The financial inclusion target of the Central Bank of Nigeria (CBN) seems farfetched as the World Bank has put the number of unbanked Nigerians adults at about 100 million.

According to The Global Findex Database 2017, only 40% of Nigerian adults have an account with a financial institution or a mobile money provider.

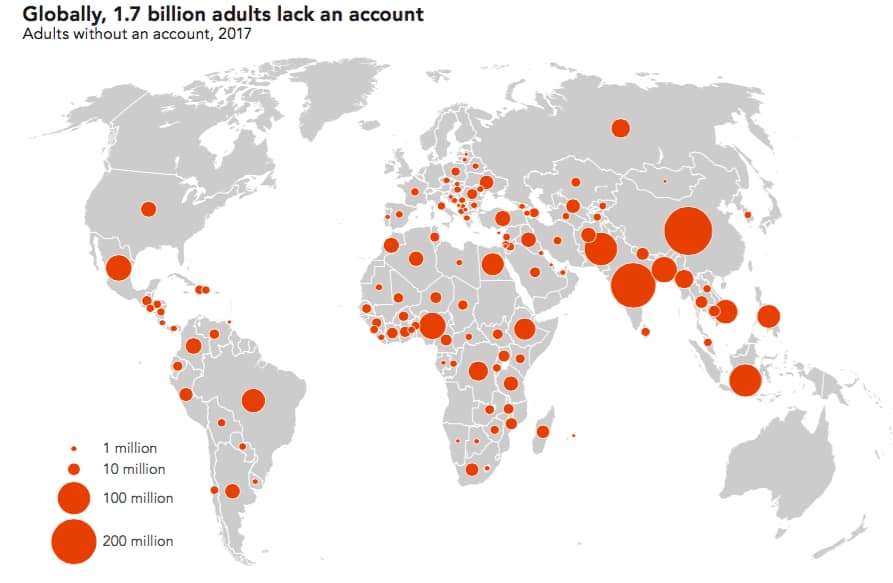

The report — which is the world’s most comprehensive dataset on how adults save, borrow, make payments, and manage risk — further revealed that Nigeria and six other countries contribute nearly half of the globe’s unbanked adult population of 1.7 billion, and 56% of that figure are women.

A larger share of those with a bank account in Nigeria have at one point or the other made and receive digital payment within the last year, and debit card ownership is still less than 40% of the population.

The new World Bank report questions the Financial Inclusion Insights that put financial inclusion in Nigeria at 35% in 2016. We can attribute the large discrepancy to the fact that the global banking institute made use of face-to-face interview methodology to arrive at the figures presented in the report.

Pointers for CBN and other players in the financial inclusion drive from the report is that 19% of the interviewed correspondents claimed they don’t own bank account because financial institutions are too far away and 13% maintained that financial services are too expensive.

Other listed barriers include lack of trust in the financial institutions, documentation required, religious reasons among others. The report also has it that unbanked adults are more likely to have low educational attainment.