Do you remember the feeling of discovering Bitcoin when it was still under $100? Or Ethereum before anyone knew what smart contracts were?

I certainly wish I had that foresight. After years of trading crypto and watching utility coins explode in value, I’ve developed a system for spotting these gems early, before they become household names.

To get ahead of the curve, here are some actionable strategies:

– Track Network Activity: Platforms like Santiment and Glassnode offer tools to monitor wallet behaviour and token flow. A sudden uptick in active wallets or decreased exchange supply can be early bullish indicators.

– Follow Regulatory Milestones: Many token surges are tied to regulatory developments. Set alerts for legal updates involving major crypto firms or protocols, particularly those with pending ETF applications or government integrations.

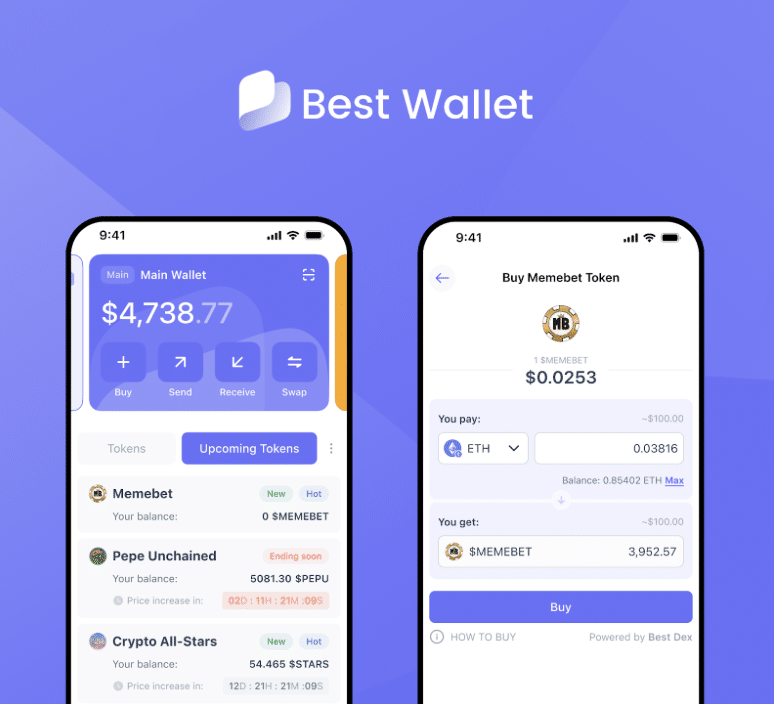

Evaluate Utility Tokens Before Listing: The most significant gains often happen before a token hits centralised exchanges. Platforms like Best Wallet offer access to early-stage utility tokens, but evaluating each project on its technical merits, not just hype, is essential.

Why Focus on Utility Coins?

Let me share something I learned the hard way: not all crypto projects are created equal. While meme coins might pump and dump overnight, utility coins with real-world applications tend to create sustainable value over time.

In my first year of crypto trading, I chased every shiny new token. The result? a portfolio of worthless coins and missed opportunities on projects with actual staying power.

Year three? I developed a framework for identifying utility tokens with genuine potential—a game-changer.

My 5-Step Framework for Finding Early Utility Coins

1. Identify Real-World Problems Being Solved

The most successful utility tokens solve actual problems. Look for projects addressing payment inefficiencies, supply chain transparency issues, data privacy concerns, financial accessibility gaps, or content creator monetization challenges.

When I discovered Chainlink in its early days, it was clear they were solving the “oracle problem”—connecting blockchain smart contracts with real-world data. That clarity of purpose was my first clue that it would become something special.

Pro Tip: If you can’t explain the problem a project solves in one simple sentence, it might be a red flag.

2. Analyze the Team Behind the Project

The people matter more than the whitepaper. Here’s what I look for:

I once invested in a project with anonymous developers who promised revolutionary DeFi solutions. They disappeared overnight with everyone’s money. Lesson learned: always verify the team.

