A $1 billion institutional crypto reserve is on the horizon, backed by industry powerhouses. As the space matures, can retail wallets like Best Wallet evolve fast enough to keep users connected to this next wave of digital finance?

Chinh Chu, a former executive at Blackstone, and Reeve Collins, co-founder of Tether, have joined forces via M3 Brigade Acquisition V Corp to raise $1 billion in capital for a publicly listed crypto investment vehicle. Cantor Fitzgerald is advising, and Wilbur Ross has taken on the vice-chair role, with Reeve Collins as CEO, signaling serious institutional intent.

The proposal is to establish a multi-token reserve with substantial stakes in leading cryptocurrencies, including Bitcoin, Ethereum, and Solana. This marks a shift toward diversified portfolios, compared to monolithic strategies like Michael Saylor’s BTC-only approach.

It also follows in the footsteps of institutional firms focusing solely on Ether, highlighting the growing acceptance of multi-asset crypto investment strategies.

The SPAC structure used by Chu and Collins blends traditional finance mechanisms – introducing mass capital – with crypto-native insights to expand institutional-grade participation in the sector.

Strategic Significance of Institutional Crypto Reserves

A $1 billion crypto reserve does more than accumulate assets; it represents a strategic embrace of digital value. For retail investors, it underscores the necessity of robust custody solutions – wallets that are secure, multi-asset capable, and compliant.

Such an institutional structure also primes markets for more stable pricing and deeper liquidity. A retailer using decentralised or browser-based wallets may soon find it difficult to interface with these custody layers without wallet infrastructure that supports compliance, asset visibility, and protocol integrations.

Retail wallets become the bridge between individual users and institutional mechanisms. The question is whether today’s wallets are built for tomorrow’s demands.

