The US state of New Hampshire has become the first to legalise a Bitcoin reserve, signalling a new era of institutional crypto adoption. However, as lawmakers turn to hard assets, a parallel shift is playing out among retail investors—one where meme coins are no longer just jokes but complex vehicles tied to broader market narratives.

On May 6, New Hampshire Governor Kelly Ayotte signed House Bill 302 into law, making the “Live Free or Die” state the first in the US to authorise its treasury to hold Bitcoin. Under this new legislation, the state’s Treasurer can invest up to 5% of total reserves in Bitcoin or other crypto assets with market capitalisations exceeding $500 billion – currently, only BTC qualifies.

The law takes effect in 60 days and is modelled on the Satoshi Action Fund’s strategic reserve framework. To ensure transparency and risk management, it mandates US-regulated custody mechanisms, including state-controlled multisignature wallets and exchange-traded products.

The move comes amid broader state-level divergence on crypto policy. While New Hampshire moves forward, Florida and Arizona have recently retracted similar proposals. Florida’s House Bill 487 and Senate Bill 550 were indefinitely postponed last week, and Arizona Governor Katie Hobbs vetoed a related bill, citing concerns about the perceived risk of digital assets.

Yet the message from New Hampshire is clear: Bitcoin is being taken seriously as a treasury asset.

Market Response: Optimism, but Not Just About Bitcoin

Bitcoin’s price nudged higher following the bill’s passage, climbing from $94,000 to an intraday high of $97,500, but while part of this movement can be attributed to broader macro-optimism – particularly easing US-China trade tensions – the legislation adds weight to a growing narrative: institutional acceptance of Bitcoin is accelerating.

What’s notable isn’t just the price reaction but the response from traders. Bitcoin options activity has surged, with data from Deribit showing over $484 million in open interest on call contracts betting BTC could hit $300,000 by June 26. While some of these contracts are viewed as “lottery tickets,” they reflect genuine sentiment that a breakout is coming.

Still, this rally narrative isn’t confined to Bitcoin alone. It’s extending into more speculative corners of the market – albeit with a twist.

Meme Coins Reimagined: The Rise of BTC Bull Token

Meme coins have often been dismissed as speculative distractions, but in 2024 and 2025, the space has evolved. Investors are now looking beyond viral memes and searching for tokens that embed real utility into their value propositions. A clear example of this shift is BTC Bull Token ($BTCBULL), a meme coin directly tied to Bitcoin’s price performance.

Unlike traditional meme coins, which often offer no tangible link to broader market assets, BTC Bull Token is structured around Bitcoin’s trajectory. With over $5.3 million raised in presale funding, the token’s utility lies in its built-in reward mechanism: holders receive Bitcoin airdrops every time BTC crosses a milestone price.

The first airdrop is triggered at $150,000, followed by subsequent payouts at $200,000, $250,000 and $300,000. This means that investors aren't just speculating on hype – they're participating in an incentive model aligned with the most closely watched asset in crypto.

The current price of $BTCBULL sits at $0.0025, with a scheduled increase on the horizon as the presale nears completion and while the returns may seem speculative, the structure of BTC Bull Token reflects a deeper shift: meme coins are being redesigned to mirror Bitcoin’s core appeal – scarcity, simplicity and utility.

Why Meme Utility Matters Now

In past cycles, meme coins like Dogecoin and Shiba Inu surged primarily on community hype and influencer buzz, but many of these projects struggled to retain relevance when sentiment cooled. The newer generation of meme coins is addressing this weakness by embedding actual use cases – often tied to staking, gamification, or, in the case of BTC Bull Token, macroeconomic triggers.

This reflects a broader trend across crypto markets: speculation is being tempered by structure. Investors are no longer satisfied with mere virality – they want features, reward systems and alignment with foundational narratives. BTC Bull Token delivers that by turning Bitcoin’s rising price into a measurable event with predefined benefits.

And in contrast to risky derivatives like options contracts – which can expire worthless – BTC Bull Token carries a longer tail of utility. If Bitcoin doesn’t hit $300,000 next month, holders aren’t left empty-handed. They still own a token designed to benefit from long-term appreciation, with supply reductions (token burns) activated at each milestone to mimic Bitcoin’s deflationary model.

