Sampurasun,

Remember this? Uganda to lift ban on Facebook if it stops “playing games”

Well, Kizza Besigye, leader of the People’s Front for Transition (PFT), a political coalition, has said President Yoweri Museveni should not be “proud” that Facebook has been inaccessible in Uganda for nearly two years.

Besigye mentioned that the Facebook ban had cost the country money.

“Many businesses that used Facebook for advertising and promoting their businesses in various other ways have suffered as a result of Facebook’s ban,” he said.

Sidebar: In September 2022, Meta announced that all Facebook ads in Uganda would be subject to Value Added Tax (VAT) at the “applicable local tax rate.” In October 2022, the government imposed an 18% VAT on Facebook.

Here’s what I’ve got for you today:

- Access Bank, GTB, and Fidelity Bank recorded 26,877 fraud cases in the first half of 2022

- Propcrowdy gets its crowdfunding intermediary (CFI) licence

- Senegal receives an additional $5.3m for its Future Park

Access Bank, GTB, and Fidelity Bank recorded 26,877 fraud cases in the first half of 2022

According to the Central Bank of Nigeria’s (CBN) Financial Stability June 2022 report, published in December 2022, 6,047 Bank Verification Numbers (BVNs) were placed on the CBN’s watch list for fraudulent transactions.

The total number of BVNs under investigation for fraud increased by 13.9% from 5,347 in December 2021, with 11,871 identified as deceased in 2022.

The CBN reportedly assessed 28 banks and the Nigerian Interbank Settlement System during the review period to ensure compliance with the Regulatory Framework for BVN Operations and Watchlist for the Nigerian Banking Industry.

2.72 million BVNs were enrolled in the first half of 2022, bringing the total number to 54.65 million. Also, 130.57 million out of 148.46 million active accounts were BVN-linked accounts.

Wema Bank and GTB suffered the highest losses due to fraud during the period under review, losing ₦670.73 and ₦511.9m, respectively.

According to analyses of their financial reports for the first half of 2022, Access Bank, GTB, and Fidelity Bank recorded 26,877 fraud cases.

The Guaranty Trust Holding Company and its subsidiaries reported 15,004 fraud incidents during the review period, recording ₦158.37 million as actual/expected loss.

Likewise, Access Bank Plc reported ₦1.2 billion fraud losses during the quarter. In the first half of 2022, the bank recorded 10,706 fraud attempts. Around 7,104 were successful, while 3,602 failed. These efforts cost ₦12.55 billion.

Musa Jimoh, Director of the CBN’s Payments System Management Department, said that as electronic payments gained traction, fraudulent transactions in 2022 would be reduced by 35% compared to 2021.

He said, “We have actually tamed down the incidence of fraud. We have recovered so many lost funds and we are putting formidable systems around our payment infrastructure and financial system infrastructure such that fraudsters cannot penetrate.”

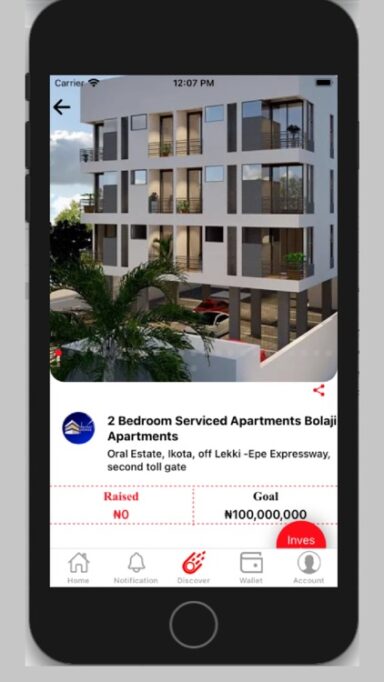

Propcrowdy gets its crowdfunding intermediary (CFI) licence

Nigeria’s capital markets regulator, the Securities and Exchange Commission (SEC), has granted Propcrowdy, a Nigerian proptech startup, a crowdfunding intermediary (CFI) licence.

Why is this important? The regulator announced the launch of Crowdfunding Intermediaries in January 2021 to facilitate crowdfunding transactions, including offers for the sale of securities or instruments via its portal.

The model typically entails pooling funds from institutional and retail investors to finance specific projects over time. Following a period, the investors earn specific returns on top of their initial capital.

In an ideal world, such payouts would occur without incident. However, with no regulation, issues could occur.

Consequently, businesses must obtain the licence to remain in operation.

The CFI licence validates crowdfunding as a viable alternative investment vehicle. So, it will provide investors with opportunities to invest in real estate for high returns.

Founded in 2019 by Roland Igbinoba, Propcrowdy is a crowdfunding platform that allows individuals to invest in African real estate.

It focuses on Nigerians earning $80 to $1,000 per month and Small and Medium Enterprise Real Estate Developers with an annual turnover of less than $5 million.

In 2021, Propcrowdy received a $500,000 investment to obtain its licence and build the necessary infrastructure for monitoring compliance as required by the SEC.

Senegal gets additional $5.3m for its Future Park

The African Development Bank (AfDB)’s directors in Côte d’Ivoire have approved an additional €5 million ($5.3m) for the Future Digital Technology Park in Diamniadio, Senegal.

The new loan supplements the bank’s 2016 loan of €60.96 million ($64.9m), and AfDB now assumes 87% of the total project cost of €73.62 million ($78.38m). The Senegalese government is contributing the equivalent of €9.64 million ($10.26m).

Twenty companies have already expressed interest in locating some of their activities in the future park.

According to reports, the park will turn Senageal into a regional digital hub, providing digital solutions to existing industries, such as agriculture. It will also raise the ICT sector’s share of GDP from 7% to 10% by 2026.

Marie-Laure Akin-Olugbade, AfDB’s DG for West Africa, said, “This project will help Senegal’s economy and private sector diversify and modernise.”

The loan will assist in equipping the data centre with cutting-edge storage and processing architecture.

There will also be outsourcing facilities, an ICT incubator, a training centre, a research centre, and an audio-visual production and content development centre.

Other perks include institutional support, capacity building, and the formation of a management team in charge of the project’s execution.

This would play a part in the country’s Digital Senegal 2025 strategy.

It aims to produce 35,000 direct jobs from activities including call centres, software and hardware engineers, and application development engineers.

It could also create approximately 105,000 indirect jobs in housing, telecommunications, real estate rental, transportation, catering, and other support services.

What I’m reading and watching

- COVID-19 vaccine patent battles continue into 2023

- Mind-blowing Artificial Intelligence Tools

- How Indigenous Guardians Protect the Planet and Humanity

- Asking Europeans What They Think of Africa

- How Iran’s repression machine works

- Western Christianity vs Eastern Christianity

Opportunities

- Misk Entrepreneurship has partnered with Plug and Play to launch the fourth cohort of Misk Accelerator 2023 where 20 startups will participate in the 12-week hybrid programme. Apply here.

- The New York Times is looking for a Researcher/Reporter in Dakar, Senegal. Apply here.

- Are you a corp member in Nigeria? Polaris Bank’s DigiCorper Programme 2023 is open. To learn data science, product management, product design, backend or frontend software development, or basic literacy skills, register here.

- The Eswatini Communications Commission (ESCCOM) has initiated a Girls in ICT’ Development Program, aimed at young ladies who are interested in pursuing an Information, Communications, and Technology (ICT) related profession. To apply, check this out.

- The United Nations is seeking an Associate Programme Management Officer. Apply here.

Have a lovely Wednesday.

Victoria Fakiya for Techpoint Africa.