A groundbreaking US Senate bill could transform crypto into a recognized asset for mortgage approvals. As lawmakers debate digital assets in the housing sector, Bitcoin Hyper – a new Bitcoin-based layer-2 solution – is emerging as a front-runner in translating that legislative momentum into technological adoption and investment opportunity.

Crypto is entering the American dream in an entirely new way. On Capitol Hill, Wyoming Senator Cynthia Lummis has introduced the 21st Century Mortgage Act, a bill that could change how Americans finance their homes by integrating digital assets into mortgage credit assessments.

This follows a June directive from the US Federal Housing Finance Agency (FHFA), which instructed mortgage giants Fannie Mae and Freddie Mac to consider cryptocurrency holdings when assessing single-family loan applications.

If passed, this legislation would prevent borrowers from needing to liquidate crypto assets to qualify for mortgages. It’s a nod to the 36% of Americans under 35 who are more likely to hold digital assets than traditional savings and often locked out of homeownership by rigid lending standards.

However, the bill is facing early resistance. Senate Democrats have voiced concerns about crypto volatility, liquidity and the systemic risks of integrating these assets into the broader mortgage market. Nonetheless, the bill represents a major turning point in how digital assets might support real-world milestones like buying a home.

Bitcoin Hyper Gains Momentum as Crypto Real-World Utility Expands

In the wake of this legislative shift, one blockchain project is racing ahead: Bitcoin Hyper ($HYPER).

While lawmakers debate whether Bitcoin and other digital assets should count toward mortgage collateral, Bitcoin Hyper is delivering the infrastructure that could make such use cases practical – not just possible.

Built on the Solana Virtual Machine, Bitcoin Hyper is a layer-2 protocol designed to bring smart contracts, DeFi, gaming and dApps to the Bitcoin network. This is more than a technical milestone – it’s a leap toward Bitcoin as programmable, spendable money rather than a static store of value.

With a live devnet already operational and transactions flowing through a real-time web console and explorer, Bitcoin Hyper is rapidly maturing from concept to reality.

Why Bitcoin’s Future Could Depend on Layer-2 Projects

Senator Lummis’ bill underscores what Bitcoin Hyper’s creators already believe: the future of Bitcoin lies in real-world integration.

Bitcoin has long been heralded as “digital gold,” but that hasn’t translated into broad utility. As Cathie Wood recently said in an interview, she still sees Bitcoin reaching $1.5 million by 2030, but that kind of growth assumes enhanced demand and more use cases beyond just holding BTC.

That’s where layer-2 projects come in. By extending Bitcoin’s capabilities into areas like lending, governance, or even mortgage backing, these solutions increase usage, reduce sell pressure and potentially boost price through scarcity. Bitcoin Hyper enables precisely this: users can lock BTC to mint assets within its ecosystem, enabling transactions and applications without moving Bitcoin off the base layer.

The $6 Million Presale Surge

Investor enthusiasm is matching the legislative buzz. Bitcoin Hyper’s presale has surged past $5.8 million, closing in on $6 million in just weeks.

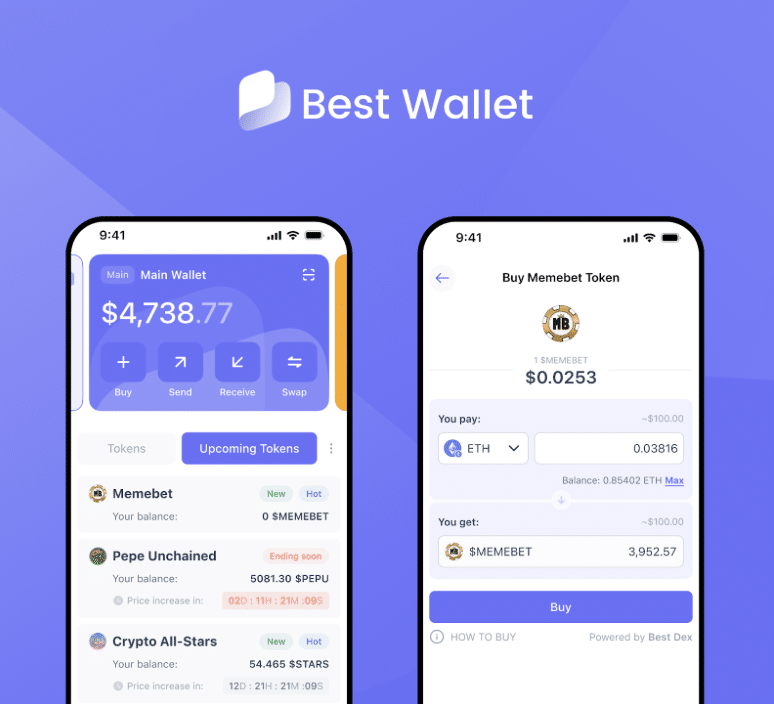

This surge isn't just speculation. With staking APYs at 169%, a current token price of $0.012475 and another price jump imminent, investors are treating Bitcoin Hyper as a practical on-ramp into Bitcoin utility and decentralised applications.

Unlike Bitcoin ETFs or centralised crypto lending platforms, Bitcoin Hyper is positioning itself as a self-sovereign, permissionless financial layer – the type that fits hand-in-glove with developments like crypto mortgage collateral.

What Does a Crypto Mortgage Mean for Bitcoin Investors?

The idea of using Bitcoin to help secure a home loan was once unfathomable, but legislation like the American Homeowner Crypto Modernization Act (introduced in the House) and Lummis’ Senate bill signals a new direction.

For Bitcoin Hyper, this is validation. Its model – where users lock BTC and mint a wrapped asset to use within its fast, low-cost ecosystem – mirrors the very use case mortgage underwriters may one day evaluate.

Not only does this approach support Bitcoin’s price through scarcity, but it also offers a compliance-friendly model where BTC remains on-chain and secure, while a parallel asset powers transactions or contracts.

As mortgage lenders explore blockchain-backed applications and risk modeling, Bitcoin Hyper could become the infrastructure standard for evaluating and integrating crypto assets into financial services.

A Layer-2 Altcoin in the Spotlight

Bitcoin Hyper is often compared to other layer-2s like Arbitrum or Optimism, but with one key difference: it’s the first to build on Solana’s speed while directly anchoring to the Bitcoin network.

This gives it a unique position. Unlike Ethereum-based layer-2s, Bitcoin Hyper extends BTC’s value, while leveraging Solana’s ultra-fast throughput and minimal fees.

As crypto continues to intersect with mainstream finance – from home buying to decentralised apps – projects like Bitcoin Hyper won’t just benefit from the trend, they may become its foundation.

Will Bitcoin Buy Your Home in 2025?

The idea of walking into a bank and backing your mortgage with Bitcoin is no longer theoretical. With legislation now in motion and technologies like Bitcoin Hyper operational, crypto is transitioning from speculative asset to financial infrastructure.

Whether or not Senator Lummis’ bill passes in its current form, the signal is clear: crypto, Bitcoin and specifically layer-2 projects like Bitcoin Hyper are gaining relevance in traditional finance.

INVEST IN BITCOIN HYPER TO BE PART OF THE BITCOIN BOOM

For investors, the question isn't whether to buy Bitcoin. It’s whether they’re positioned in the ecosystems – like Bitcoin Hyper – that will define its future.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Cryptocurrency involves risk. Always conduct your own research before participating in any presale or token offering.