Shalom,

Victoria from Techpoint here,

Here’s what I’ve got for you today:

- Wema Bank loses $595K to fraud

- Sim Shagaya’s 20-year entrepreneurial journey

- Pula’s $20 million Series B

Wema Bank loses $595K to fraud

Wema Bank spilled the beans on its financials, and let’s just say, it’s been a rollercoaster ride.

Despite hauling in a whopping ₦1.8 trillion in consumer deposits, it had to cough up ₦685 million ($595K) due to fraud and forgery losses in 2023.

But the bank is not sitting idle. Wema’s beefing up its fraud monitoring game and digital compliance crew to tackle the issue head-on. It’s confident that things will look up in 2024, fingers crossed.

But it’s not all bad news. Wema Bank saw some growth in 2023, tripling its profits to ₦35 billion, thanks in part to a sweet ₦13 billion FX gain. However, it hit a snag when the CBN clamped down on banks dipping into those FX gains for dividends or operational costs.

Besides, Wema Bank’s earnings shot up by a whopping 71%, with net interest income jumping 69%. It raked in ₦4.1 billion from FX transactions alone, and loans to customers skyrocketed by 53.6% to ₦801.10 billion.

On the digital front, things are looking up too. ALAT, Wema’s digital banking arm, snagged 2.1 million new users in 2023, adding to its growing digital income.

Sure, there are some bumps in the road, but Wema Bank’s showing no signs of slowing down.

Sidebar Alert: In 2023, Access, Nigeria’s largest commercial bank by assets, reported losses of ₦6.15 billion from fraud and forgery, up from ₦1.44 billion the previous year.

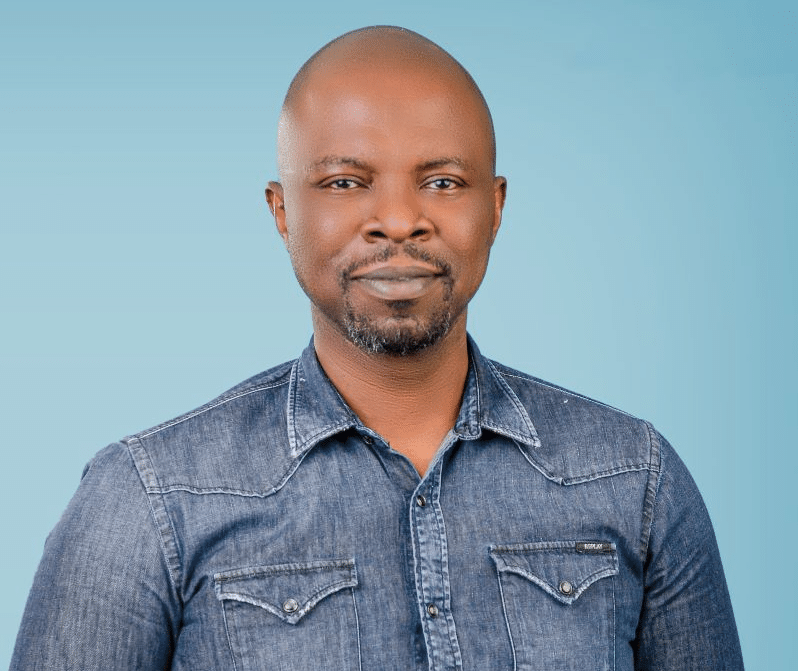

Sim Shagaya’s 20–year entrepreneurial journey

Did you know that Konga almost merged with Jumia at the very beginning?

Let’s start from the beginning. Sim Shagaya saw an opportunity in eCommerce even at the time when there were only four million smartphone users and 13.8% of people had access to the Internet.

Before his eCommerce venture, Sim had already made moves in the business world. He started with an outdoor advertising company called E-motion, which later got acquired.

But Sim’s journey started way back when he left the University of Lagos at age 18 to study electrical engineering at The George Washington University. He was fascinated by wireless technology, and even attempted to start a wireless communication network in Nigeria.

But, despite raising some funds and getting a quote from Motorola, he couldn’t get the necessary licence. After a stint at Harvard Business School, he joined Rand Merchant Bank, where he gained valuable experience but couldn’t shake the urge to return to Nigeria.

With a dream in mind and some cash in hand, he started E-motion. It was tough at first, but things picked up quickly. Within hours of his first billboard going live, he landed a contract with Airtel.

From there, Sim’s entrepreneurial journey only gained momentum. He ventured into various startups, including Konga, uLesson, E-motion, and Miva University.

In an interview with Chimgozirim, he shares the highs and lows of his two decades as an entrepreneur. Read it here.

Pula’s $20 million Series B

Pula, a Kenyan insurtech startup, has raised a $20 million Series B funding round, led by BlueOrchard and backed by big names like the IFC and the Bill & Melinda Gates Foundation.

The company wants to use the funding to expand further. Its goal? To establish new partnerships and provide coverage to even more farmers, including those in the livestock sector.

Pula, a Kenyan insurtech founded in 2015, has worked to make agricultural insurance more accessible to small-holder farmers in emerging markets. They shield these farmers from losses caused by pests, diseases, floods, droughts, and other extreme weather events.

Rather than selling insurance directly to farmers, Pula has a smart approach. It works with over 100 partners, like banks, governments, and agricultural companies, to embed insurance in products farmers already use, like seeds or credit.

Its customised products are tailored to each client’s needs and the specific demands of the farmers they serve. And it is working wonders; in Zambia, for example, insurance premiums have been linked to fertiliser and seed packages, reaching farmers nationwide.

Pula’s impact speaks for itself. It’s seen increased investment, improved yields, and boosted savings for farmers. Plus, it will make a massive $800,000 insurance payout in Ethiopia due to wheat rust disease.

And it’s not stopping there. Pula is gearing up to introduce livestock insurance in Kenya, building on the success of its pilot programme in Nigeria. It’s also eyeing expansion in Asia and Latin America after making strides in these markets last year.

In case you missed it

- Meta rolls out campaign to help tackle misinformation ahead of South Africa’s elections

- VALR, Luno, and Zignaly obtain crypto licences in South Africa

- regulator orders Starlink to cut off subscribers in Zimbabwe

What I’m reading and watching

- Tesla to lay off more than 10% of staff globally as sales fall

- Every Argument For Atheism

- All arguments for God explained in 10 minutes

Opportunities

- Apply for Visa Everywhere Initiative (VEI) by May 6, 2024, here.

- Seedstars has announced INFUSE 2024, a global invitation for innovative applications aimed at fortifying health systems against climate threats and improving immunisation delivery. Apply here.

- Explore this website to find multiple job opportunities in Data that align with your preferences.

- If you are a software engineer, creative designer, product manager, design researcher, or a techie looking for an internship role, please, check out this website.

Have a terrific Tuesday!

Victoria Fakiya for Techpoint Africa.