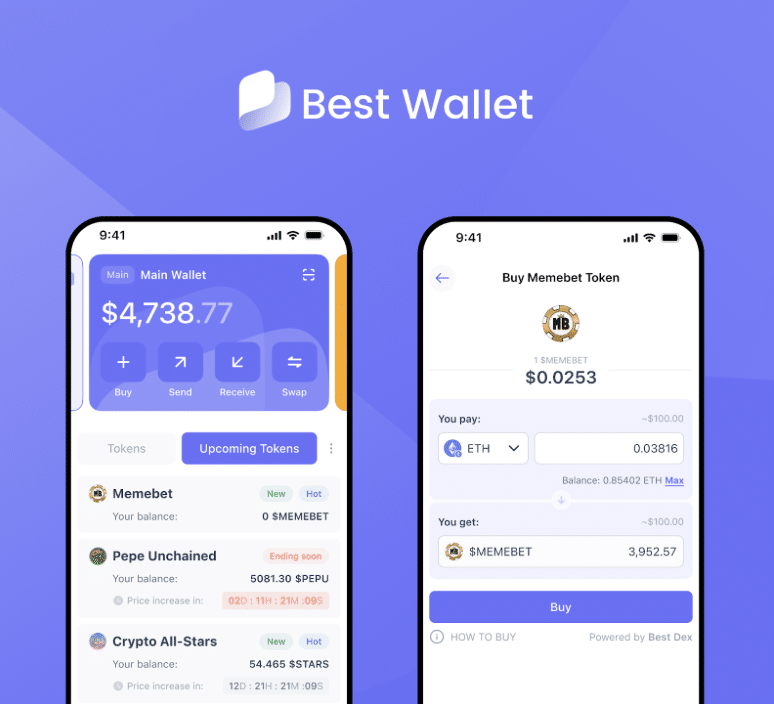

Awarded the prestigious WalletConnect Certified badge earlier this month, Best Wallet has entered an elite group of Web3 wallets recognized for their security, UX design and integration capabilities. For retail traders in Europe, this validation is more than symbolic. It’s an assurance that their most trusted tool is ready for the demands of the next financial wave.

With features like gas-token–free transactions, DCA tools for Bitcoin, staking aggregators and real-time project screeners, Best Wallet has become a go-to platform for users navigating the complex digital asset ecosystem.

This seamless functionality is particularly vital in countries like Ireland and Norway, where retail crypto adoption is climbing fast but where users still demand ease, efficiency and security. In Switzerland – Europe’s blockchain capital – Best Wallet’s integration with over 330 decentralized protocols and 30 cross‑chain bridges helps its 250,000+ active users keep pace with one of the most mature crypto markets on the continent.

Regulatory Clarity Is Driving Real-World Crypto Integration

Behind this adoption wave is an even more powerful trend: regulatory clarity. With the recent passage of the GENIUS Act in the U.S and similar frameworks emerging across the EU, digital assets like stablecoins and tokenised real-world assets (RWAs) are being fast-tracked into traditional financial systems.

This evolution has unlocked billions in institutional capital – capital that now demands secure, compliant and feature-rich tools.

For retail traders, platforms like Best Wallet are a natural on-ramp to this new digital economy, offering immediate access to assets that were once the domain of hedge funds and institutional banks.

This convergence is already visible in Europe’s most crypto-forward countries. In Belgium, for instance, crypto adoption rose by nearly 500% in one year – alongside widespread interest in RWAs and stablecoin solutions for remittances and payments.

Best Wallet’s roadmap, which includes RWA yield integrations and an upcoming Best Card for real-world spending, is perfectly aligned to support these developments.

WalletConnect Certification Signals a Shift in Retail Power

While Best Wallet has been gaining ground over the past year, its WalletConnect certification represents a turning point. The platform is now listed alongside legacy players like MetaMask, Trust Wallet and Binance Wallet, but its feature depth and retail-focused design give it a critical edge among everyday users seeking to do more with their crypto.

In traditionally conservative banking environments like Germany and France, where crypto adoption is growing steadily, Best Wallet offers a bridge between decentralised opportunities and centralised expectations. The app’s security protocols, user interface and upcoming derivatives trading features make it one of the few retail-grade wallets positioned to scale with Europe’s maturing crypto environment.

Retail Traders Lead the Way in Europe’s New Wealth Paradigm

The idea of crypto creating the next richest country in Europe may once have sounded far-fetched, but today, with Luxembourg, Ireland and Norway blending high GDP per capita with record-breaking crypto ownership growth, the narrative is becoming reality.

Retail traders, once seen as fringe participants, are now at the heart of this financial evolution. Their adoption is fueling infrastructure upgrades, guiding regulatory policy and influencing how traditional banks position themselves in the digital economy.

They’re doing it with tools like Best Wallet – simple enough for newcomers, powerful enough for seasoned investors and versatile enough to serve a market in transition.

Crypto’s Wealth Engine Has Shifted Into High Gear

Europe’s wealthiest countries are no longer defined just by natural resources or historical financial institutions – they’re being shaped by innovation, decentralization and retail participation. Crypto is no longer just an investment category; it’s a building block of national economic identity.

Retail traders in these nations are riding the wave, powered by tools like Best Wallet and contributing directly to a reshaping of Europe’s financial map.

Whether through smart stablecoin usage, RWA yield strategies, or daily DCA accumulation, the continent’s most forward-thinking citizens are using crypto to build wealth that’s accessible, transferable and increasingly secure.

JOIN BEST WALLET NOW

As policy aligns with demand and infrastructure continues to evolve, the question is no longer if crypto will influence Europe’s richest economies – it’s how fast and how deeply.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always conduct your own research before investing in digital assets.