As Washington moves closer to establishing guardrails for the fast-growing stablecoin sector, the debate around user protection and infrastructure security in crypto is intensifying. On May 20, the Guidance and Establishing National Innovation for US Stablecoins (GENIUS) Act cleared a critical Senate hurdle in a 66-32 vote, setting the stage for a whole-floor debate on what could become the United States’ most consequential digital asset law to date.

Support for the bill had faltered earlier this month when Democratic lawmakers balked over potential conflicts tied to President Trump’s crypto investments.

However, after revisions to address bipartisan concerns, including anti-money laundering provisions, over 15 Democrats flipped their stance. Senate Minority Leader Chuck Schumer still voted against it, but the successful cloture motion now opens the floor for full legislative deliberation.

The Push Toward Stablecoin Regulation

In February, Senator Bill Hagerty introduced the GENIUS Act aims to impose federal standards on the estimated $248 billion stablecoin market. If passed, it would require that all stablecoins be fully backed, with regular audits and approval from either state or federal regulators. Crucially, the legislation would also prohibit algorithmic stablecoins that lack full reserves, signalling a crackdown on more experimental models.

“This groundbreaking, bipartisan legislation will bring America’s payment system into the 21st century,” Hagerty wrote on X (formerly Twitter), highlighting the dual goal of boosting US Treasury demand and preserving the dollar’s global dominance.

Senator Cynthia Lummis, a longtime digital asset advocate, praised the revised draft and said she hopes to see the bill fully debated and passed by Memorial Day. “Digital assets are the future, and now we’re one step closer to ensuring America leads the way,” she said.

The GENIUS Act follows related legislation in the House—the STABLE Act—which was approved by the House Financial Services Committee in April. These efforts represent a growing institutional consensus that more precise stablecoin regulation is essential for consumer protection and broader market stability.

Spotlight Shifts to Crypto Wallet Security

As regulation advances, so does the scrutiny of the infrastructure users rely on to interact with digital assets. One area drawing increasing attention is crypto wallet security – a critical layer in ensuring consumer safety amid expanding institutional oversight.

