There’s a new clause in Nigeria’s Finance Bill for 2021 that will drive down import duties on foreign vehicles from 35% to 5%. Divisive opinions from investors and industry players have met the proposed policy as it could potentially limit the demand for locally produced vehicles.

At the Nigerian Economic Summit Group (NESG) conference, Chidi Ajaere, CEO of GIG Group, parent of GIG Mobility and GIG Logistics voiced his concerns on how the policy affects investors who have put billions of naira into the local production of vehicles.

“We have invested all that money. What is going to happen to us (the investors in that vehicle assembly plant) now with the policy somersault? Will the federal government come to our aid with incentives for the monies already sunk into the investment?”

In response, Nigeria’s Vice President, Yemi Osinbajo, explained that the decision to slash the import duties on vehicles was made to reduce the cost of vehicles and, by extension, cut down on the cost of transportation in Nigeria.

He stated that the removal of fuel subsidies had increased the cost of transportation across the country, and the reduction of import duties would cause deflation in prices.

According to the Vice President, owing to Nigeria’s annual vehicle demands of 720,000, the local production, which currently stands at 14,000, barely meets the need. Hence, the decision to reduce import duties.

Why it matters and the bigger picture

Transportation is the lifeblood of commercial activities across the globe. And we observed that the pandemic-induced restriction on movement led to the scarcity of goods like food, gadgets, and industrial raw materials.

According to expat.com, a tourist platform, 80% of trips in Nigeria are made by road. Still, thanks to a weak public transport service system, Nigerians seem to rely heavily on privately owned vehicles (taxis, buses, tricycles, and motorcycles) for their daily commute.

As of 2018, the Nigerian Bureau of Statistics (NBS) recorded that there were ~11.8 million registered vehicles in Nigeria, with the then population of 198 million people putting the vehicle per population ratio at 0.06.

Of this number, 39% (4.6 million) were privately owned, 56% (6.7 million) were commercial vehicles, 1.1% (135,216) were registered as government-owned, while 0.4% (5,834) were registered for diplomats.

With an adult population of over 99 million, this seems to present vehicle manufacturers with the opportunity to reach a vast market. However, historical and current socio-political developments suggest otherwise.

Going deeper

So far, Nigeria has relied on imports to meet the massive annual demand for vehicles and cover the gaps left unfilled by its fledgeling automobile industry. In response, past and present governments have come up with different policies in the name of improving local vehicle manufacturing.

Through strategic partnerships during the oil boom of the 70s Nigeria housed vehicle manufacturing plants from several global giants like Nissan, Peugeot, and Volkswagen, as well as indigenous players like Anambra Motor Manufacturing Company Limited (ANAMMCO).

Unfortunately, irregular policies and an increasingly harsh economic environment made several of these companies shut down operations.

In 2013, during Goodluck Jonathan’s administration, the government introduced another policy: the Nigerian Automotive Industry Development Plan (NAIDP).

Among other regulations, it introduced:

- A duty that took the total vehicle import tariff to 70%.

- The establishment of automotive test centres to make sure locally assembled vehicles met international requirements.

- A degree in automotive engineering offered at three Nigerian universities and mechanic training workshops in different cities.

- A digital solution to check smuggling.

- A vehicle financing scheme for Nigerians.

- Licences for thirty-five companies to assemble/produce vehicles.

The effect

Encouragingly, in January 2020, Nigeria’s National Automotive Design and Development Council (NADDC) claimed that the country attracted $1 billion (₦381 billion) in 12 months.

International brands like Nissan and Hyundai have established mini assembly plants, and indigenous brands like Innoson Vehicle Manufacturing have been making significant strides in building trust. JET Motor Company raised $9 million in research capital to build electric vehicles.

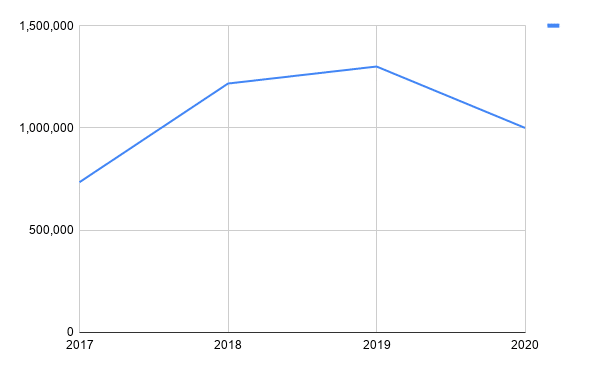

Despite this, there appears to be an increase in the importation of vehicles. In 2019, Nigeria imported an estimated 1.3 million vehicles, 56% more than 734,000 in 2017. Because of the high rate of smuggling, it is difficult to get the exact figures for vehicle imports in Nigeria.

In 2017, the comptroller-general of customs claimed that smuggled vehicles represented 90% of total vehicle imports in Nigeria.

According to the NBS, Nigerians spent a whopping ₦1.08 trillion ($2.7 billion) to import used cars and motorcycles between October 2018 and September 2019.

So what went wrong?

At the NESG, VP Osinbajo opined that the idea behind the previous policy was that if duties and levies are increased on imported vehicles, local production will kick into high gear.

Local production has not grown as much as many hoped, vehicles have increasingly become expensive, and the government claims that the reduction in import tariffs would beat down transport costs.

