It’s probably safe to state that technology and exposure have changed how startups operate in Nigeria. After its first entry with Senegal’s Wave, Y Combinator, one of the most prestigious accelerators in the world today, has gained increasing prominence in Africa.

Research from the good folks at Intelligence by Techpoint, our data and research team, has shown that African startups, on average, enter YC within a year or two of launch.

In March 2005, four illustrious professionals decided to start a company that would change how venture capitalists (VCs) invest in startups. With a seed fund of $150,000, the company took in the likes of Reddit in its first batch and has gone on to fund an enviable list of startups, including Stripe, Airbnb, and OpenSea.

Since Paystack’s entry in 2016, Y Combinator has seemingly increased its focus on Africa annually. This has significantly changed how African startups operate and, per some founders, helped refine their business processes.

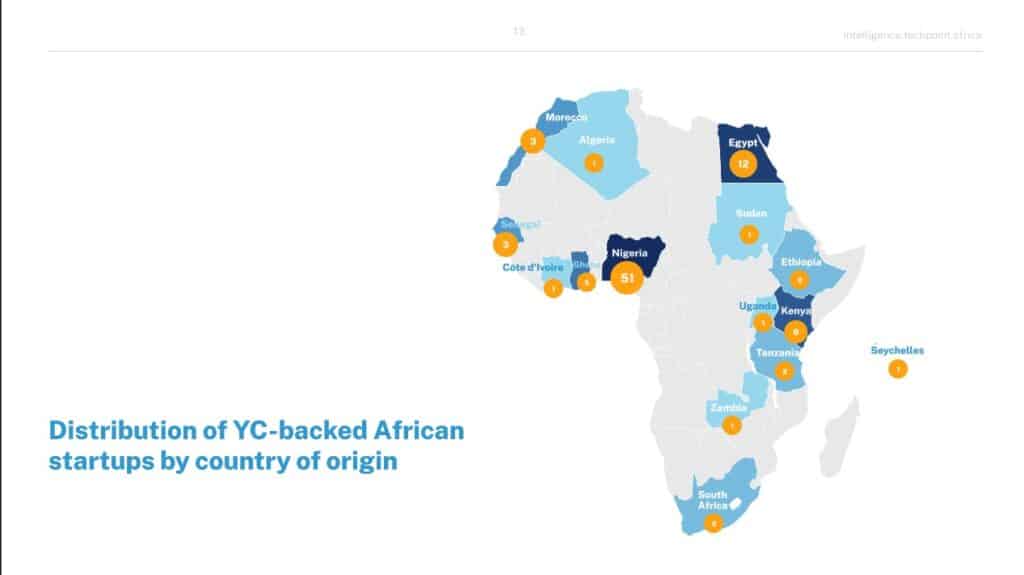

Since Paystack’s entry in 2016, Nigerian startups have dominated the scenes, gravitating towards the accelerator. Little wonder that 53% (51) of YC-backed African startups (95) are from Nigeria. Egypt comes in at a distant second with 12 startups, while Kenya rounds up the top three countries with 9 startups.

Different interested parties have reasons for Nigeria’s seeming dominance in YC, but it’s not so surprising for the accelerator.

Kat Manalac, Head of Outreach at Y Combinator, points out that when one company from a region goes through YC, gets featured in the press, and raises money after demo day, more founders from that region start applying the following year.

“We saw this in 2014 with Algolia — the Algolia founders were some of YC’s first French founders. They went through YC in Winter 2014, and in the following batch, we saw 17 French founders go through the program. This is what started happening with African companies after Paystack went through the batch,” she says.

Combined, Africa’s YC-backed startups had raised $1.3 billion as of March 2021, with two of them — Wave and Flutterwave — reaching a billion-dollar valuation. Paystack, another huge success story, was acquired by Stripe, a US-based payments startup, for $200 million in 2020.

These headline-grabbing stories appear to show investor attraction for YC-backed companies. For most investors, getting into YC means that a startup now has a higher valuation. But the big question remains: What problems are Y Combinator-backed startups solving?

What problems are Africa’s YC-backed startups solving?

While this might be the most obvious question, I guess we should have framed it thus: What problems are Africa’s YC-backed startups ‘trying’ to solve? Why? To use the Nigerian parlance, “Problem nor dey finish”, which simply means problems are never ending.

