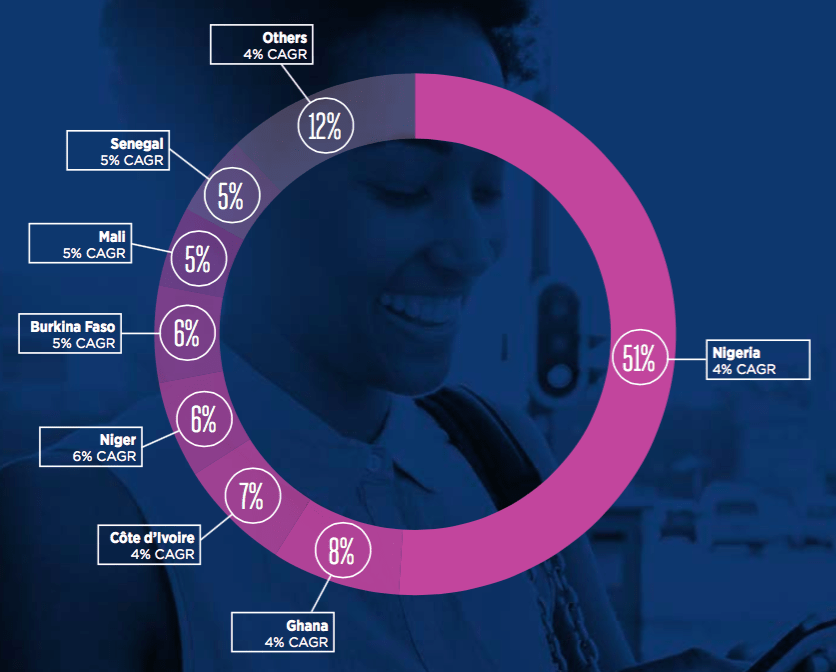

Of the 15 countries in the Economic Community of West African States (ECOWAS), Nigeria is expected to contribute 51% of the projected additional 72 million unique mobile subscriptions in the region by 2025.

With unique mobile subscribers currently at 93.5 million, coupled with the projected growth, Nigeria is likely to hit its financial inclusion target for 2020. But this is dependent on if the recent Memorandum of Understanding signed by the Nigerian Communications Commission (NCC) and the Central Bank of Nigeria (CBN) adopts a telco-led model.

The telco-led model for mobile money has been avoided for a while, seeing as it could potentially create fierce competition between telcos and the banks, on the notion that telcos already have the infrastructure in place and the numbers, in terms of subscribers.

Aside from the recent agreement with NCC, the apex monetary authority has made attempts to drive its financial inclusion goals, one of which is the National Financial Inclusion Strategy (PDF) released in 2012 to reduce the percentage of adults in the country excluded from financial services which, according to a recent report by the World Bank, stands at 40%.

Since the early days of GSM in Nigeria, people have devised an informal means of payment using prepaid airtime recharge cards. The payer buys a recharge card and sends the PIN to the payee, who then resells to recharge card vendors, usually for a lower amount.

The banking system is totally excluded from the entire process, However, there’s a limit to the amount that can be sent, considering that the higher the amount involved, the higher the vendors’ cut on it.

According to CBN’s Guidelines on Mobile Payments Services in Nigeria (PDF), network operators are not to enable the use of airtime value loaded by their subscribers for purposes of payment or to transfer monetary value.

However, airtime value, both loaded and otherwise, is still being used as a means of payment or transfer of value by individuals. In fact, there are platforms like Zoranga and Monapay, among others that are trying to institutionalise the process.

Call it hype, but East Africa’s M-Pesa is still a point of reference for mobile money across the world. And all that’s needed for the mobile money service is ownership of a Safaricom SIM and registration for the service.

Such is the power of mobile technology, relying on its own infrastructure and network of vendors to reach its target.

Towards improving mobile money penetration

Riding on mobile technology would help Nigeria’s financial inclusion drive. Unique mobile subscription as at 2017 was at 49% and it’s projected to be 55%, which equals 128.5 million Nigerians that will be with a mobile subscription in the next 7 years.

Speaking at the recent GSMA Mobile 360 Series West Africa conference, the Executive VP Mobile Financial Services at Orange Group, Patrick Roussel, stated that a solid distribution network, technology, and being part of the operation and abiding by the rules are the factors for successful mobile money penetration.

The Nigerian telecom industry already has a robust distribution network across the country, and the technology — mobile telephone and infrastructure — is not only in place, but still growing. And the NCC and sister agencies are ensuring that telcos play by the rules.

Being that the unique mobile subscription is calculated as a percentage of the population, and Nigeria’s population in 2017 according to Worldometers is 190.9 million, it means that 93.5 million have a mobile phone: that’s how large the potential of mobile phone technology to financial inclusion drive is.

With the needed factors already in place, the appropriate policies by CBN would go a long way to drive its financial inclusion target of 80% by 2020.

Mobile money, taxation, and the economy

The GSMA report also has it that West Africa recorded $15.6 billion in mobile revenue in 2017 with Nigeria accounting for nearly half of that figure in spite of the current economic condition of the country.

If Nigeria can contribute about half of the region’s mobile revenue in a year with such a low mobile subscription penetration, it implies that mobile could contribute a great deal to the economy as subscriptions to mobile services continue to grow.

On the challenges of the industry, Roussel pointed out that taxing the sector will slow down mobile money penetration.

The federal government can consider granting tax holidays for the mobile money sector to push adoption which will also serve as a form of support for licensed operators. After all a tax holiday was given to the telecom industry at the initial stage, so given licensed mobile money operators the same won’t be out of place.

A robust financial inclusion would not only ensure that majority of the population is within the financial system in one form or the other, it will also boost the telecoms industry’s contribution to GDP which is currently at 8.66%.