The Central Bank of Nigeria (CBN) Governor, Godwin Emefiele recently made a comment through his Deputy Governor, Economic Policy Directorate, Okwu Nnana that fintech is a threat to the banking industry.

In spite of CBN’s claim, commercial banks are relying on the power of technology to service their customers. Micro-finance banks are not left. An example is Asha Microfinance Bank, which provides tablet devices to its loan officers to ease their process, reporting among others.

One of the oldest banks in Nigeria, Wema Bank was the first to introduce a fully digital bank — ALAT. Many more traditional banks are already investing in financial innovation and as far as putting self-service points powered by mobile technology within their physical branches.

The place of fintech in the banking sector

Despite its perception as a threat to the banking sector, experts agree that the digital revolution has been nothing short of transformative.

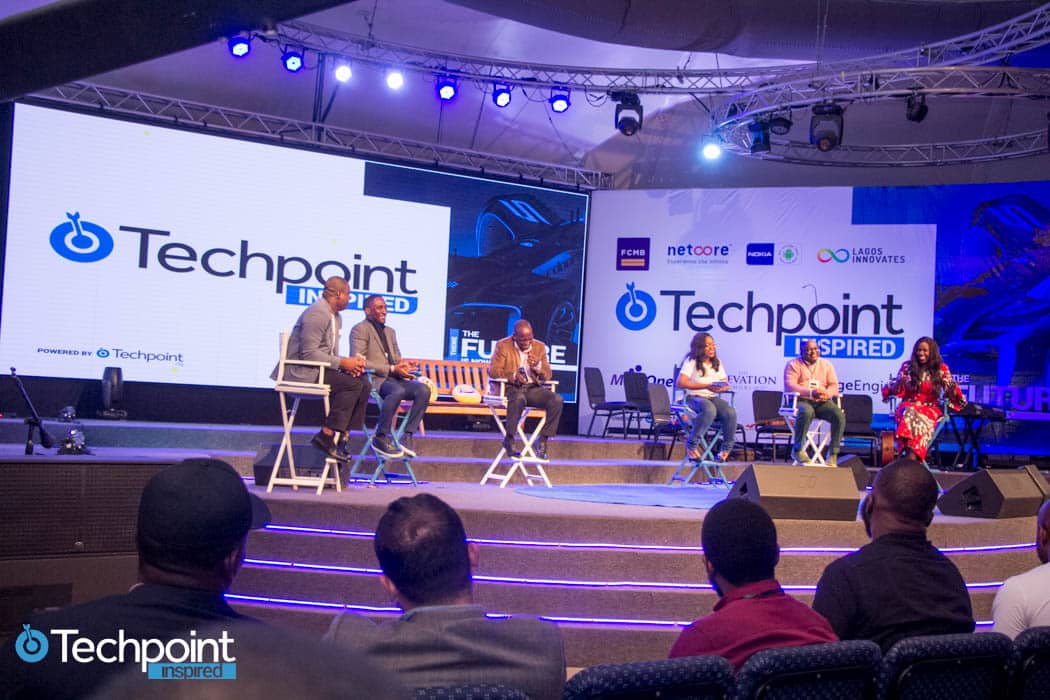

Speaking during a panel session titled ‘The Consumer, the Bank and Fintech’ at the 2018 edition of Techpoint Inspired, Julius Wanyaga, Head, Digital Banking Transformation, FCMB claimed that there’s a disconnect between Nigerian banks and digital natives.

Other members of the panel were Divisional Head, FinTech & Innovation at GTBank, Deji Oguntonade; TeamApt founder/CEO, Tosin Eniolorunda; MasterCard’s Country Director, Adebanjo Omokehinde and Open Banking co-founder, Adedeji Olowe.

On whether fintech is a threat to the banking industry, Tosin Eniolorunda of TeamApt gave an affirmative response. But this hasn’t stopped his company from collaborating with commercial banks. In fact, this has made it possible for them not to bother about raising external funding.

“Looking at the fintech and banking environment, I can project that in the next 5 years, there would be mergers eventually. Banks would probably acquire some fintech companies that are real threats and some fintech would become really great, working with banks.”

Julius Wanyaga of FCMB revealed that the Commercial Bank of Africa, Kenya has over 20 million customers of the total 49 million population and the website of the bank lists less than 50 physical branches. Technology is enabling financial institutions to serve customers without the need for physical contact.

Going into a banking hall to have an issue resolved with a customer service representative can be a nightmare. Technological innovation is capable of offering a refreshing and satisfactory experience to consumers.

Customers want to be served cheaper, faster and easier, and fintech solutions are making this possible. With Leo of United Bank for Africa (UBA) and Diamond Bank’s Ada, customers can open a bank account and initiate transactions from within the Facebook Messenger app.

“In the next 10 years, if a bank is not a software company, it would mostly die,” Julius Wanyaga said. He further claimed that fintech will drive the cultural shift to a software-driven business model in the banking sector.

MasterCard’s Country Director, Adebanjo Omokehinde hinted at one of the company’s initiatives, Start Path, with which MasterCard is ensuring partnership and collaboration between the banks and fintech solutions.

Adebanjo also claimed some banks run fintech solutions that are white label products. According to her, MasterCard plays between fintech and banks, by leveraging on the strength of all the parties involved.

The winner will be the company that makes financial services easier, faster and cheaper. Fintech companies are here to stay and the banks are not going away either.

The real threats: Consumers and Internet giants

For Divisional Head, FinTech & Innovation at GTBank, Deji Oguntonade, fintech companies will always be partners to the banking sector.

According to him, the real threats are consumer internet companies — like Google, Facebook and WhatsApp — that are exploring the financial and payment space. These Internet giants continue making efforts to serve their users at every point of their need, both socially and financially.

Apple has 1.3 billion active devices globally, and its payment solution — Apple Pay — had 127 million users as at the end of 2017, up from an estimate of 62 million by 2016 ending.

Alibaba Group’s payment platform, the Alipay app controls over 50% of the $5.5 trillion Chinese mobile payments sector, and tech giant, Tencent is its only major competitor.

These tech giants have access to customer insights with which they can provide a highly customised financial service experience.

The consumers are also a threat to the banking industry as a failure of the banks to meet them where and when they want to be served could lead to a shift to fintech or the Internet giants solutions for their financial and payment services.

Eniolorunda made mention of a survey which revealed that the major pain points for consumers are charges, ease of loan as well as customer support. In all of these, the side that would win will be the one that can address the listed pain points.

The future of payment industry would be won and dominated by companies that are fast in providing financial and payment services with cheaper charges.

Advocating for cheaper and smarter products, Adebanjo said financial products need to be radically different and at a very low cost.

“I cannot struggle to make money and struggle to spend the money,” she added.

Open Banking co-founder, Adedeji Olowe cited the cost of transactions as one of the reasons a larger share of the population is financially excluded.

Olowe revealed that it costs the banks not more than ₦10 for an inter-bank transfer. Yet, banks used to charge as high as ₦100 before it was reduced to ₦50 last year.

The reduction, no doubt, had an effect on the number of inter-bank transfers conducted in a day.

“The product of the future for the financial segment is going to come from fintech and fintech banks,” Adebanjo said.

According to a report (PDF) by the World Economic Forum, platforms that offer the ability to engage with different financial institutions from a single channel will become the dominant model for the delivery of financial services.