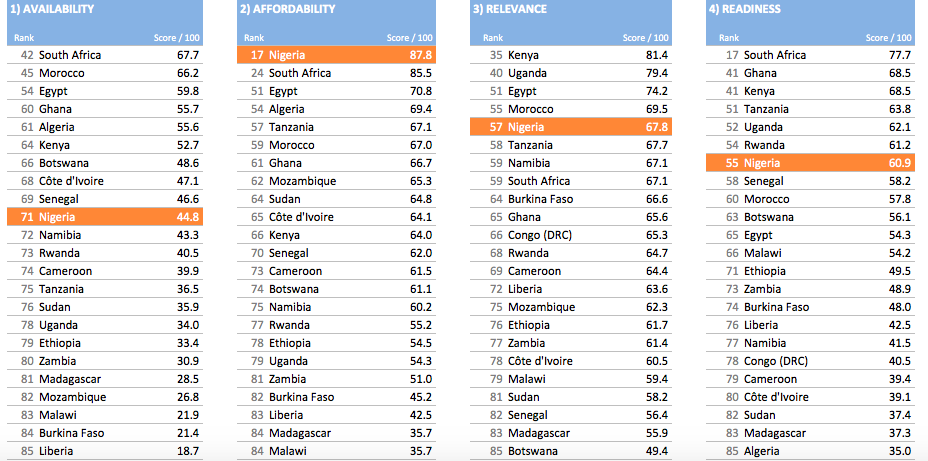

According to data from the 2018 edition of the Inclusive Internet Index by The Economist Intelligence Unit (EIU), Nigeria now ranks number one in Internet affordability in Africa and 17th globally.

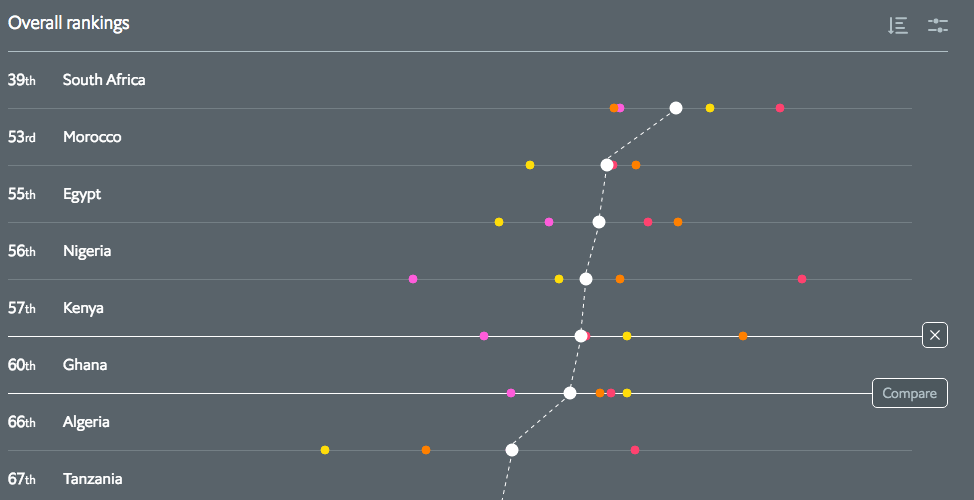

However, on the overall ranking for inclusive internet, Nigeria is 4th in Africa with South Africa, Morocco, and Egypt topping the continent’s list in that order.

In 2017, Nigeria became the first African country to endorse the affordable Internet initiative created by the Alliance for Affordable Internet (A4AI). That same year, the country ranked 6th in a survey on the cost of broadband per gigabyte in selected African countries.

The affordable Internet initiative by A4AI stipulates that the cost of 1GB of Internet data should not be more than 2% of average monthly income. The Inclusive Internet Index also made use of average monthly income to measure Internet affordability, but against the cost of 500MB.

The EIU’s ranking will, no doubt, come as a surprise to the average Nigerian Internet subscriber considering a recent #MakeDataCheaper campaign on Twitter, calling on telcos and concerned stakeholders to reduce the cost of Internet subscription.

Twelve months after Nigeria’s endorsement of the affordable internet initiative, the average cost of data remains the same, with the cost of broadband gulping up to 30% percent of household income.

The regulatory agency overseeing the telecommunications industry, the Nigerian Communications Commission (NCC), had set a benchmark for the cost of data which was later withdrawn. But there’s still a sort of control in that regard as the cost of data across the four major telcos is within the same range.

According to Numbeo, the average monthly income in Nigeria is ₦84,478.57, an equivalent of $234.66, whereas 40% of Nigerians earn less than half of the average monthly income, resulting in basic mobile broadband taking up to 7-18% of their monthly income.

It’s on this basis that we used minimum wage instead of average monthly income for our findings of the cost of data in the top four countries on the EIU’s index.

- A gigabyte goes for $1.09 from Morocco’s Maroc Telecom — just 0.33% of the country’s minimum wage of $326.

- Vodafone Egypt sells 1GB for $1.13 — 1.66% of Egypt’s minimum wage of $68.

- Airtel Nigeria sells 1GB for $1.85 — 3.7% of the minimum wage at $50.

- MTN South Africa has 1GB for $5.83, which is 1.79% of South Africa’s minimum wage of $326.

But Morocco, which appears to have the cheapest data according to the above, ranked 6th in Africa on the index. Meanwhile, in Nigeria, ₦1,000 which is 5.55% of the minimum wage, can only get an average of 1.25GB.

Of the four countries, Nigeria has the most expensive Internet access compared to minimum wage, and for the other three countries, the cost of 1GB is less than 2% of their minimum wage.

This raises the question of how Nigeria topped the EIU’s ranking for affordable internet, despite not sticking to the target of the A4AI.

It is worthy of note that the EIU’s index makes use of survey data. Also, asides affordability, other categories measured for the overall index are availability, relevance, and readiness.

- Affordability index measures the price of Internet access, as well as the concentration of the marketplace for Internet service provision.

- Availability looks at the connected population, quality of connection, network availability, and the basic infrastructure to support Internet connectivity.

- The relevance index category assesses the availability of Internet content in local languages.

- Readiness, on the other hand, measures the population’s level of education, Internet safety and cultural acceptance, as well as national strategies designed to promote the safe and widespread use of the Internet.

During a presentation at the Lagos Business School, MainOne CEO, Funke Opeke listed the advantages of broadband for businesses to include increased reach, enhanced marketing, and leveraging the cloud to manage technology and deployment cost, among others.

The cost of broadband is still a thorn in the flesh for individuals and business owners that rely on the Internet for their day-to-day activities. Hence, the need to identify key barriers to affordable access while also devising tailored strategies to drive down the price of broadband.

What do you think? How close is Nigeria to having affordable and fast Internet access?

Photo Credit: melita_dennett Flickr via Compfight cc