Key takeaways:

- The Nigerian Electronic Fraud Forum (NeFF) has joined the Association of Mobile Money and Banking Agents of Nigeria (AMMBAN) to create a feature that will flag fraudulent transactions on PoS terminals in Nigeria.

- However, it is not clear the types of PoS fraud it will tackle.

- Interestingly, some companies that own these terminals are not aware of the feature or how it will be implemented.

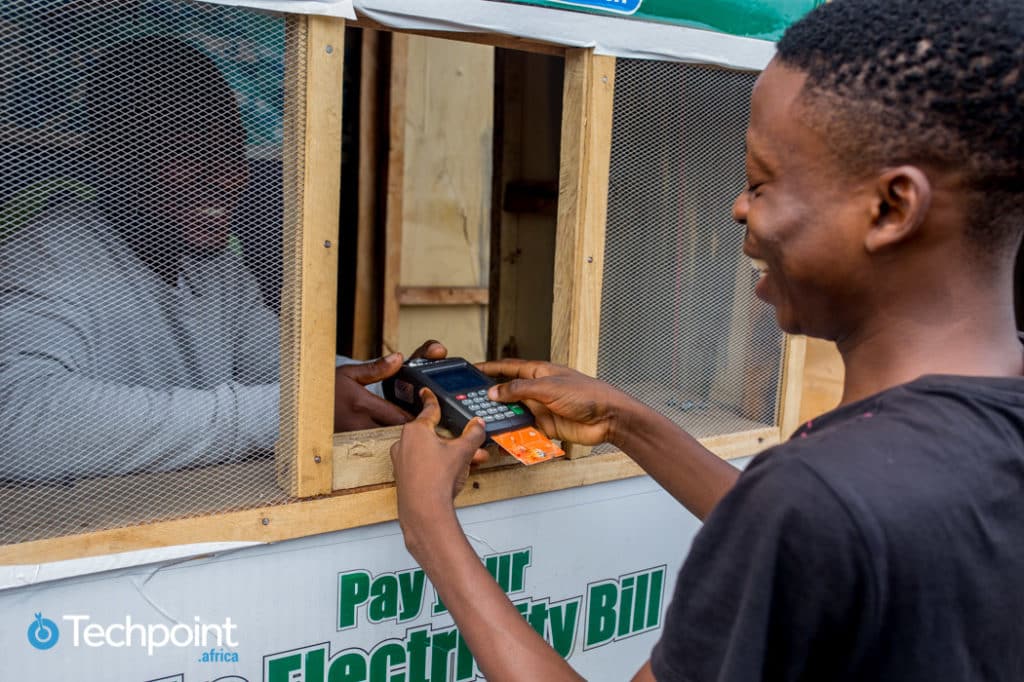

The fraud-flagging feature NeFF is creating in collaboration with AMMBAN and Nigerian Inter-Bank Settlement Systems (NIBSS) was announced on January 30, 2024 and will go live on PoS machines by the end of Q1 2024.

The President of AMMBAN, Fasasi Sarafadeen Atanda, said “We are at a very advanced stage, and we’re about to finish the technology side of it in terms of activating some features.”

However, two of the companies that own PoS machines in Nigeria are not aware of this feature or how it will be implemented. Techpoint Africa reached out to AMMBAN and NIBBS for comments but hadn’t gotten a response as of press time.

While the feature is a step in the right direction, it raises questions about what stage the solution is in and the technical details of how it will work.

The only information revealed is that specific KYC details will be requested before transactions are carried out. It is still unclear if these details will be required by the agent or PoS machines.

How big is PoS fraud in Nigeria?

Data from the Financial Institutions Training Centre (FITC) revealed that in Q2 2023, there were 1,994 cases of PoS fraud in Nigeria resulting in a loss of ₦428 million ($474,770).

Figures from the same quarter in previous years show that PoS fraud has consistently risen.

In Q2 2021, the amount involved in PoS fraud was ₦105.1 million ($116,474); this increased to ₦310 million ($343,876) in Q2 2022.

This increase in fraud cases can be attributed to the increase in the number of PoS transactions in the country. Per Statista, PoS transactions went from ₦167.58 billion ($185.8 million) in 2017 to ₦1.152 trillion ($1.2 billion) in 2023.

The value of PoS transactions and the increase in fraud rate signal a need to beef up security on the platform, which makes the fraud flagging feature important.

The fact that companies that own these terminals aren’t aware of the feature is one problem; other factors also stand in the way of its development.

Types of PoS fraud and how a fraud-flagging feature might not curb them

There are different types of PoS fraud and it is unclear which the feature plans to tackle. However, we’ll focus on the two most popular types based on multiple reports about them.

PoS fraud by banking agents

In this article, it was revealed that PoS or banking agents find a way to copy a cardholder’s details and authorise transactions without their consent. Stopping fraud when the fraudster has information to pose as the cardholder will be difficult unless the PoS machine requests biometric verification before transactions are authorised.

PoS chargeback fraud

People make chargeback requests at their bank when they do not receive value for a payment they made to a merchant. If the merchant confirms that they did not receive the value of the payment, they get their money back.

However, chargeback fraud occurs when a customer receives value for the payment but still makes a chargeback request.

Fraudsters can perpetrate this type of fraud by making the chargeback request over a month after the transaction has occurred, making it harder for the merchant to refute the claim.

This tactic was revealed in 2020 when PoS merchants called on the CBN to change the policy on chargeback.

The policy allowed customers to lodge chargeback claims six months after a PoS transaction has happened; merchants, on the other hand, have only two days to confirm or refute the claim. If the merchant is unable to do either within this time, the customer is credited.

Since false chargeback claims come months after a transaction has occurred, it is hard to see how a fraud-flagging feature will curb them.

Many fraud-fighting alliances, but little action

From fraud-fighting alliances to proposed frameworks, we’ve seen initiatives to fight fraud in Nigeria but they’ve been followed by little to no action.

Last year, it was reported that leading fintech companies in Nigeria were working to tackle cyber fraud in the country with an initiative called Project Radar, a database of individuals and groups that have attempted or made fraudulent transactions.

However, we’ve not heard anything about the proposed fraudster blacklist.

The Fintech Association of Nigeria also announced last year that it would release a fraud-fighting framework to improve fraud reporting in January, but it remains to be seen when that will be released.

From a ₦30 billion fraud at Interswitch to Flutterwave’s ₦2.9 billion hack, fraud cases in the country continue to increase. More than ever, fraud-fighting initiatives need to be clear and backed by actions.