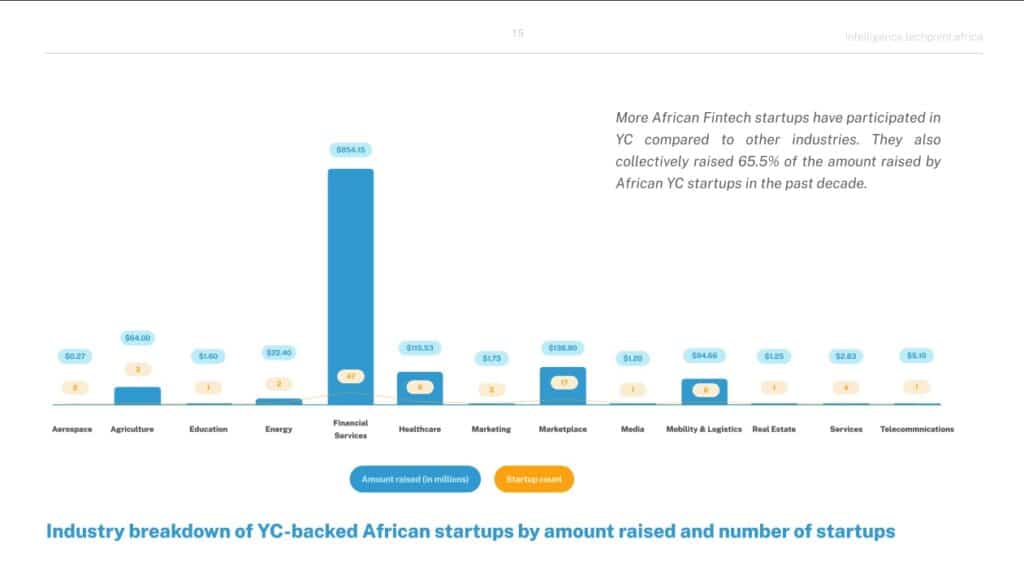

Our data shows that these startups are playing in various industries, including Financial Services, eCommerce, Agriculture, Healthcare, and Mobility & Logistics.

We’ll work our way up from the industries with the least focus to the ones with the most focus for this article. We found some startups working in some unexpected industries, but you’ll have to download the report to find out.

Education, Media, and Telecoms

Education, Media, and Telecoms are together because each sector has only one YC-backed startup trying to solve its problems. This is hardly surprising, considering that only 5% ($245m) of the $4.9 billion African startups raised in 2021 went to the Education sector.

While Africa’s education startups didn’t get up to 3% of startup funding in 2020 ($1.07 billion), Media and Telecoms did not make any notable imprint on the funding numbers for 2021 and 2020.

These startups have raised a combined $7.2 million and are seemingly making decent strides in their respective industries.

In 2021, the African Union reported that there were 42 million out-of-school children in Africa, with 40% of this number coming from West Africa. Six out of ten Africans are still without access to the Internet, and affordability remains a big issue for those who have access.

It’s important to note that these are huge capital-intensive sectors and might not be appealing to the fast-paced, high-growth nature of modern startups. But we might just be an innovative execution away from the problem. Easier said than done, we know. As for media? That’s a different ball game entirely.

Other sectors like Real Estate and Marketing also feature in this group.

Energy

So far, two Energy startups have gone through the prestigious accelerator programme and closed a combined $22 million to date. Slightly better than the three industries above, renewable energy solutions have attracted decent funding in Africa.

While it only accounted for 5% ($245 million) of funding in 2021, it took 22% of funding in the previous year. A cursory glance at the numbers, which show that 43% of Africans didn’t have access to electricity as of 2019, evidently points to a vast untapped market.

Like Telecoms, this is also capital intensive, and from what we’ve observed, several renewable energy solutions are barely affordable for the average (or even upper-middle-class) African.

Agriculture

With all its classes and tasty nutrients, food is an integral part of society. So far, YC has funded three startups looking to provide tech-enabled solutions for food security in Africa, and they have secured a combined $64 million.

Like the previous industries, it appears there’s a low investor appetite for startups building agriculture solutions across the continent. Agriculture startups accounted for 4% of funding in 2021, lower than 7% in 2020.

According to world vision, 282 million people are undernourished in Africa, and that’s just one result of several underlying problems. While food prices keep rising, 37% of food produced gets wasted.

Mobility & Logistics

Mobility & Logistics is at the heart of commerce and nearly everything we do. To date, six African Mobility & Logistics startups have gone through YC, raising $94.6 million. A trend we observed is that most of these startups are based in North Africa, with roughly 30% from Nigeria.

