Nigerian laws addressing employment are exhaustive. We considered some major ones earlier, and this article delves into three additional provisions and frameworks.

While providing insights about the laws, it barely acknowledges the grey areas, implications, and use cases where they can be exploited.

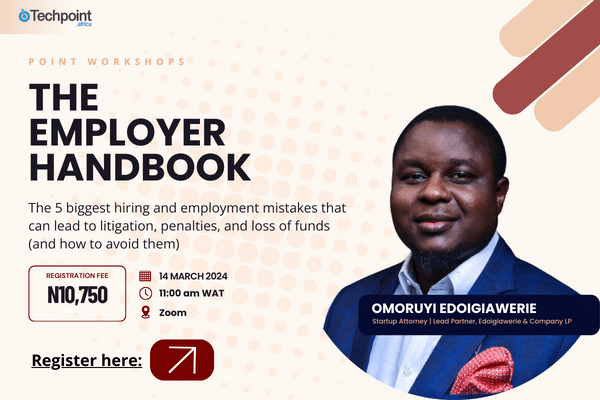

The Employer Handbook is a structured training that opens employers’ and HR professionals’ understanding of the relevance of these legislations and how they help drive a compliant workplace.

Employees’ Compensation Act 2011

This Act addresses matters related to compensation for employees who suffer workplace injuries or sustain occupational diseases during their employment. It replaced and annulled the Workmen Compensation Act 2004.

On May 16, 2023, the Federal Executive Council (FEC) approved the implementation of this Act, meaning the public sector, which comprises federal, state, and local governments, now has to adopt this for the protection of their workers.

It covers guidelines for reporting injuries and death, which diseases and injuries should be compensated, procedures for claiming compensation, and the scale of compensation, among other things.

The Nigeria Social Insurance Trust Fund Management Board (“the Board”) implements this Act. The Act also classifies occupational diseases based on the causal agent and organ affected, as well as the extent of disabilities.

Provisions of the Act

This law applies to employers and employees in both the public and private sectors but exempts all members of the Armed Forces (except those employed in a civilian capacity).

Employers must make provisions for the prevention of workplace disabilities, including enforcement of occupational safety and health standards. Employers must maintain a Compensation Fund managed in the interest of employees and employers.

Procedures for reporting an injury

In the case of injury, disease, or disability, the employee – or the dependant, in case of death – should inform the employer within 14 days of the occurrence. Information provided must include the employee’s name, time and place of the occurrence, and the nature and cause of the injury/death.

Occurrence can be at the primary place of work, outside the normal place of work (as long as the employee has the employer’s permission to work there), between the workplace and place of residence, or on the way where they take their meal or receive remuneration.

Employers must report the incident to the Board within 7 days of receiving the information. Not making a report constitutes an offence under this Act.

The Board will prescribe an application that will be signed by the employee or dependant. Compensation can still be processed if filed within 3 years after the occurrence, based on the Board’s discretion.

Employer and employee’s responsibilities

No agreement between the employer and employee is permitted to waive or forego benefits or the right to compensation for employees or dependant. Compensation should be made to the employee or their dependants.

Employers must make provision for the rehabilitation of employees with work-related disabilities. An employee is entitled to compensation for mental stress either resulting from a traumatic event during the employment period or from the nature of work (working conditions, work capacity). An employee is entitled to compensation for hearing impairment that arises in the course of employment.

Compensation in case of death

- With one child, the spouse gets a monthly payment of 85% of the monthly remuneration of the deceased.

- With two or more children, the spouse gets a monthly payment of 90% of the monthly remuneration of the deceased.

- With no child but the spouse is invalid and under 50 years, they get 60% of the monthly remuneration of the deceased.

- With no child and the spouse is not invalid, 1% of the remuneration will be subtracted for each year while the spouse is still under 50 years, provided the total is not less than 30%.

If there’s no surviving spouse and the dependant is a child,

- they get 40% of the total monthly remuneration of the deceased;

- for two children, they get 60% of the total monthly remuneration of the deceased;

- for three children or more, they get 80% of the total monthly remuneration of the deceased.

These children are either 21 years and above or have completed undergraduate studies to be entitled to this compensation.

If there are no surviving spouses or children, the Board decides the compensation for the next-of-kin who was entirely dependent on the employee before they died.

In case of permanent disability or disfigurement

The affected is compensated with a periodic payment equal to 90% of the employee’s monthly remuneration if they are less than 55 years old and will continue until the date the employee is supposed to retire.

Maintaining the Fund

1% of the total monthly payroll must be contributed to the Fund monthly by the employer. Other sources include a take-off grant from the Federal Government, proceeds of investments from the Fund, and gifts/grants from local or international organisations.

Pension Reform Act 2014 (PRA)

The Pension Reform Act 2014 (PRA) governs the framework and procedure for pensions in the public and private sectors, aimed at assisting individuals in saving for their livelihood during old age. The Act provides for the smooth operations of the Contributory Pension Scheme.

In the private sector, the Act applies to any organisation with at least one employee but is mandatory for organisations with 15 workers or more. The amount payable as a retirement benefit is not taxable.

Expectations from employee and employer

Every employee is expected to maintain a retirement savings account (RSA) with any Pension Fund Administrator (PFA) of their choice, notify the employer, and provide the details of the savings account.

If an employee does not provide or open an RSA within six months of taking a job, the employer is at liberty to request a PFA to open one for the employee.

Employers can deduct the monthly contribution from the employee’s monthly remuneration (which must not be less than 8% of the salary) and ensure it is remitted into the RSA not later than seven days after the salary is paid.

If the employer is generous, they can decide to bear the full responsibility and not deduct this remittance from the employee’s salary.

It’s an offense for an employer not to deduct or remit this monthly contribution within the stipulated time. The employer is liable to a penalty of at least 2% of the unpaid contribution, which is a debt owed to the employee’s RSA in addition to the regular remittances.

An employee is permitted to change PFA but not more than once in a year.

Employees can only have access to their RSA once they retire or reach the age of 50 years (whichever happens first). There’s an exemption if the employee had to retire before 50 years due to health reasons.

Industrial Training Fund (Amendment) Act 2011

This Act focuses on the establishment of a Fund, which is the contribution made to promote and encourage the acquisition of skills to generate a pool of indigenously trained manpower sufficient to meet the needs of the economy.

Other uses of the Fund include setting training standards, monitoring compliance, and evaluating and certifying skills acquired in collaboration with relevant organisations.

Provisions of the Act

This law binds every company operating in Nigeria having five or more employees or less than five employees but with an annual turnover of ₦50 million and above. Companies with fewer employees aren’t mandated to contribute to this fund.

This covers both MDAs, commercial, industrial, and private establishments.

Employees in this context are those working for more than 30 days on a full-time or part-time basis and are paid salaries or wages.

Any employer under this Act is required to remit 1% of its total annual payroll to the Fund on or before April 1 of every year.

The Act also requires employers to accept students for industrial attachment purposes and provide adequate training for indigenous employees.

An employer who contributes to this Fund is entitled to 60% of its contribution in a year, provided that the Council is satisfied that the training provided is adequate and relevant to the employee’s performance.

Penalty for defaulting

Failure to remit this contribution attracts a penalty of 5% of the unpaid amount for each month the default continues.

Any employer that doesn’t accept students or satisfactorily train indigenous employees can be convicted to pay ₦500,000 for the first breach and ₦1 million subsequently.

If the principal officers (C-suite officers) are found guilty, they are liable to a fine of ₦50,000 or two years imprisonment.