Now I check for proven track records in tech or finance, previous startup experience, public profiles with verifiable achievements, and active GitHub repositories. I want to see founders who engage transparently with their community and have skin in the game.

The Polkadot team stood out early because of Gavin Wood’s Ethereum background. His technical expertise and vision gave me the confidence to invest before most people understood parachain technology.

3. Examine the Tokenomics

Tokenomics can make or break a project. Two years ago, I invested in a promising NFT marketplace that allocated 60% of tokens to the founding team with no vesting period. Within months, they dumped their tokens, and development stalled. Never again.

Is there an apparent reason why this needs a token? Does token utility increase with network growth? What’s the distribution model? Is there a reasonable vesting schedule? What’s the inflation rate?

I passed on a “revolutionary” DeFi project last summer because their tokenomics showed massive inflation with no real utility. Six months later, the token had lost 95% of its value.

4. Check Technical Implementation

You don’t need to be a developer to assess technical quality. When I first looked at Solana in 2020, I was impressed by its consistent GitHub activity and precise technical documentation. Their solution to blockchain scalability made sense even to my non-developer brain.

Look for open-source code, active development on GitHub, third-party audits, and working products (not just promises). The technical documentation should be clear enough to help you understand the basic architecture.

I found one of my best-performing investments by joining a project’s technical Discord channel and watching how quickly and thoroughly developers responded to community questions. Their competence was evident long before the token gained mainstream attention.

5. Evaluate Community Engagement

A strong, knowledgeable community often predicts success. The projects that survive bear markets aren’t the ones with the loudest marketing but those with dedicated communities focused on building.

In early 2021, I joined a small privacy coin’s Telegram group. Instead of moon talk, members discussed implementation challenges and use cases. The founder held weekly AMAs addressing technical questions in depth. That community-focused approach signaled a long-term commitment, and the project thrived despite the market downturn.

Look for quality discussions beyond price speculation, developer engagement with users, growing utilization metrics, organic social media presence, and legitimate partnerships.

Red Flags I’ve Learned to Avoid

After some painful losses, I watch out for these warning signs:

Last year, I nearly invested in a “game-changing” DeFi protocol until I noticed their whitepaper contained entire sections copied from other projects. Two months later, they vanished with investor funds.

Be wary of excessive marketing with limited technical details, unrealistic promises or timelines, team members with no digital footprint, copy/pasted code, lack of a clear roadmap, and artificial urgency tactics like “last chance to buy!”

Where to Find These Gems Before They Explode

Finding projects early requires looking in the right places. I saw one of my best investments by following the Ethereum Foundation grant recipients and researching each project methodically.

Focus on crypto incubator programs, grant recipients from established blockchains, technical conferences (not influencer events), developer-focused Discord servers, and early-stage venture capital announcements.

In 2022, I attended a technical Ethereum meetup and discovered a promising Layer 2 solution. While everyone was talking about popular tokens, developers were excited about this under-the-radar project solving real scaling issues. That early insight paid off tremendously.

Another way I find tokens that solve real-world problems is to use Best Wallet to discover them, then do my due diligence to make sure they meet my criteria.

My Personal Investment Strategy

Here’s how I approach early utility coins:

I research dozens of monthly projects but only invest in two or three. I start with small positions—never more than 2% of my portfolio—and, if development progresses as promised, I average the dollar-cost over several months.

Last summer, I found a data privacy project addressing GDPR compliance for Web3 companies. I invested a small amount initially, then increased my position as they hit development milestones and secured business partnerships. I’ve managed risk and upside by taking partial profits at predetermined targets while holding a core position.

Most importantly, I never invest more than I can afford to lose. Even the most promising projects can fail in this volatile space.

What You Can Learn from XRP Whales: Timing and Research

Ripple’s long-running legal battle with the U.S. Securities and Exchange Commission (SEC) is finally over, marking a significant milestone for XRP and the broader crypto space. Earlier this week, Ripple CEO Brad Garlinghouse confirmed that both parties had withdrawn their remaining appeals, effectively concluding the four-year case.

