For some, the goal is to retire at age 40; for others, it is 50.

Is this possible? Yes. It is achievable by increasing your regular and passive incomes.

About 45% of Nigerian parents plan to rely on their children after retirement, according to the Access to Financial Services in Nigeria (A2F) 2020 report by EFInA.

Add this to the increasing pressure of meeting the rising cost of living, and you might be headed for this vicious circle if there is nothing to fall back on after mandatory retirement.

So, what do you do? Start a Side hustle?

Ironically, you don’t have to add a side hustle to your 9 to 5 to create passive income.

Today, with digital products provided by fintech companies, you can grow your wealth by generating up to 15% interest from yearly savings on some platforms and 20% yield from investments on others.

You can even own stocks in some of the world’s biggest companies like Facebook (Meta), Amazon, Apple, Netflix, and Google (Alphabet).

Inflation in Nigeria hit a 17-year high this year, and the value of the naira keeps dropping. However, some fintech products can help you hedge against inflation and ensure that the value of your savings doesn’t drop but rises instead.

The list of products is endless, and they allow you more time to move up the corporate ladder, increase your income, or concentrate on other ventures while your money works for you. If you are capable, you can still add a side hustle.

Interestingly, financial technology is not just for ‘techies’ but people from all walks of life. Fintech products have now made it possible for the average worker earning a couple of thousands to grow wealth.

How do I start?

On November 26, 2022, Techpoint Africa will host The Fintech Summit (2022). Fintech companies, founders, and people with answers to your questions will be there.

You get to interact with fintech companies and their teams to understand their offerings better and learn how to leverage them to build wealth at the summit.

What better place to start your journey to financial freedom than at the biggest fintech gathering in Nigeria?

The Fintech Summit 2022 is themed ‘The Fintech in Everything’ and will explore how financial technologies shape how we live and do business today.

When and where will the Summit hold?

The Fintech Summit will hold on Saturday, November 26, 2022, at Four Points by Sheraton, Oniru, Victoria Island, Lagos.

How do I register to attend The Fintech Summit?

Here’s how to register and get your early-bird ticket in five simple steps:

- Head over to fintech.techpoint.africa

- Tap the ‘Register Now’ button

- Register with your email and tap the ‘Get Ticket’ button

- Select your preferred ticket type and provide the required information

- Proceed to pay for your ticket

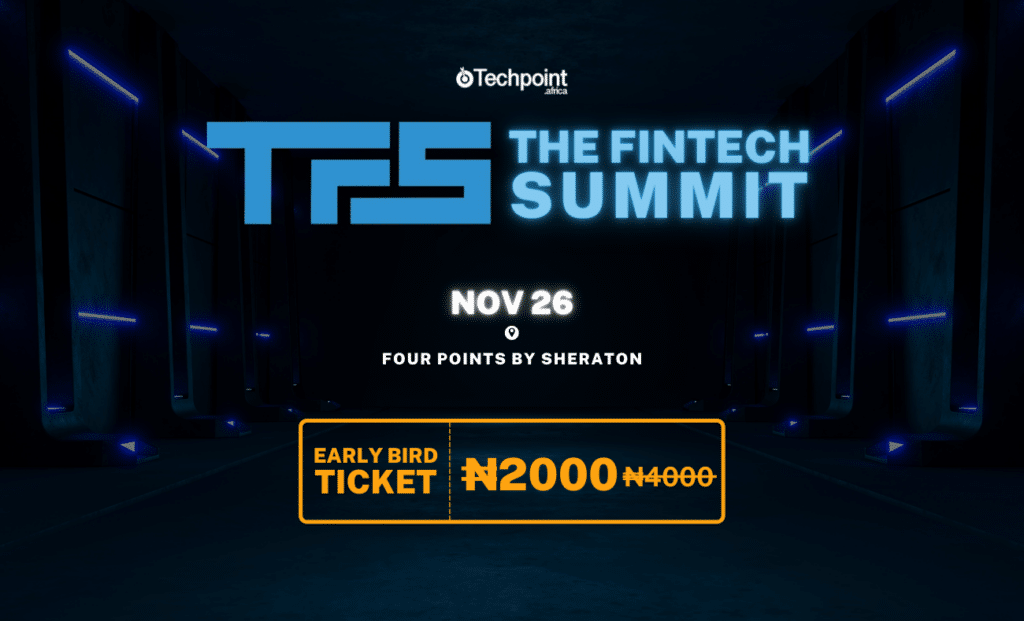

Tickets

General Badge (Early Bird): ₦2,000

General Badge: ₦4,000

VIP (Early Bird): ₦30,000 (includes lunch with speakers, reserved seats, and exclusive access to the VIP room)