Crypto Governance Meets Real-World Adoption

As states like New Hampshire bring Bitcoin closer to the public treasury, these developments reinforce why tokens like BTCBULL may be more than just speculative vehicles. They’re also narrative instruments – ways for the average investor to express a bullish thesis on Bitcoin without relying solely on spot exposure or high-risk instruments like call options.

BTC Bull Token’s model resonates with investors looking for structured speculation. It rewards patience, long-term belief in BTC’s trajectory and provides more flexible entry points compared to traditional ETFs or futures markets. This is particularly appealing to retail users priced out of direct Bitcoin purchases or put off by complex trading platforms.

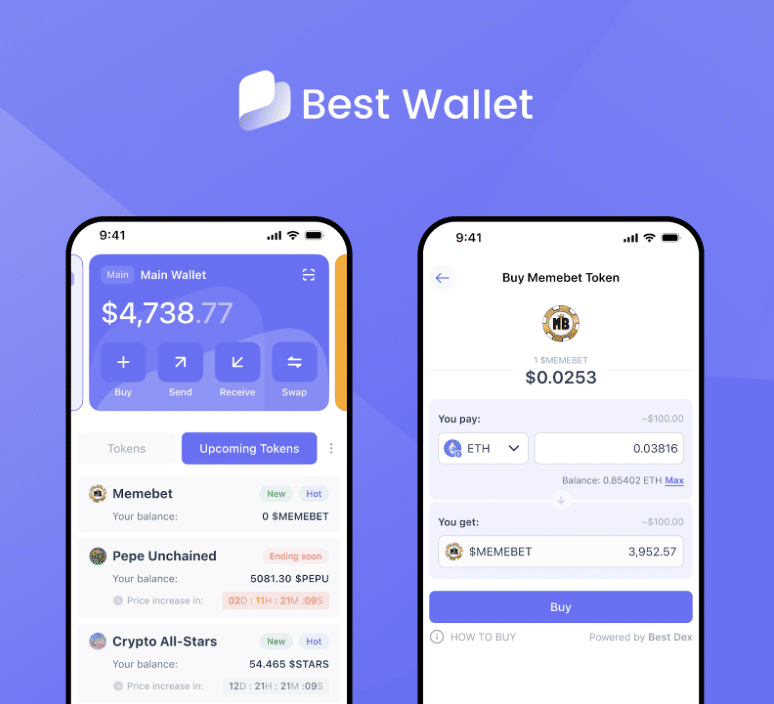

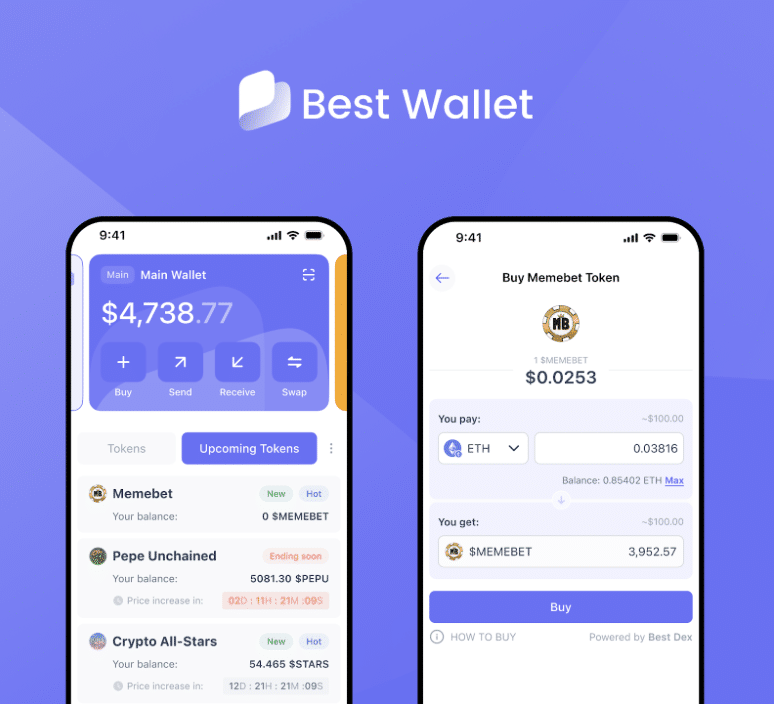

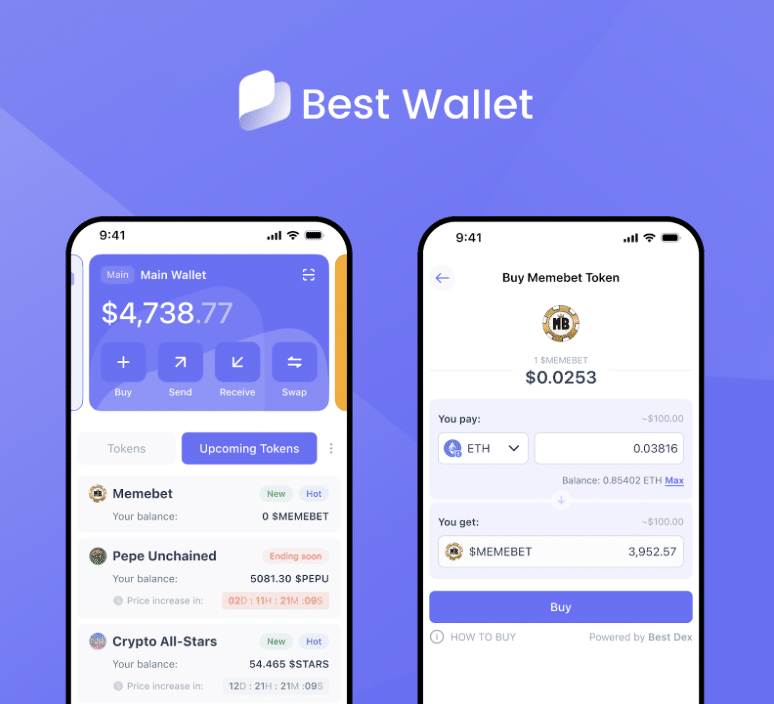

Moreover, the ecosystem is becoming increasingly interconnected. Platforms like Best Wallet – which support BTC Bull Token’s staking and airdrop tracking – are positioning themselves as infrastructure for the new retail investor. These aren’t just wallets; they’re evolving into all-in-one dashboards that support smart contract-based rewards, token discovery and staking without technical friction.

A New Market Phase Driven by Utility and Policy

The alignment of policy momentum and structured speculation marks a new phase in the crypto market cycle. On one side, we see governments like New Hampshire recognising Bitcoin as a credible reserve asset. On the other, meme coin projects like BTC Bull Token are no longer divorced from market fundamentals – they’re integrating them.

