As Ethereum-based funds like BUIDL go mainstream, crypto investors are looking beyond exchanges and custodians for more innovative and safer ways to hold tokenized assets. With decentralised wallets offering privacy and control, are we entering a new era of self-custody?

In a year marked by regulatory clarity and institutional adoption, the rise of real-world asset tokenisation has turned heads across the financial spectrum. At the centre of this shift sits BlackRock’s USD Institutional Digital Liquidity Fund (BUIDL) – an Ethereum-based money market fund tokenized on-chain and now accepted by leading cryptocurrency exchanges, including Crypto.com and Deribit.

For years, crypto traders had to choose between stability and yield when posting collateral as security. Stablecoins offered predictability but no returns. Volatile assets offered potential upside, but increased exposure to liquidation risk. BUIDL changes that equation.

Now paying around 4.5% annually and backed by US Treasuries, BUIDL introduces an entirely new category of capital into the crypto ecosystem: stable, yield-generating, Ethereum-based collateral. Exchanges are responding, with Deribit set to accept BUIDL for futures and options trading and Crypto.com extending it to institutional clients.

“Tokenised securities are no longer experimental,” said Michael Sonnenshein, COO at Securitize. “They’re programmable, productive capital and a serious alternative to traditional stablecoins.”

With $2.9 billion in assets already under management, BUIDL’s rapid growth signals a broader trend. Investors want more than passive parking spots. They want capital that works.

Ethereum’s Role in Tokenised Fund Infrastructure

The BUIDL fund’s success highlights a deeper point: Ethereum remains the dominant infrastructure for tokenising real-world assets (RWAs). According to data from RWA.xyz, nearly 60% of tokenized RWAs reside on the Ethereum network, which is also home to most of the innovation in on-chain collateral, decentralized finance, and smart contract standards.

The tokenisation sector now accounts for nearly $24 billion in onchain assets, having grown over 50% since the start of the year. As Ethereum’s role solidifies, the platforms used to access, hold, and manage Ethereum-based funds are becoming just as important as the assets themselves.

That’s where decentralised wallets enter the picture.

Wallet Choice Is Strategy: Why Self-Custody Matters

For investors exploring tokenised assets like BUIDL, the question of where to store these tokens is as critical as what to invest in.

Centralised exchanges offer convenience but come with custodial risk. With history as a guide – think FTX, Celsius, or BlockFi – that’s a trade-off many investors are no longer willing to make. This has led to a rise in non-custodial wallets that give users complete control over their digital assets, including Ethereum-based funds.

