Institutional inflows may have triggered Ethereum’s breakout rally, but its long-term trajectory increasingly depends on AI-powered utility tokens like SUBBD that demonstrate real-world use cases on the Ethereum network.

After a sluggish start to 2025, Ethereum has staged a powerful comeback. In just 72 hours, ETH surged by over 44%, marking its most aggressive rally since January 2021. The move has pushed Ethereum’s price from around $1,800 to over $2,400, reigniting speculation around its long-term potential.

What makes this latest rally particularly noteworthy is its correlation with institutional activity. On-chain data revealed that crypto investment firm Abraxas Capital quickly withdrew nearly $400 million worth of ETH from exchanges, a move many see as a vote of confidence in Ethereum’s future. Historically, such aggressive off-exchange accumulation from major players tends to reflect long-term conviction rather than speculative positioning.

This institutional appetite has driven up prices and helped restore on-chain profitability. Sentora analytics noted a significant recovery in the percentage of ETH addresses in profit, up to over 60% from just 32% a month ago.

The surge in value has also restored Ethereum’s technical momentum. Market analysts, including Titan of Crypto, point to key levels reclaimed on multi-year trendlines and a return to bullish formations like ascending triangles.

Although ETH still trades below its all-time high of $4,878, current sentiment suggests a steady path toward recovery. With upcoming resistance levels at $3,073, $3,700, and even $4,000, some traders now speculate that Ethereum could target $12,000 before the year ends.

Institutional Demand in a Changing Ecosystem

Much of Ethereum’s long-term investment case rests on its capacity to support innovation. While Bitcoin is primarily valued as a digital store of value, Ethereum’s utility-driven network underpins an entire ecosystem of decentralised applications, smart contracts, and emerging use cases.

The platform's appeal to institutional investors isn’t just about price movements – it’s also about network effect, programmability, and future-proofing. This is especially relevant as newer use cases continue to emerge across sectors like decentralised finance (DeFi), NFTs and increasingly, artificial intelligence (AI).

One example of this shift in utility is found in projects like SUBBD, a tokenised AI content platform built directly on Ethereum’s infrastructure. While Ethereum’s value is partially derived from the projects it supports, innovations like SUBBD also demonstrate how applications on the network can create new avenues for user adoption and, by extension, network activity.