That’s a notable shift from previous bull runs, where hype alone often fuelled explosive but unsustainable gains. Today’s environment demands more: more clarity from regulators, more reliability from token models and more tools for retail investors to engage meaningfully with the ecosystem.

As Bitcoin edges closer to six figures and institutional inflows surge (over $4 billion in May alone through spot ETFs), the presence of intelligent meme coins hints at a democratisation of opportunity. No longer are market milestones reserved for whales or funds; through structured tokens, retail traders are invited into the same narrative, albeit with differentiated risk profiles.

EXPLORE BTCBULL TO LEARN WHY RETAIL TRADERS ARE INVESTING

New Hampshire’s decision to put Bitcoin on its balance sheet might seem like a symbolic move, but it’s more than that. It’s a signal that crypto is entering the mainstream at multiple levels: policy, infrastructure and asset design.

At the same time, meme coins like BTC Bull Token are proving that speculation doesn’t have to be mindless. When designed around real assets and economic triggers, they can bridge retail enthusiasm with market structure – offering a front-row seat to the next leg of the crypto cycle.

This isn’t just about Bitcoin anymore. It’s about the systems built around it and how they reflect a broader shift from chaos to coherence.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Cryptocurrency markets are volatile and speculative. Always conduct your own research and consult a licensed financial advisor before making investment decisions.