Chipper Cash, a mobile cross-border money transfer platform focused on African markets, has raised a Series A round of $13.8 million.

This comes after the fintech startup raised a seed round of $6 million six months ago.

Led by Deciens Capital, lead investor of the previous round, TechCrunch reported that the startup plans to hire 30 new staff across its offices around the world.

Quite thrilled to announce our $13.8M Series A. Special thanks and love to our 1.5m+ Chipper community out there who inspire us everyday – we have a few special things in store for you. I love you❤️😀https://t.co/RMHvsTSEiE

— Ham Serunjogi (@HSerunjogi) June 17, 2020

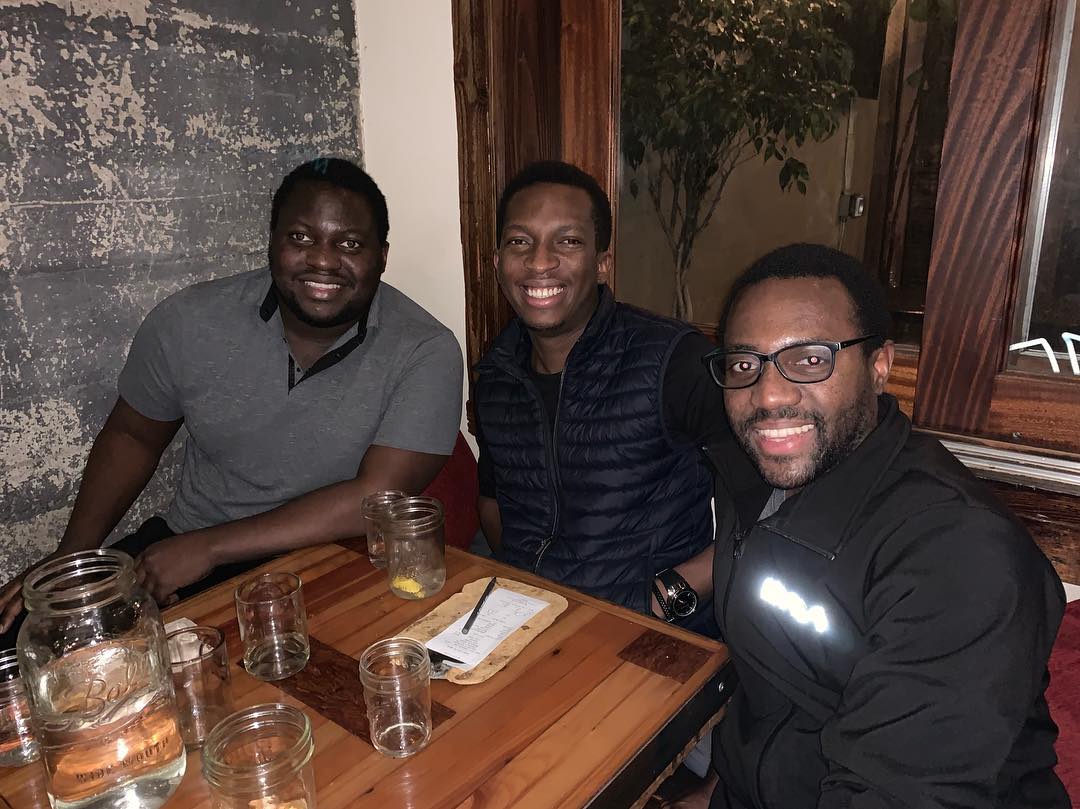

Founded in 2018 by Ugandan Ham Serunjogi and Ghanaian Maijid Moujaled, Chipper Cash operates in seven African countries — Ghana, Kenya, Nigeria, South Africa, Rwanda, Tanzania, and Uganda.

In a space of a year, the startup has raised $22.2 million. In May 2019, it raised $2.4 million from Deciens Capital, 500 Startups and Liquid 2 Ventures. The trio also participated in this Series A round.

Last year, the startup operated in six African countries and reportedly expanded to South Africa in March after raising its second seed round of $6 million.

At the time, the startup CEO, Ham Serunjogi, said Chipper Cash had more than 600,000 active users with over 3 million transactions processed on the platform.

But now, active users stands at about 1.5 million while it does over $100 million monthly transactions, in terms of volume.

As said earlier, the new funding will be used to hire staff in Lagos, London, Nairobi, New York and San Francisco.

It will be interesting to see how Chipper Cash competes with other cross-border fintech players with bigger coffers. Its gratis-payment structure, which is the two-year-old startup main value proposition might give it an edge.

Also, there is the fact that it is present in three markets dominating digital finance in Africa — Kenya, Nigeria, and South Africa.

However, there are enough users and customers to go around in Africa’s unbanked population and these fintech startups have barely scratched the surface.

Featured image: Chipper Cash founders, Ham Serunjogi (L) and Maijid Moujaled (R). Source: Ham Serunjogi Instagram.