There is an ongoing a war on cryptocurrency from every angle of the world; this questions the future of the virtual currency.

Earlier in March 2018, Google listed cryptocurrency as one of the unregulated financial products that the search engine giant would no longer allow ads from.

This is after Facebook and even Twitter revealed plans to prohibit ads promoting the likes of bitcoin on their platforms. Countries across the world are also joining the clamp down.

The Central Bank of Nigeria (CBN) is not left out, as the apex bank has warned that dealers, as well as investors in any kind of cryptocurrency in Nigeria, are not protected by law, being that it’s not regulated by the government.

Futurist speaker, Thomas Frey doesn’t agree with the Internet companies and governments that are against cryptocurrency. He believes cryptocurrencies will displace about 25% of national currencies in the next 12 years. According to him, this is because digital currencies are more efficient.

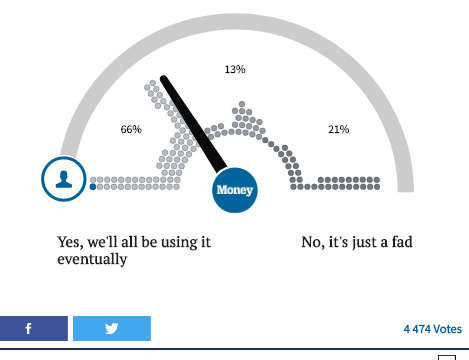

And according to an ongoing poll by Time, of the 4,474 votes as at the time of writing this post, 66% believe cryptocurrencies will eventually become generally acceptable in the future.

Nevertheless, it appears that the fate of cryptocurrency lies in the hands of government regulatory agencies.

Indeed, the CBN, alongside the Nigeria Deposit Insurance Corporation, did make a move last year to examine the chances of adopting digital currencies; hinting at a possible regulation of sorts in the country.

Just like Nigeria, cryptocurrency is not considered a legal tender in South Africa. However, just recently, the country’s revenue service made a move to start demanding that gains or losses on cryptocurrency be declared and that normal income tax paid on them.

South Africa is not the first to impose taxes on cryptocurrency; the United States Congress in December 2017 passed a law that eliminates an exemption for bitcoins and the likes from tax.

On the flip side, the Southern European country of Malta has become something of a safe haven for cryptocurrency, as it keeps welcoming companies involved in digital currencies. It appears the country has plans towards developing the digital currency industry.

While we continue to debate about the future of cryptocurrency on the bases of legality and regulation, its daily preaching on social media is not dying down. And with countries like Malta wholly embracing the technology, we might as well discuss its future in Nigeria.

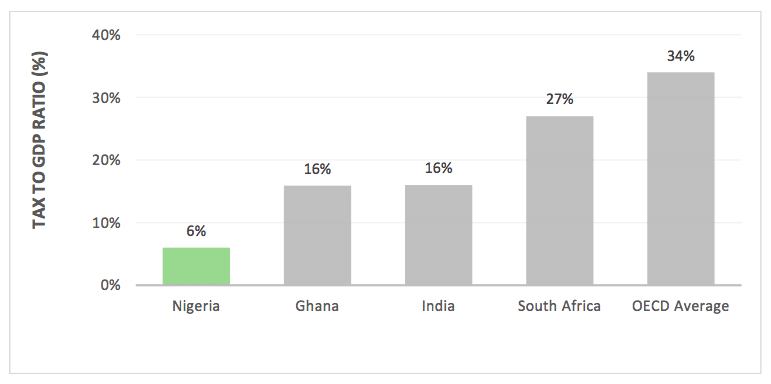

Maybe it is time to call on the Federal Inland Revenue Service (FIRS) of Nigeria to start taxing gains from digital currencies, being digital assets. It will definitely give the tax-to-GDP ratio a little boost.

Responding to a question on Quora about what a government stands to gain from recognising bitcoin, Javier Gonzalez, who is a banker, believes bitcoins would lead to a low inflation environment while allowing the economy to grow at a faster pace.

“Let us remember that in the 19th century, more exactly before 1913, commercial banks emitted their own notes or currency. So it wouldn’t be the first or the last time that private notes serve the purpose of currency, as long as they have a very strong credibility.”

We are already trading and making payment for goods and services with bitcoin among other digital currencies which the CBN cannot really do much about, just as the government cannot regulate the Internet.

The government, through its agencies, should put in effort to make digital currencies work for the good of the economy since the crackdown on it is in no way affecting its increasing adoption.

CBN can also work with the Nigerian Stock Exchange to put together a framework and structure around raising funds through Initial Coin Offerings (ICO). All of this is dependent on whether the government accepts cryptocurrency as a legal tender or not.