Key Insights on Consumers and Digital Payments Security from Visa’s Stay Secure Report

Nigeria’s digital payments ecosystem is witnessing rapid expansions, fueled by increasing smartphone penetration, innovative fintech solutions, and a growing preference for cashless transactions. However, alongside this growth comes a critical need for robust security measures to protect consumers from fraud. Visa’s latest Stay Secure report surveyed 5,800 adults across 17 CEMEA markets with 500 Nigerians that provided key insights into the rise in consumer awareness and proactive security measures Nigerians are taking as they adopt digital payments.

Based on Nigeria-specific data, here are five key takeaways from the report:

Nigerians Are More Security- Conscious

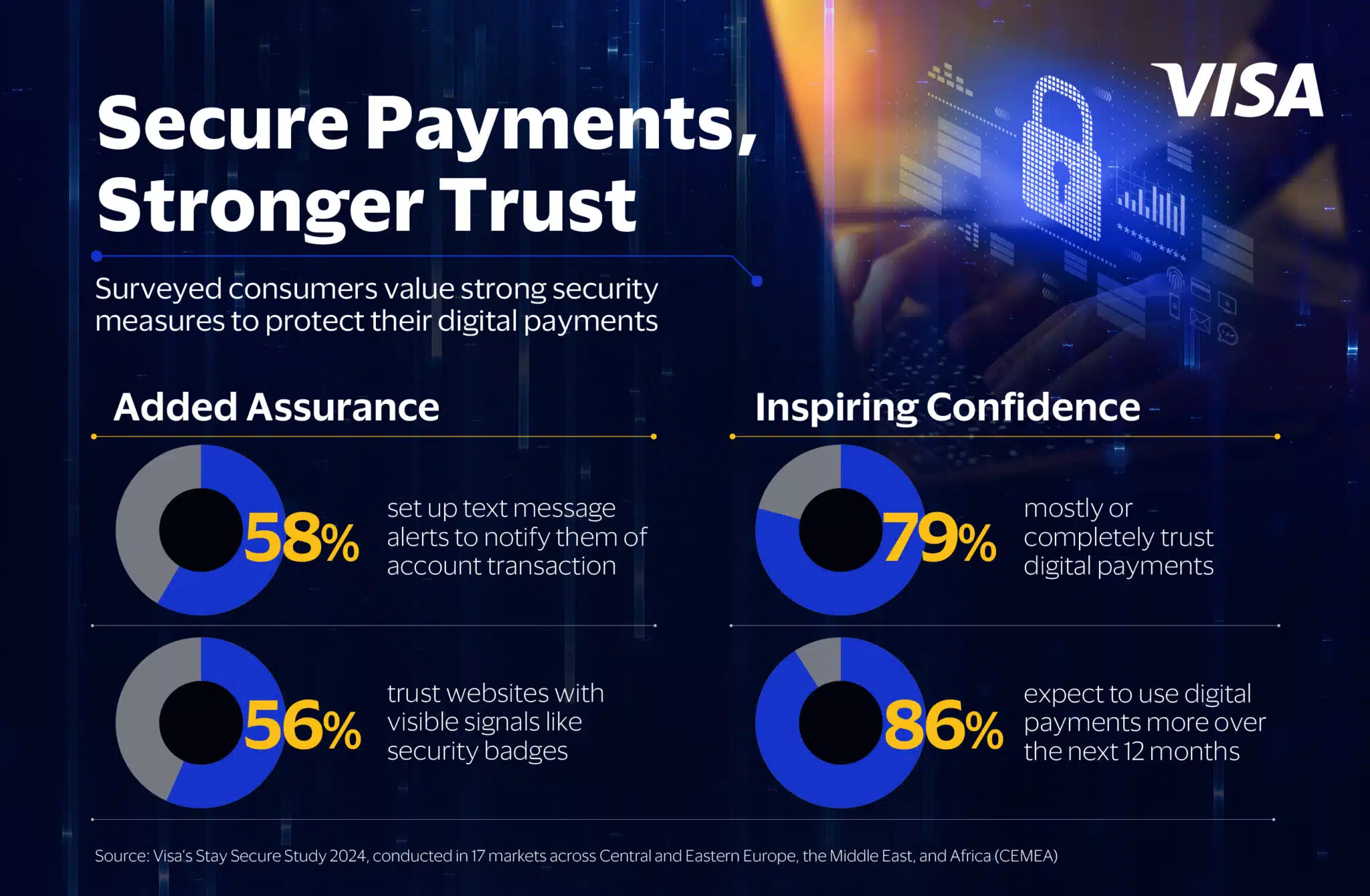

An overwhelming 98% of surveyed Nigerian consumers actively take precautions to secure their digital transactions. This heightened awareness is evident in behaviors such as setting up text message alerts (58%), avoiding email requests to transfer money (69%), and refraining from sharing sensitive account details (63%). The data suggests that digital acceptance grows, so does financial literacy around digital transactions as Nigerians are becoming more vigilant about their payment security.

Growing Trust in Digital Payments

Digital payments have gained significant trust among consumers. People are becoming more comfortable with online transactions, and this trust is expected to grow. Despite concerns about potential scams, 79% of Nigerian consumers mostly or completely trust digital payments, highlighting confidence in secure transaction methods. Additionally, 86% of consumers expect to use digital payments even more over the next 12 months, further reinforcing their reliance on electronic transactions.

Secure Payment Preferences Are Shaping Consumer Behavior

As digital payment options expand, Nigerian consumers are showing a preference for secure payment methods. 51% of respondents feel safer using digital payments, and 56% leverage online credit or debit card transactions. Moreover, the increasing adoption of two-factor authentication (2FA) and biometric authentication reflects a shift towards innovative solutions that provide enhanced security layers. The growing reliance on these security features indicates a demand for financial institutions to integrate more advanced fraud detection technologies.

Government and Industry Partnerships Bolster Payment Security

As scams become more advanced, educating and supporting consumers is the best defense against fraud. Consumers are placing more trust in payment enablers who take real, proactive measures to protect them. The report found that 82% of Nigerians are more likely to trust government-backed payment programs (such as instant payments and local card schemes) when they collaborate with well- known brands like Visa. These findings suggest that strategic partnerships between financial institutions, payment processors, and regulators are crucial in enhancing digital security and ensuring consumer confidence.

Fraud Is Impacting Trust

As Nigerian consumers grow more aware of fraud risks, cybercriminals are continuously adapting their tactics. Bad actors often target individuals who are vulnerable or unaware. In fact, 96% of Nigerians worry that their family or friends could fall victim to a scam, and 43% believe Baby Boomers are the most susceptible to such schemes. Despite this, 64% of Nigerians acknowledge their own vulnerability to scams. However, there is a positive shift in consumer behavior, with an increasing adoption of security measures and a preference for stronger authentication methods.

Towards a Safer Digital Payments Future

Findings from Visa’s Stay Secure report highlights that Nigeria is on a promising trajectory toward a more secure and inclusive digital payment landscape. While technology plays a critical role in securing payments, consumers must stay vigilant by enabling multi-factor authentication, monitoring transactions, and practicing safe online habits to protect their financial information. As scams grow more sophisticated, the battle for security never stops. By leveraging cutting-edge security technologies and fostering industry partnerships, stakeholders in the payments ecosystem can deploying tools, expertise, and processes to help identify and mitigate fraud for sustained growth.