SUBBD: A Use Case That Mirrors Ethereum’s Utility Thesis

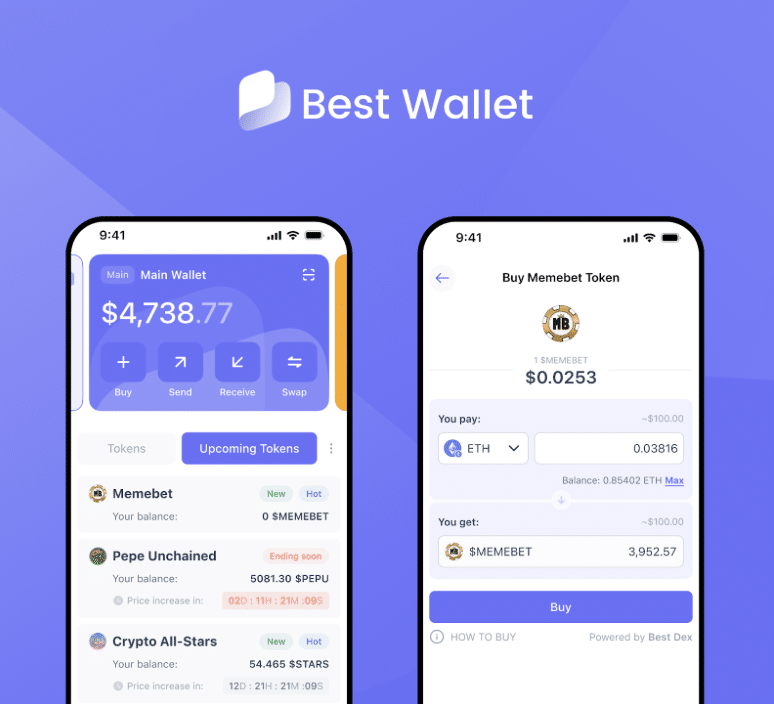

SUBBD isn’t a speculative meme coin or a DeFi protocol chasing yield. It’s an AI-powered content subscription platform designed to serve creators and their followers directly with blockchain-based tools. The project has already attracted over 250 million users across its ecosystem, using Ethereum to offer decentralised, peer-to-peer monetisation for influencers and fans.

In contrast to traditional content platforms, which often charge hefty commissions and retain control over user data, SUBBD leverages smart contracts and $SUBBD tokens to automate payments, subscriptions, and content access. Transactions are direct, secure, and cost-efficient—exactly the kind of high-utility model Ethereum was designed to support.

Holders of $SUBBD tokens can access exclusive content, benefit from early drops of AI-powered features, and earn staking rewards currently yielding around 20% APY, but it’s not just about perks. The real story here is how the token creates mutual value across the network: creators retain more earnings, fans gain more access, and both engage in a system that removes costly intermediaries.

This isn’t hypothetical. The platform’s AI tools already enable content generation in the form of videos, voice memos, and personalised avatars – features that make the service attractive to both mainstream influencers and crypto-native creators.

Why Ethereum Still Matters in This Context

Ethereum remains the bedrock for a wide range of decentralised applications. It’s the platform of choice for projects like SUBBD, not only because of its existing network effects but also because of its developer tools, security infrastructure, and expanding layer-two ecosystem.

What makes the recent ETH price increase really significant is that it’s not being driven solely by speculative retail trading. As seen through large capital flows, institutional confidence indicates that smart money is betting on Ethereum’s ability to host the next wave of high-utility, decentralised applications.

In this way, projects like SUBBD don’t just benefit from Ethereum—they validate it. The more real-world applications the network supports, the stronger its long-term value proposition.

SUBBD’s decision to integrate with Ethereum, while also supporting BNB Chain, reflects a broader trend of projects seeking both reach and resilience. Ethereum’s relative decentralisation and upgrade roadmap (including moves toward further scalability) ensure it remains central to Web3 development.

Price Predictions Are Only Part of the Story

While traders and analysts are projecting ETH targets as high as $12,000 by the end of 2025, the most compelling story behind Ethereum’s rise lies in its relevance. Abraxas Capital’s withdrawal reflects long-term positioning, just as the success of SUBBD demonstrates the growing demand for real utility.

Ethereum’s price, like Bitcoin’s, will always be subject to the broader macro environment, risk sentiment, and regulatory factors. Still, its ability to host platforms that bridge traditional and decentralised economies, such as AI, media, and finance, ensures that institutional demand is rooted in more than just hype cycles.

EXPLORE THE SUBBD TO SEE HOW UTILITY TOKENS ARE DRIVING ETHEREUM’S NEXT CHAPTER

As investors increasingly seek exposure to projects that offer functionality, monetisation opportunities and scalable user bases, tokens like $SUBBD may represent a growing subset of altcoins that outperform simply by delivering on practical use cases.

From Accumulation to Application: The Future Path

Ethereum’s most recent rally may have been sparked by institutional accumulation, but its sustainability depends on continued innovation. That’s why analysts are closely watching ETH’s price levels and network activity—new applications, total value locked (TVL), and developer engagement.

In this context, the rise of token ecosystems like SUBBD is not just additive to Ethereum’s story – it’s essential to it. If Ethereum is to reach $12,000 or beyond, it will be because projects like SUBBD bring millions of new users, creators and financial activity to the network.

Disclaimer: This article is for informational purposes only. Always conduct your research and consult a financial advisor before making investment decisions. Cryptocurrency carries significant risk and may not be suitable for all investors.