The news:

- Tabby has raised $58 million at a $660 million valuation to expand its operations and product offerings across the markets where it is present.

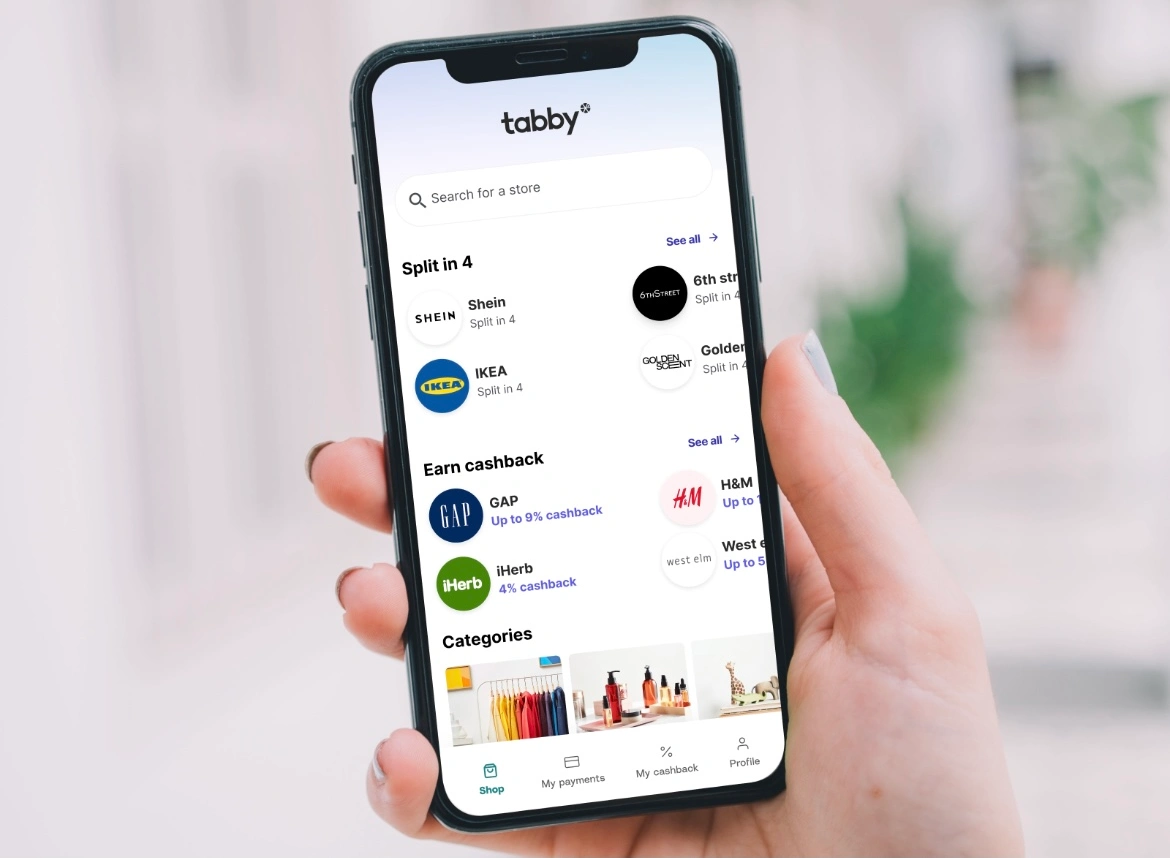

- It offers users buy-now-pay-later (BNPL) services to users who want to make in-store and even online purchases from international brands such as H&M.

- The startup has raised $410 million since it launched in 2019.

Tabby’s $58 million funding round was led by Sequoia Capital, with other investors such as PayPal Ventures, Mubadala Investment Capital, and Endeavor Catalyst participating in the round.

According to TechCrunch, the company will use the funding to support its operations across markets where it has a presence and create more consumer financial services.

Hosam Arab founded the company in 2019 after leaving his position as CEO of Namshi, an eCommerce company that later got acquired by a Dubai-based real estate firm.

Arab founded the company not only to provide BNPL services for people in the MENA region but to solve the problem of over-dependence on cash-based transactions.

According to the second-time founder, “with buy now, pay later, our view and hypothesis was that, in addition to the well-known benefits of buy now, pay later, we also provide an alternative for consumers to pay online digitally. And if we’re able to do that, that becomes a very interesting solution for the retailers of this market.”

In August 2021, it raised $50 million at a $300 million valuation. At the time, it announced that it had 400,000 active shoppers using its platform, and approximately 3,000 installs were recorded daily.

With this new raise, the startup has revealed that it now has over a million active users who shop with more than 3,000 brands yearly. It also expanded into Egypt last year, making it active in four markets which are — with the inclusion of Egypt — Saudi Arabia, UAE, and Kuwait.

According to Arab, credit penetration in developing countries is low, leaving a huge gap for startups such as Tabby to thrive in those regions. Tabby is now one of the most valued startups in the MENA region.