Every month used to feel like 100 days long. And no, I’m not exaggerating.

You know that moment around the 14th or 15th when you check your wallet or banking app and realize, “Wait, how did everything finish already?” You do a mental audit: food, airtime, transport, one or two “small enjoyment” moments… and then boom — it’s all gone. The worst part? There’s still over two weeks left in the month.

That was my story — every single month.

And January was the most notorious. That month has its own special reputation. After spending during the December holidays like we just hit a jackpot, January rolls in with all 31 days, and no compassion. That’s when you hear phrases like “January is three months in one” or “na now I understand suffering.”

I used to joke about it — until I lived it.

When Earning More Still Wasn’t Enough…

As a youth corp member receiving the old ₦33,000 NYSC allowance which felt impossibly small, I used to think, “If only I earned more, things would be better.”

So, when the Federal Government adjusted the minimum wage and increased our allowance to a whooping ₦77,000, I was ecstatic. I thought my “broke days” were finally over. I dreamed of having enough to cover my basic needs, give to my younger siblings, and maybe even begin saving toward that first piece of land in Abeokuta (no joke!).

But reality hit hard.

Just a few months into the new allowance, I was still broke before month-end. The money vanished faster than expected — little splurges here, unexpected bills there. It was as though I had been cursed.

The story remained the same month after month. First half of the month? Enjoyment. Second half? Survival mode. The money was still vanishing — unplanned expenses, impulse buying, and emergency transfers I didn’t plan for. To the point I started wondering if it was a spiritual problem… until someone introduced me to the My Lantern App.

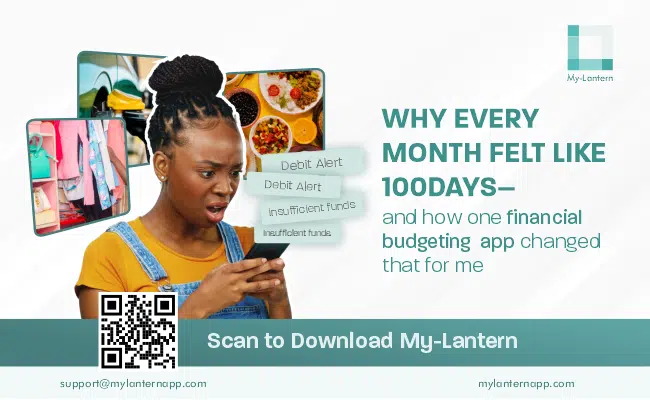

Meet Lantern: The Budgeting App That Actually Works

Lantern is not just a budgeting app — it’s your personal money accountability partner. It is designed to curb impulsive spending and ensure that your money is always available when you planned to use it.

Here’s how it works:

- Once your salary or allowance comes in, you budget it in Lantern, assigning specific amounts to specific future dates— not just categories.

- The app locks away the funds until those dates. So, the money for “end-of-the-month groceries” can’t be touched during your mid-month cravings. No access. No temptation.

- If you really need it, you can withdraw early — but you’ll lose a small percentage depending on how far away from the scheduled date. Just enough to make you think twice, pause and ask, “Do I really need this now?” and discourage impulse spending unless it’s a true emergency.

It’s the kind of “tough love” financial system I didn’t know I needed.

This simple friction changed my life.

While others were groaning through the last 10 days of the month, waiting on the next credit alert, I had money ready and waiting — released by Lantern exactly when I planned to need it.

I have now discovered that I didn’t need to earn more to have money through the month — I just needed better control. That’s what My Lantern App gave me.

Simple to Use, Easy to Fund

Lantern was built for real life in Nigeria. You can:

- Fund your wallet via Lantern-to-Lantern usernames, USSD from your bank, or direct bank transfers to your Lantern wallet.

- Download the iOS version from the Apple Store, and for Android, get it directly from www.mylanternapp.com/downloads.

- Get a ₦500 bonus as an early user — just for trying it out.

- And if you’re a corps member like I was, you can even become a Lantern Product Ambassador, introducing the app to others around you while earning extra.

Why Lantern Is a Financial Game-Changer—I Don’t Stress About Money Like I Used To

It’s easy to assume that our money problems will vanish when we “earn more.” But the truth is, discipline beats income — especially when that discipline is powered by the right tools.

For me and many others, Lantern is that tool.

Since I started using the app, I no longer experience that second-half-of-the-month panic. My money doesn’t finish in the middle of the month. I always have funds available — not because I started earning millions, but because I budget smartly and Lantern holds me accountable.

While others are crying “this month long die” and anxiously waiting for their next alert, I’m calm because I already planned for my needs and my money is right there when I need it — thanks to this simple but powerful app.

If you’re a corps member, student, or young professional who wants to stop the monthly cycle of financial stress, I encourage you to give it a try. Your January — and every other month — might just start feeling shorter.

Lantern has helped me break the cycle of financial stress — and it can do the same for you.