XRP surged from $2.30 to $2.60 in under an hour before retracing to the $2.45 range. This looked like a typical “sell-the-news” event for some traders, but on-chain data reveals a more nuanced story.

According to blockchain analytics firm Santiment, XRP wallets holding over one million tokens increased their balances by 6.5% in the two months preceding the case’s resolution.

Network activity also surged, with Ripple recording a sixfold increase in daily active wallets in March compared to previous months. While this doesn’t necessarily suggest insider knowledge, it does highlight the advantage of early positioning in crypto markets.

Rather than focusing on post-news FOMO, smart money in crypto often operates weeks or months ahead of significant events.

While not every investor can access institutional-level tools, retail traders can still gain an edge through disciplined research, on-chain data, and presale platforms that offer early access to promising utility tokens.

Best Wallet: A Research Tool That Helps You Find Great Utility Coins

Best Wallet has emerged as a one-stop mobile app for trading, storing, and discovering crypto assets.

Beyond its sleek interface and multi-chain support (Ethereum, Solana, BNB Smart Chain, and more), one of its most valuable tools is the Upcoming Tokens section. This curated launchpad highlights new projects based on user demand and internal due diligence.

This feature can be a powerful ally for diversifying beyond the top-10 coins like XRP. Users can compare roadmaps, tokenomics, and presale structures without leaving the app.

BTC Bull Token: A Real-World Incentive Layer for Bitcoin Maxis?

Among the projects listed on Best Wallet is BTC Bull Token ($BTCBULL). Built on Ethereum, BTCBULL isn’t just another meme coin; it rewards holders with real BTC when Bitcoin hits pre-set milestones ($150K, $200K, and $250K). This ties the token directly to Bitcoin’s growth without requiring users to hold BTC themselves.

The airdrops are executed via smart contracts and linked to price oracles. This ensures transparency and automates distribution, offering a unique, technically verifiable reward mechanism.

In addition, BTCBULL implements scheduled token burns after each significant BTC price threshold is hit, reducing supply and aiming to support price appreciation. A live staking system also offers up to 106% APY during the presale.

Challenges: BTC Bull Token’s reliance on Bitcoin price growth introduces a dependency that may limit independent performance. As with any new token, exchange liquidity post-launch is not guaranteed.

MIND of Pepe: AI Meets On-Chain Intelligence

Another featured project is MIND of Pepe ($MIND), a meme-inspired token with a strong AI utility layer. At the core of MIND is a sovereign AI agent designed to identify market trends, scan influencer activity, and analyse token performance before major moves occur.

Technically, the AI combines Retrieval-Augmented Generation (RAG) with real-time data feeds. It analyses up to 60,000 social media posts per day and cross-references them with on-chain metrics. Based on its insights, it can even autonomously launch new tokens tailored to trending market themes.

Token holders gain exclusive access to these insights and can stake their tokens for up to 300% APY. The protocol also plans to introduce a DAO structure, enabling the community to vote on future AI upgrades and token launches.

Risks: MIND’s success depends on continued training and refinement of its AI model. The project also faces competition from more established AI tokens like Fetch.ai and SingularityNET, which have deeper developer ecosystems and institutional partnerships.

XRP Was Just the Beginning – Here’s Where Early Investors Are Looking Next

XRP investors may have enjoyed recent gains following Ripple’s courtroom victory, but large-scale returns are increasingly found in early-stage, utility-driven tokens.

Platforms like Best Wallet give everyday traders access to presales that might otherwise go unnoticed —whether that’s BTC Bull’s innovative airdrop model or MIND of Pepe’s AI-enhanced trend detection.

What unites these opportunities is the potential for utility, not just hype, to drive value.

FIND THE NEXT UTILITY COIN BEFORE THE CROWD WITH THE BEST WALLET

Access presales like $BTCBULL and $MIND on Best Wallet. Download it now from the App Store or Google Play and start tracking early-stage crypto before listings go live.

Disclaimer: This article is for informational purposes only and should not be considered investment advice. Always research and consult with a licensed financial advisor before making investment decisions. Crypto markets are volatile and carry significant risk.