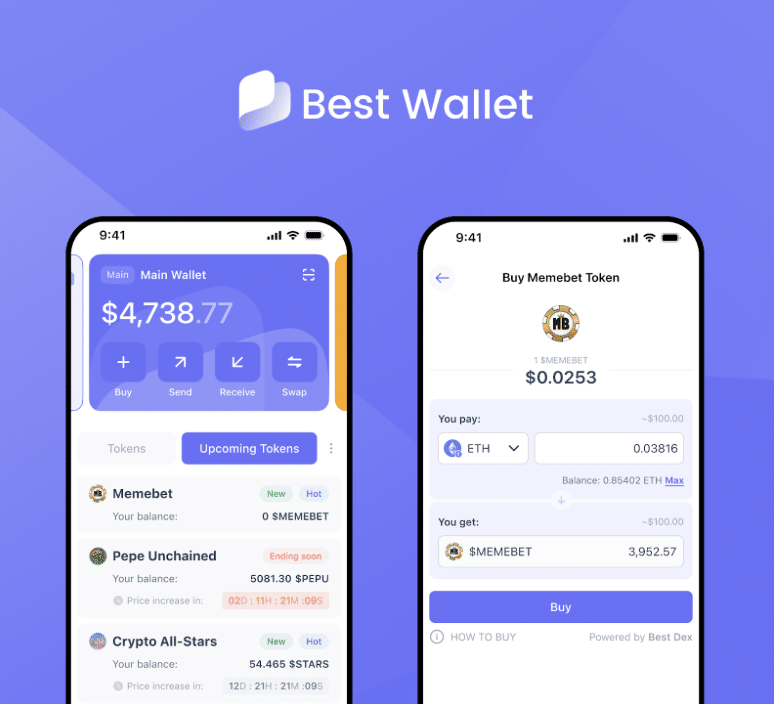

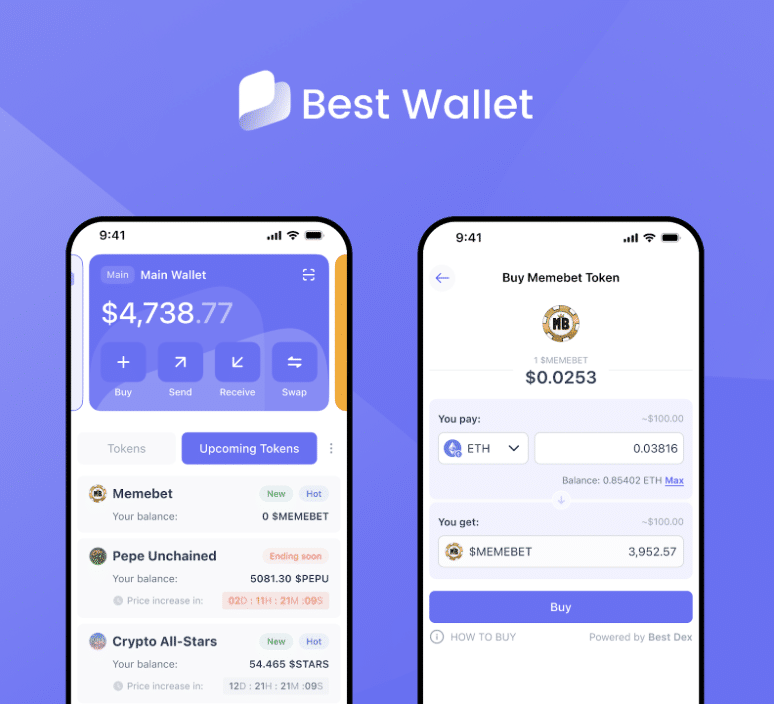

Among the emerging contenders in this space is Best Wallet, a mobile-first crypto wallet that prioritises security and accessibility. While it remains a relatively new player compared to longer-standing wallet providers, Best Wallet’s approach is gaining traction due to its seamless integration with DeFi applications, NFT marketplaces, and its privacy-first model.

Best Wallet does not require users to undergo know-your-customer (KYC) verification, offering complete anonymity. This might raise flags in regulatory circles, but controlling private keys without providing personal information is a defining feature of true self-custody for many users.

In a climate where trust in centralised exchanges continues to waver, such decentralised tools are becoming increasingly relevant.

From Compliance to Custody: A Changing Landscape

Stablecoin regulation also forces a reassessment of how digital assets are stored, traded, and tracked. The GENIUS Act’s mandate for licensed issuance and regular audits implies a shift toward greater transparency but also introduces challenges. If stablecoins are to remain accessible to the general public without sacrificing compliance, wallet interfaces must evolve to accommodate both institutional and retail use cases.

New wallet solutions such as Best Wallet strive to bridge this gap. In addition to its user-friendly interface and multi-chain support, it offers early access to partner token launches, including meme coin presales. This feature could help wallets stay relevant as decentralised finance (DeFi) becomes more mainstream.

Furthermore, Best Wallet provides staking and airdrop rewards via its native $BEST token, incentivising long-term user participation. While its limited track record is a drawback, the platform’s roadmap and feature set are aligned with the kind of innovation stablecoin regulation is intended to promote, structured growth without compromising user control.

Balancing Innovation and Oversight

This tension between innovation and regulation is at the heart of the current debate in Washington. Lawmakers are walking a fine line between enabling financial innovation and ensuring market integrity. If the GENIUS Act passes, it will impose a stricter regime on stablecoin issuers but could simultaneously create more opportunities for decentralised infrastructure to flourish.

Senator Hagerty’s emphasis on the role of stablecoins in reinforcing US Treasury demand is a clear nod to the geopolitical significance of digital dollars. Yet beneath the headlines, the implications for end users may be even more significant.

Enhanced regulation will inevitably increase the demand for wallets that can interface securely with permissioned and permissionless systems, offering transparency without sacrificing autonomy.

In this context, crypto wallet security becomes more than just a technical detail; it is a central pillar of digital finance. Whether users are storing USDT, swapping DeFi tokens, or managing meme coin holdings, the safety and functionality of their wallet will determine their confidence in the broader ecosystem.

DISCOVER ALL THE FEATURES OF BEST WALLET

As the GENIUS Act advances through the Senate, it reflects more than just a legal milestone – it signals a shift in how the US intends to manage digital currencies and the platforms that support them. While stablecoin regulation may focus on institutional compliance, the spotlight is now firmly on crypto wallet security as a prerequisite for trust, usability, and longevity.

Emerging tools like Best Wallet, which emphasize self-custody, interoperability, and non-custodial privacy, could become critical to ensuring that users continue to access decentralised networks without compromising safety or functionality.

Whether this new regulatory era will lead to more resilient crypto markets or stifle innovation remains to be seen. Still, one thing is clear: the current infrastructure choices, particularly regarding wallet technology and user control, will shape the next chapter of digital asset adoption.

Disclaimer: This article is for informational purposes only and does not constitute financial or investment advice. Readers should research or consult a qualified advisor before making investment decisions about digital assets or wallet platforms.