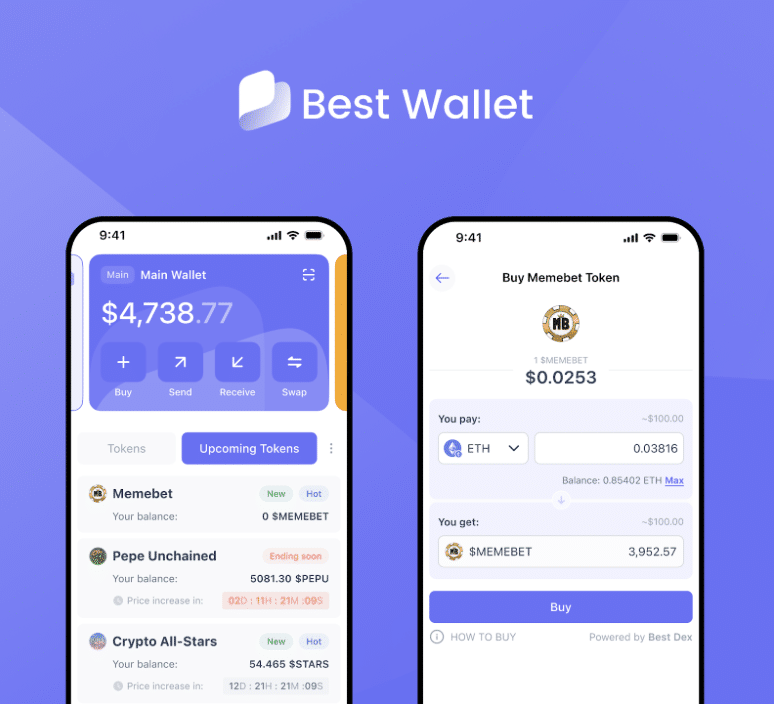

Among them, Best Wallet is emerging as a preferred choice, especially for privacy-conscious, yield-seeking users operating across Ethereum and beyond.

Best Wallet: A Decentralised Alternative for Ethereum-Based Assets

Best Wallet is a mobile-first, non-custodial wallet designed to support major cryptocurrencies, including Bitcoin and Ethereum, while also offering future compatibility with over 1,000 tokens and 60 blockchain networks. For investors holding assets like BUIDL, this matters.

Because BUIDL is tokenised on Ethereum, it requires Ethereum compatibility, but that’s just the beginning. Best Wallet supports direct Ethereum token storage, swaps, private key management, and in-app governance for its utility token, $BEST.

More critically, Best Wallet removes dependency on intermediaries. No KYC is required to sign up, and users maintain complete control over their keys, which is essential for investors who value security, mobility, and decentralized control.

From BUIDL to Broader Ethereum Exposure

The utility of Best Wallet extends beyond simply holding a token, such as BUIDL. As more institutional and retail investors explore Ethereum-based assets, having a wallet that can facilitate interactions with DeFi, token launchpads, and on-chain governance becomes a strategic advantage.

The wallet’s upcoming crypto debit card, for instance, could enable users to spend yield generated from BUIDL in real-world settings – bridging traditional finance with on-chain income in a way that custodial platforms still struggle to replicate.

Meanwhile, the $BEST token offers holders reduced transaction fees and governance rights, allowing users to shape the development of wallet features, such as which assets are supported or which networks are prioritized.

In a sense, Best Wallet mirrors the ethos behind Ethereum-based funds like BUIDL: programmable, interoperable, and user-controlled.

Ethereum-Based Tokenisation and the Future of Financial Tools

As Ethereum continues to serve as the technical foundation for on-chain securities, platforms like Best Wallet could represent the user-facing layer that allows those tools to reach broader adoption.

Consider the evolving digital wallet landscape. While Europe inches toward the launch of a centralised digital euro, decentralised wallets offer an alternative model – one where privacy, not compliance, is the default. In this context, Best Wallet is more than just a storage tool. It’s an interface for financial autonomy.

As governments and institutions begin to tokenise sovereign debt, money markets, and even infrastructure, Ethereum-based tools like BUIDL will likely be joined by hundreds of other asset classes.

Investors who start building fluency now, by combining secure wallet infrastructure with strategic token exposure, could be better positioned as this market matures.

The Smarter Way to Hold BUIDL in 2025

The launch and rapid growth of BlackRock’s BUIDL fund have validated Ethereum as the de facto standard for tokenized financial assets. With exchanges like Deribit and Crypto.com now accepting BUIDL as collateral, the line between traditional finance and DeFi continues to blur.

However, as tokenized securities transition from novelty to necessity, the tools we use to hold them matter more than ever.

Non-custodial platforms like Best Wallet provide a privacy-focused, decentralized way to engage with Ethereum-based tokens like BUIDL, while also unlocking broader utility, governance rights, and multi-chain compatibility.

EXPLORE BEST WALLET’S LATEST ROADMAP, PRESALE FEATURES, AND HOW TO SECURE YOUR INVESTMENTS

In 2025, the most innovative strategy might not just be what you invest in, but where you hold it.

Disclaimer: This article is for informational purposes only and does not constitute financial or investment advice. Cryptocurrency investments are volatile and carry significant risk. Always conduct your research and consult a qualified financial advisor before making investment decisions.