Stripe’s acquisition of embedded wallet provider Privy marks a pivotal shift in digital finance. As the boundaries between crypto and traditional payments blur, decentralised wallet projects like Best Wallet are emerging to meet growing demand for seamless, secure user experiences.

Stripe, one of the world’s largest payment processing firms, has deepened its crypto ambitions with a major acquisition. On Wednesday, it announced the purchase of crypto wallet infrastructure firm Privy, a startup known for powering embedded wallet experiences across top blockchain applications like OpenSea, Pump.fun and Hyperliquid.

While the deal’s financial details remain undisclosed, what’s clear is the strategic intention: Stripe is moving fast to bring digital assets into the mainstream by eliminating the pain points typically associated with wallet usage. Privy, which allows users to create wallets without handling seed phrases or external extensions like MetaMask, will continue operating independently, but under the Stripe umbrella.

Stripe CEO Patrick Collison summed it up succinctly on X: “Money has to reside somewhere and Privy builds the world's best programmable vaults.”

This acquisition follows Stripe’s stablecoin-focused expansion, including its purchase of Bridge in late 2024 and rollout of Stablecoin Financial Accounts for over 100 countries. Collectively, these moves reflect a vision for the future of digital finance where fiat and crypto become not just interoperable, but indistinguishable in daily use.

Embedded Wallets Are the New Onboarding Gateway

Privy’s real power lies in what users don’t see. Its embedded wallet tech abstracts away complex crypto operations and integrates directly into apps. That includes holding assets, interacting with dApps and transacting – without needing to connect third-party wallets. The result: fewer drop-offs and more intuitive onboarding, especially for Web2-native users.

According to Privy, its platform supports over 75 million wallets and works with 1,000 developer teams. These figures reflect a clear market direction – wallets are no longer just crypto utilities; they are financial interfaces that need to scale globally, securely and seamlessly.

Stripe appears to understand this shift. As fiat and blockchain rails converge, crypto wallets are evolving into front-end entry points for next-gen financial products, whether it’s stablecoin-based payments, digital commerce, or tokenised identity services.

The Wallet Race: Stripe’s Centralised Push vs. Best Wallet’s Decentralised Rise

While Stripe’s integration of Privy highlights how centralised players are racing to shape the future of digital finance, decentralised challengers are rising in parallel. One such contender is Best Wallet, a non-custodial, no-KYC crypto wallet quietly gaining traction and funding.

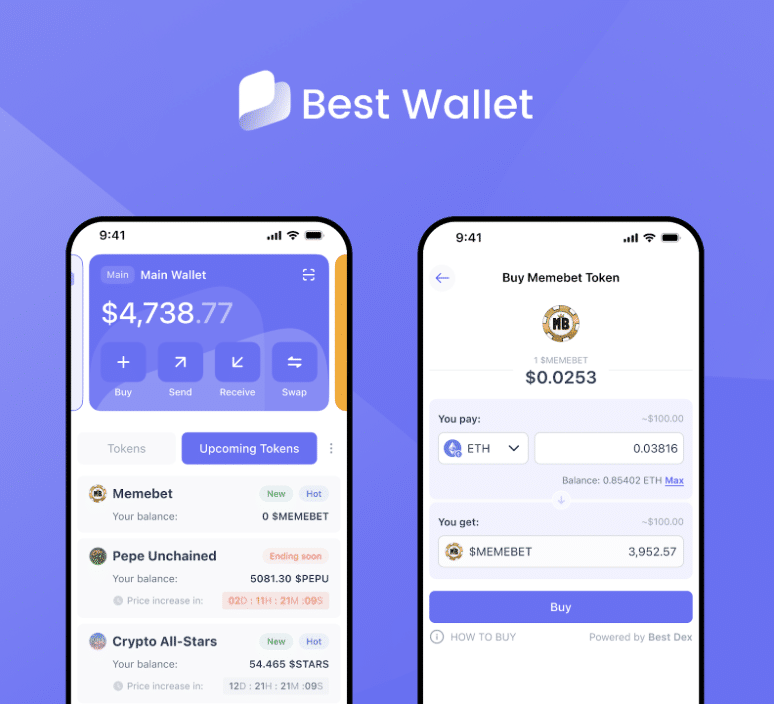

With over $13.2 million raised in presale, Best Wallet’s utility token $BEST, is designed to support seamless wallet operations and provide additional rewards to its holders. These include higher staking yields (up to 105% APY), early access to new token launches, and reduced transaction fees.

Best Wallet fundamentally differs from Stripe’s Privy-backed model in that self-custody and privacy are embedded, not abstracted. Built on Fireblocks’ MPC-CMP technology, the wallet prioritises security while keeping the UX simple. Users don’t need seed phrases or external extensions. Everything—from staking to cross-chain transfers—can be managed within the app.

Wallets as Launchpads, Not Just Storage

What makes Best Wallet particularly relevant in the post-Privy acquisition climate is its ability to function as a wallet and a launchpad for investment. Its Upcoming Tokens feature allows users to participate in early-stage crypto projects directly within the app – something Stripe has yet to enable, even with Privy in its stack.

One example is BTC Bull Token, which uses Best Wallet as its primary rewards and distribution channel. Holders of $BEST gain preferred access to these launches, a growing trend in a market where access and timing often determine upside.

DISCOVER THIS NON-CUSTODIAL AND NO-KYC WALLET, THE BEST WALLET

The implication is clear: as Stripe builds infrastructure to make crypto invisible, decentralised wallet projects like Best Wallet are doubling down on visibility, access and ownership. Both aim to simplify crypto, but one does so by abstracting control, the other by empowering it.

Convergence or Divergence? Two Paths to Digital Finance

Stripe’s move to acquire Privy isn’t just a business deal—it’s a directional signal. It shows that major fintech players now see crypto wallets as core infrastructure, not niche tools. The question is: Will these wallets serve the user or the platform?

In Stripe’s model, the wallet becomes an embedded component of the broader payments stack, blending crypto into existing rails. In Best Wallet’s approach, the wallet is the gateway to a decentralised ecosystem – where users aren’t just participants, but stakeholders.

If both visions succeed, the future of digital finance may not be either/or, but both. Centralised and decentralised wallets could coexist, with users choosing depending on the task – holding stablecoins for international payments or participating in early-stage DeFi launches.

What Stripe’s Privy Move Means

The Privy acquisition marks another leap in Stripe’s crypto playbook, one that aligns closely with its broader goal of making financial infrastructure more global, modular, and internet-native. Embedded wallets are no longer a technical detail—they’re the battleground for who controls the user relationship in crypto.

As Stripe expands its empire, decentralised wallets like Best Wallet are building their own domains – ones where users retain custody, access early opportunities, and benefit directly from their participation.

Whether you favour Stripe’s seamless experience or Best Wallet’s self-sovereign ethos, one thing is sure: crypto wallets are no longer just for holding coins. They are shaping how value moves, how ownership is verified, and how the next generation of finance will function.

Disclaimer: This article is for informational purposes only and does not constitute financial or investment advice. Cryptocurrency investments are volatile and carry significant risk. Always conduct your research and consult a qualified financial advisor before making investment decisions.