Recent funding announcements have shown a renewed interest in eCommerce in North Africa. Overall, Mobility & Logistics companies accounted for 10% of the total funding in 2021, a marginal improvement from 7% in 2020.

When we split both sectors, we’ll find that most of these companies are logistics companies. Mobility startups, on the other hand, have not raised as much.

Healthcare

Africa’s Health sector is huge not for its number of hospitals and medical infrastructure but for the number of problems waiting to be solved. Everything, from preventive healthcare, telemedicine, health insurance, and precision medicine, represents critical areas in Africa.

Y Combinator has invested in eight African Health startups that have bagged a combined $115 million. These startups offer diverse healthcare solutions in preventive healthcare, health insurance, cancer diagnostics, medical logistics, and precision medicine.

Nine out of the top ten causes of death in Africa are health-related problems that run pretty deep. While healthcare startups are emerging, their services are mainly meant for a particular class, so it’s hard to see how they can reach the mass market without significant regulatory backing.

Health startups accounted for 8% of 2021’s funding, not improving on 9% in 2020. While technology is great, there are other serious considerations beyond its scope — for now at least.

Marketplace

Marketplace startups have grown in popularity in recent years, and platforms that simply offer the technology to connect sellers to buyers are popping up with diverse execution strategies. So far, YC has invested in 17 startups looking to help Africans buy and sell online.

Considering the well-documented struggles of Jumia and Konga, questions abound on the viability of eCommerce startups in Africa. But these questions have not stopped YC-backed African eCommerce startups from bagging $138 million to date.

Overall, eCommerce startups have accounted for 3% and 5% of funding in 2021 and 2020, respectively. Also noteworthy is that an increasing number of eCommerce startups are now serving businesses rather than consumers directly.

Financial Services

Financial Services startups are the cream of the crop and the most popular sector by almost any metric in use. It has attracted the most funding and, perhaps, the most media attention for the past four years.

So far, YC has invested in a whopping 47 Financial Services startups in Africa, almost half of its Africa alumni. They’ve collectively raised over $854 million, about 65% of the total funding raised by Africa’s YC alumni.

However, this trend is not peculiar to YC. Fintech companies accounted for 62% of funding in 2021, mainly due to megadeals from Flutterwave and Chipper Cash. In the preceding year, fintechs grabbed 33% of funding, still much higher than any other sector.

There are some obvious reasons for the prominence of fintech companies. Over half of the continent’s population does not have access to formal financial services. As of 2020, the median age of Africans was 19.7 — this means half of the population was younger, and half of the population was older.

Most fintech companies’ efforts do not seem geared toward improving financial inclusion but rather promising a better experience for people who already have bank accounts. However, the jury is still out on how successful they’ve been.

Payments, for instance, have witnessed the most advancement. With the exploits of Paystack and Flutterwave, API-led fintechs are changing how financial companies communicate, but nearly every other sub-sector is still in the early stages.

Why is the focus on fintech?

“What we fund is typically a reflection of what strong teams are applying with,” says YC’s Manalac, in response to our question on fintech’s evident dominance.

Manalac’s assertion suggests that the company does not deliberately look out for fintech companies, but it receives several applications from founders offering financial services solutions.

“That payments lead the way shouldn’t come as a surprise because it is a primary pain point for all human beings irrespective of where you are, and is one area that technology has proven that it can build solutions for,” says Adesoji Solanke, Director, Frontier/SSA Banks & Fintech Equity Research, Renaissance Capital.

Pelumi Aboluwarin, CTO of Nigeria’s Nomba (formerly Kudi), maintains that running a business is hard, so payments shouldn’t be difficult too. Perseus Mlambo, CEO, Zambia’s Union54, also argues that payment is the key to unlocking innovations in health, agriculture, and industry.

While both founders run prominent financial services startups, Ikenna Nzewi, CEO of Releaf, a Nigerian Agritech startup, agrees.

“Fintech was the first piece of our growing innovation story so it makes sense that most of the investment and attention so far has gone to that sector. However, as innovation from more sectors emerges, I believe we will see a more diverse split.”

All things considered, we can safely say that YC-backed companies are mainly looking to solve problems in finance, eCommerce, logistics, and Healthcare. As these entrepreneurs gain more experience, we should better understand how these tech solutions could be best applied in an African context. As the founders we spoke to explained, going through YC is just the beginning.

Looking to understand how YC’s activities are changing Africa’s startup landscape? We spoke to some prominent entrepreneurs who have gone through the accelerator to gain insights. Watch this space on Monday.