How Best Wallet Prepares Retail Users

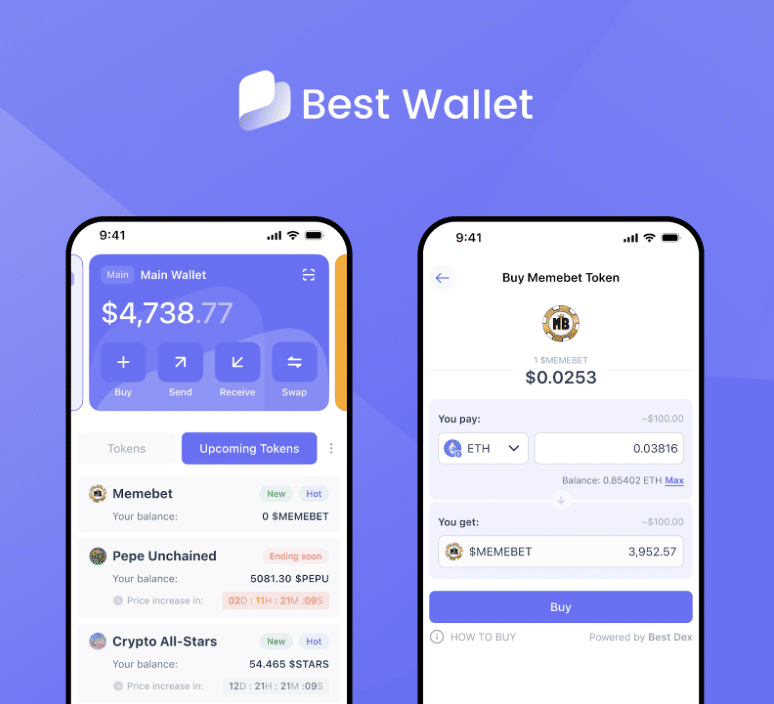

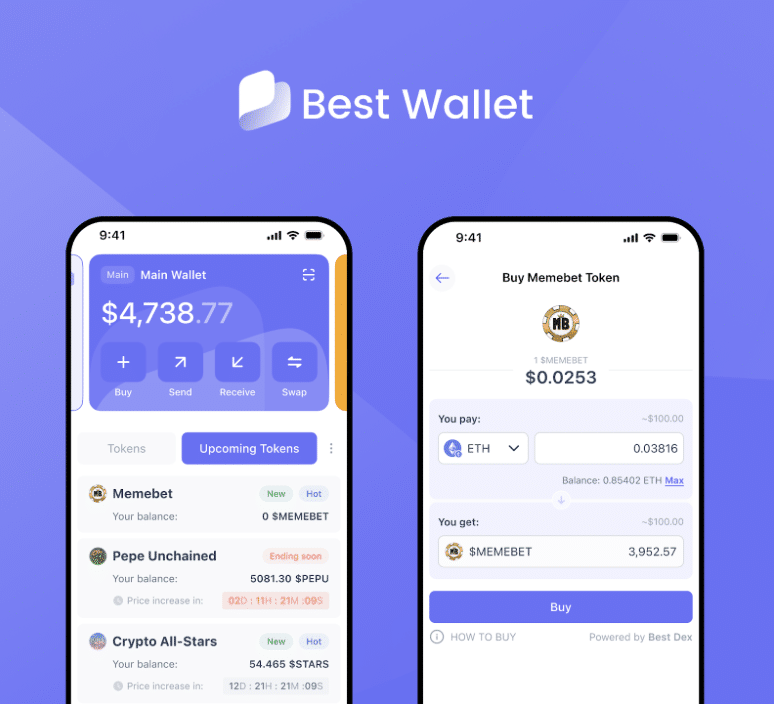

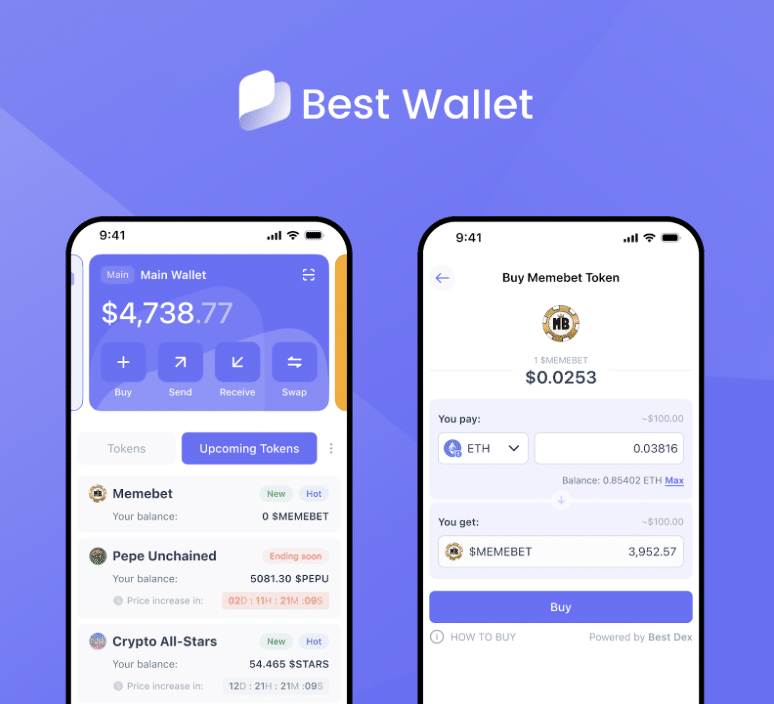

Best Wallet presents itself as a forward-looking contender, matching features to institutional needs. With a one-minute email sign-up, native support for 60+ chains and multiple wallets, it’s built to offer diverse asset access, precisely what a crypto reserve demands.

Security is decentralised and private-key managed. Despite being non-custodial, users benefit from passcode, biometric login, two-factor authentication, and scam filters. These protections are increasingly demanded as large reserves and regulated platforms begin to enforce stronger custody standards.

For an institutional vehicle, on-chain credibility matters. For retail, Best Wallet provides transparent token tracking, real-time profit monitoring, and built-in DEX trading. It also integrates notifications for airdrops and market sentiment, which helps everyday traders align with major institutional moves.

Connecting Large Capital with Everyday Investors

The rise of multi-token reserves drives demand for wallets that can offer more than just storage. They must act as active financial platforms, tracking performance and enabling access to new instruments.

Best Wallet’s roadmap proposes staking aggregators, an NFT gallery, a browser extension, and advanced analytics. These capabilities parallel what institutional investors need: cross-chain support, integrated DeFi access, and enhanced security.

For example, a $1 billion reserve may involve protocol staking in ETH or Solana. If a retail investor wants to participate, their wallet must be prepared for expansions into staking, yield aggregation, and the transparent management of large-scale governance across ecosystems.

Will Retail Wallets Meet Rising Standards?

Institutional-grade reserves raise questions about security, compliance, and functionality. These ecosystems require robust custody methods, transaction audit trails, and transparent governance.

Retail wallets must evolve. Best Wallet’s multiple-wallet support, key protection layers, and built-in DEX functionality indicate a positive trajectory toward integrating institutional-grade features.

Still, areas remain where gaps exist. Wallets may need better integration with SPAC-like instruments or direct access to escrowed deposits controlled by significant funds. They also must navigate compliance with emerging digital asset custody regulations tied to public offerings.

The Road Ahead: Symbiosis Between Institutions and Users

A $1 billion crypto reserve brings prestige and demand to the space. Retail wallets, such as Best Wallet, are evolving to meet people where institutions are heading. As these wallets gain multi-chain support, decentralized exchanges, and security layers, users can begin to access more sophisticated strategies, such as yield aggregation, multi-token asset management, and real-time performance tracking.

Institutional fund announcements signal a broadening of crypto’s financial foundations. Without robust wallet options, retail users risk being excluded from participating meaningfully in this sector.

Best Wallet’s integration of diverse assets, security basics, and future-ready features offers a playbook for retail platforms aiming to match institutional needs, from seamless UI to decentralized key security and a multi-chain dex that can handle extensive reserve interactions.

The Time for Wallet Innovation is Now

The arrival of a $1 billion SPAC-backed crypto reserve signals a critical inflection point in digital asset finance – one that demands scalable, compliant, and secure retail wallet infrastructure. Wallets that remain single-chain, low-security, or limited in functionality may be left behind.

Best Wallet is an example of the kind of platform that matches evolving market needs. As institutional crypto comes online, retail wallets must serve as bridges, not just endpoints. Whether through staking, analytics, or compliant token handling, the next generation of wallets must deliver on both security and sophistication to support users in a thriving, multi-layered crypto economy.

Retail investors should explore wallet features today that reflect tomorrow’s needs – multi-chain support, strong encryption, performance dashboards, and access to emerging passive income tools.

USE BEST WALLET TO KEEP UP WITH CRYPTO INNOVATIONS

The crypto reserve may be institutional, but its impact will be broad. Retail wallets that are “ready” can ensure everyday users ride the next wave of digital asset innovation rather than being sidelined by it.

Disclaimer: This article is informational only and not financial advice. Cryptocurrency investments carry significant risk. Please conduct thorough due diligence before selecting any wallet or investment.