Chipper Cash, a mobile cross-border money transfer platform, is expanding its cross-border payment services to Nigeria in partnership with payment gateway company, Paystack.

The startup began operations in October 2018 and its expansion into Nigeria brought the number of African countries where its services are available to six — the others are Ghana, Kenya, Rwanda, Uganda, and Tanzania; the Nigerian expansion hinges on the country’s large population and economy.

Since Nigeria’s fintech industry is one of the most advanced in Africa, along with South Africa and Kenya — accounting for 65.2% of African fintech startups — it only makes sense for any company in the fintech space across borders to have a presence in Nigeria.

A major offering for Chipper Cash is its no-fee cross-border P2P mobile payment service, which helps as many as 70,000 active users make payments. Already, the startup claims to have processed 250,000 transactions on its platform.

The unbanked and underserved population in Africa remains large, and Chipper Cash is joining existing Nigerian players — Carbon, Flutterwave, and Paga — to tackle the problem, as there is enough room for all to operate.

Chipper Cash, along with payments company Flutterwave and digital lending startup, Mines, maintains a presence in San Francisco. This structure is enabling their efforts to become global fintech players while maintaining a presence in Africa.

Chipper Cash was co-founded by a Ugandan, Ham Serunjogi and a Ghanaian, Majid Moujaled. The startup will establish a presence in Lagos by hiring Abiodun Animashaun, a former co-founder of ride-hailing startup Gokada, as country manager.

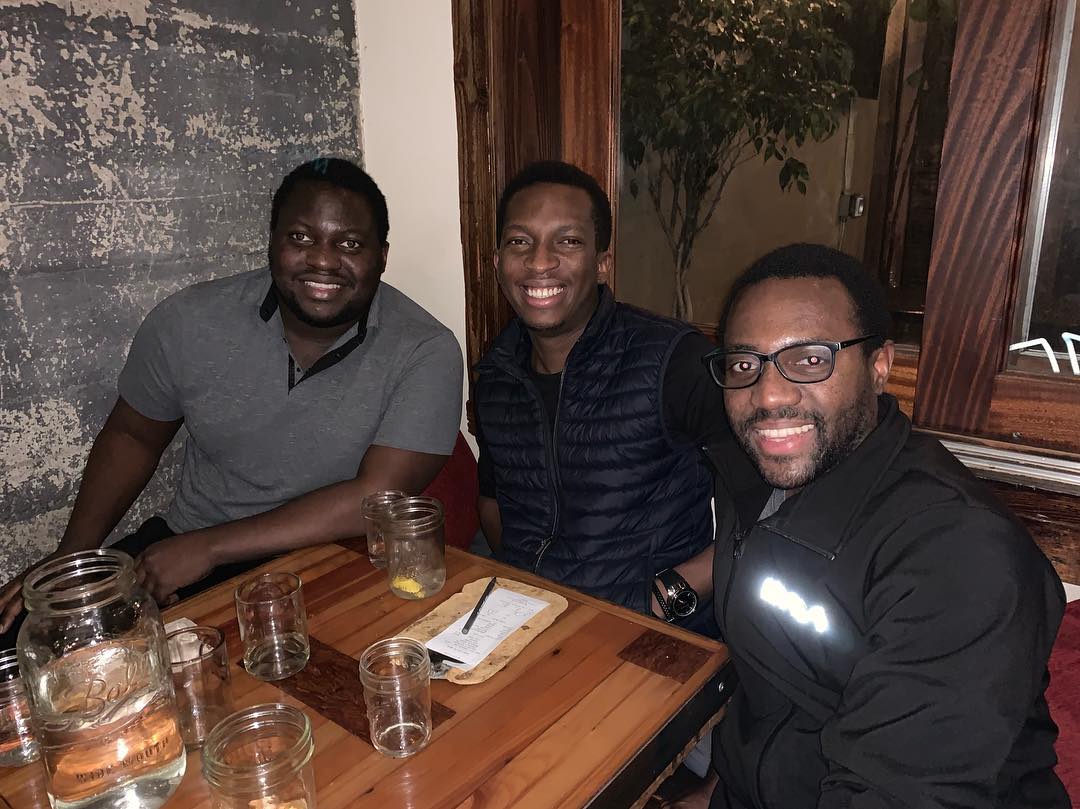

Featured image (L-R): Ham Serunjogi, Shola Akinlade (Paystack) and Majid Moujaled.