The high cost of transportation is probably an analysis for a different story. Still, a look at Nigeria’s automotive plan showed that the NADDC anticipated most of the problems it faced but did little to implement solutions.

The FG created a web portal to help tackle the possible rise in smuggling following the introduction of an extra 35% levy on imported cars. While it’s not clear how the portal would help rapidly growing rate of smughling, it is currently inaccessible.

Also, the council tried to establish automotive engineering degrees in 2018, but not much has been heard since.

The NADDC claims that it has provided loan facilities to 57 companies amounting to ₦12.575 billion ($31.7 million) through the Automotive Development Fund (ADF). But as this article explains, the majority of Nigerians either have to pay up in full or get bank loans at exorbitant interest rates to finance vehicle purchases.

According to Deloitte, as of 2016, just 2% of Nigeria’s population could afford new vehicles, and bank interest rates could go as high as 20% with at least a 10% down payment.

Most financing providers agree that monthly loan repayment should not exceed 35% – 40% of monthly income. Still, the short repayment terms demanded by most banks make it difficult for low and middle-income households.

In January 2020, the council announced another ₦5 billion ($12.6 million) vehicle financing scheme, but it remains to be seen what the outcome would be.

According to Ajaere, the original policy (NAIDP 2013) might have begun to attract a lot of investors, but the decision to slash import levies could discourage current and future investors if they don’t see stability.

The minds behind the original automotive plan also anticipated such policy somersaults and tried to get it passed into law to discourage future governments from changing its resolutions.

While the NADDC claimed that the Bill has been legislated and was awaiting presidential assent, in 2019, the minister of industry, trade and investment said it was not received at the National Assembly. The government said it wanted to get things right with stakeholder input.

As of November 2020, the NAIDP Bill is still undergoing review, and it is somewhat doubtful as to what kind of stakeholder input it has received so far.

Although several licences have been issued, the number of companies assembling vehicles in Nigeria is somewhat unclear. As this academic research reveals, only a few players in the industry have vehicle manufacturing plants.

In 2019, the NADDC admitted that only nine assemblers were active.

A majority of the genuine players work with well known foreign brands, and only a few of them are indigenous companies promoting the Nigerian brand.

Beyond import duties

Nigerian vehicle manufacturers have to deal with a plethora of challenges, besides import duties that discourage importation. One of the most prominent suspects across all sectors is the country’s epileptic power supply.

However, Ajaere opines that this is an issue that auto manufacturers, like those in other sectors, have been finding ways to resolve.

“While some other sectors need power round the clock, the local automotive sector assembles based on orders. About 90% of your power need is only for a specific period, and the other 10% will just be for administrative purposes,” Ajaere explains.

“Let’s say I have an order for 50 vehicles, and I’m able to assemble ten vehicles every 18 hours, I will need maybe six days to finish assembling them. Even if I run a diesel generator for the entire duration, all I’ll do is add the cost to my cost of production.”

According to him, vehicles can end up being cheaper if there is steady power, but that shouldn’t stop any serious manufacturer. He also explains that since the cost of labour is more affordable, it will eliminate the cost of shipping these vehicles and paying clearing charges at the port. Sometimes the price might even out.

Like several businesses that deal with a lot of hardware, another challenge for entrepreneurs in this space is access to funding, and there have been few incentives from the government.

Unlike the 70s, when Nigeria had a thriving rubber industry, and the Ajaokuta Steel Company operated at a relatively decent capacity, most automotive companies today still have to import several vehicle parts and deal with irregular official and unofficial charges.

An industry insider contends that it costs ₦1.3 million to move a 40-foot container from Apapa, Lagos to Ikeja, Lagos. No thanks to port inefficiencies, sometimes players pay demurrage charges of ₦500,000 or up to a million.

What’s the way forward?

Interestingly, GIG Group’s Ajaere insists that local Nigerian manufacturers can meet the massive demand for vehicles and also leverage their economic influence to begin exporting to neighbouring countries.

“Look at any strong economy in this world, and you will see that they usually have a strong automobile foundation. And you see the government supporting homegrown manufacturing companies in countries like the US, Japan, Germany, and South Korea,” he says.

According to him, the government has to be deliberate about its intentions for the automotive sector and maintain consistency in its policy approach.

“It’s still a young industry, and the government needs to let it develop with time by making the policies consistent. When manufacturers of diverse vehicle parts see this consistency, they can decide to set up shop in Nigeria. Before long, we would begin to see a thriving automobile industry,” he adds.

Ajaere also suggests that the government can have power clusters as was instituted In Edo State to provide 24-hour electricity for manufacturers. Other incentives he recommends are funding for indigenous manufacturers and the establishment of vehicle financing schemes for customers.

Dr Conelius Agbo, a mechanical engineering lecturer at the University of Nigeria Nsukka, argued in this paper that Nigeria needs a pragmatic approach to the formulation of policies that would ensure that only genuine players operate in the sector.

Agbo believes that the NAIDP itself might not be enough to create a robust ecosystem for vehicle manufacturing in Nigeria due to the abuse by some parties.

Ajaere likens this to visa policies in countries like Canada, which some people choose to abuse. “This does not mean that there aren’t genuine people playing in the space,” he says.

For now, Nigeria’s policymakers have to back up its policies with action if there’s to be a thriving ecosystem for the automobile industry.