With nearly $1 billion in liquidations and major cryptos tumbling, the Trump–Musk feud has spotlighted the fragility of investor sentiment. As volatility spikes, non-custodial wallet projects like Best Wallet are emerging as safer entry points for retail participation.

In a week where digital markets struggled to stay afloat, the public breakdown between Donald Trump and Elon Musk sent shockwaves across the crypto landscape. Amid mounting political tension, Bitcoin crashed to a multi-week low, billions were wiped from total market capitalisation and a sharp spike in crypto volatility forced investors to reconsider their exposure.

As markets tumbled, data revealed that BTC and ETH balances on centralised exchanges dropped by over 4% and 7% respectively. The trend, while alarming on the surface, may indicate accumulation, as holders appear to be moving assets to self-custody amid heightened uncertainty. However, the backdrop was anything but ordinary: a feud between two of the most influential voices in tech and politics spiralled into a public war of words.

Trump-Musk Tensions Fuel Crypto Market Panic

On June 5, Elon Musk posted that Trump’s flagship economic bill would push the U.S. into recession, accusing the government of reckless spending. The President retaliated on Truth Social, defending his legislation as “one of the Greatest Bills ever presented to Congress.” Musk escalated matters further by announcing that SpaceX would decommission its Dragon spacecraft, in response to a perceived threat of cancelled federal contracts.

The feud took a darker turn when Musk, on X, implied that Trump was listed in the Epstein files – allegations that sent social media into meltdown and injected renewed risk into already fragile markets. Over $988 million in crypto positions were liquidated in the following 24 hours, affecting nearly 228,000 traders – most of whom were long on Bitcoin.

The broader crypto market shed nearly $170 billion in value, hitting a one-month low at $3.26 trillion before staging a partial rebound. Bitcoin fell below $101,000 before recovering marginally, while Ethereum dipped below $2,400. According to Binance’s weekly investor outlook, markets remain sensitive to macroeconomic signals and crypto volatility is once again front and centre.

Institutional Moves Underscore Shifting Risk Landscape

Despite the chaos, signs of institutional adaptation suggest that crypto’s foundational infrastructure continues to strengthen. JPMorgan’s decision to allow ETF shares as loan collateral marked a notable pivot in risk perception.

At the same time, regulatory clarity from the SEC allowed crypto ETFs to integrate staking rewards, providing new routes for passive income within traditional finance frameworks.

Elsewhere, Circle’s IPO on the New York Stock Exchange – raising $1.5 billion – indicates that digital assets are being absorbed into mainstream capital markets, albeit cautiously. However, for retail investors navigating a sea of volatility, questions remain about where to find security, stability and long-term opportunity.

Best Wallet Rises Amid Crypto Volatility

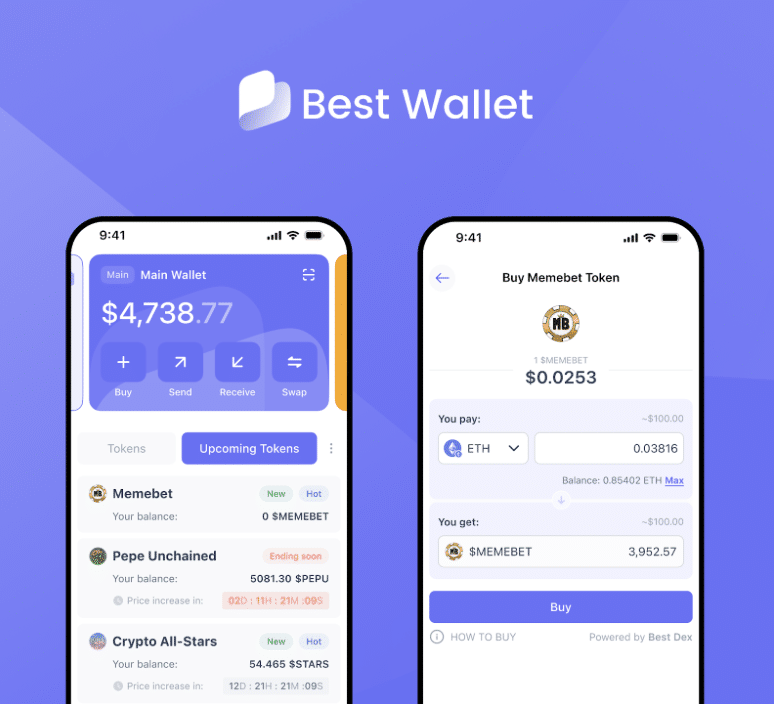

While macro headlines dominated the news cycle, Best Wallet quietly positioned itself as a robust decentralised alternative for users seeking control. This non-custodial wallet has built a growing user base by offering simple onboarding – email only, no KYC and seamless support for Bitcoin and over 60 blockchains.

Amid the Trump Musk-induced turmoil, demand has increased for wallets that enable users to safeguard their assets during market turbulence. With advanced security features like Fireblocks’ MPC integration and fiat conversion tools embedded directly into the app, Best Wallet provides more than basic storage – it offers a decentralised financial toolkit.

How BEST Token Adds Value in Uncertain Markets

At the heart of this ecosystem is the BEST token, currently in presale and already raising over $13.1 million. Unlike the speculative assets that dominate headlines during market booms and busts, BEST is designed to give holders practical benefits. These include fee reductions, access to early-stage token sales and even community governance.

JOIN THE BEST WALLET TOKEN PRESALE

During volatile market phases like the one triggered by the Trump–Musk fallout, BEST holders can also stake their tokens for up to 107% APY. The platform’s staking aggregator enhances returns across other tokens too, offering an additional hedge for users who choose to stay active in the space rather than retreat to fiat.

From Volatility to Utility: Reframing Crypto Exposure

In light of the recent market chaos, retail investors are reevaluating what crypto participation should look like. While the Trump–Musk headlines may fade, the underlying lesson is clear: high-profile drama can spark extreme crypto volatility. Tools that offer real utility and stability – like Best Wallet – are proving to be better suited for long-term positioning.

Crypto remains a fast-moving, high-risk environment, but that doesn’t mean all assets carry the same level of unpredictability. As seen this week, coins and platforms that emphasise custody, rewards and access over hype may offer a more sustainable path forward.

The Outlook for Retail Investors Post-Trump Musk Fallout

For investors rattled by billionaires clashing on social media and the subsequent fallout in crypto markets, projects like Best Wallet provide a timely counter-narrative. The combination of decentralised control, staking incentives and real-world payment tools like the Best Card offers users a foothold in Web3 without overexposure to headlines or hype cycles.

Moreover, the fact that over 246 million BEST tokens are already staked points to rising confidence in utility-focused projects, even when the broader market stumbles. This suggests that amid the noise, there is a growing segment of crypto investors seeking substance over speculation.

As the dust settles from the latest Trump Musk drama and the crypto world recalibrates for the next macro event, the question remains: will investors continue chasing volatility, or will they pivot towards tools that actually support long-term participation?

Disclaimer: Cryptocurrency markets are volatile and involve significant risk. This article is for informational purposes only and does not constitute financial advice. Always conduct your own research before making investment decisions.