Back in 2016, I needed to dispose of my smartphone to take care of an emergency, so I posted it on OLX and in less than 32 hours, I had sold it to a contact gotten from the classifieds site. This is the typical way an average Nigerian uses classifieds sites for transactions.

Though the landscape of selling used personal items in Nigeria has surely recorded some changes over the years, we still put the word out so our friends tell their friends about an item that’s up for sell.

The Nigerian Internet space has both welcomed and bid farewell to a handful of classified sites, which successfully bridge the gap between sellers and buyers. However, it appears these sites are getting the short end of the stick.

Naspers recently revealed a move to shutdown OLX’s office in Nigeria by March 2018 with a promise that the online marketplace will continue to run. Efritin made a similar promise when it was shutting down its Lagos office, but the site was eventually pulled down alongside its app on Google Play Store.

We must not forget that the parent company of OLX Nigeria, Naspers, acquired competitor TradeStable back in 2015 and redirected its traffic to OLX. What went wrong?

Despite coming in with a different approach to the market, Efritin joined the party late and still left early, blaming its exit on poor Internet penetration, and challenging economic conditions of the country, among others.

Aside the single-niche classifieds like ToLet, Cheki, and the likes, 2 popular general classifieds sites in Nigeria at the moment are Jiji and Rocket Internet’s classifieds site which now runs as the deals arm of Jumia. In addition to Efritin, other defunct classifieds include Mobofree and Andy (now an entertainment portal).

The value

Working on a consumer to consumer (C2C) business model, classifieds websites are just media with both sellers and buyers as the consumers, with no role in payment or product delivery.

One clear value that classifieds give is the facilitation of connections between the buyers and the sellers, and in most cases merchants, who seek refuge in classifieds sites since they can choose not to pay to use the platform to sell their products or services, unlike when they use eCommerce stores.

OLX Nigeria had in 2016 launched the Do It For Me (DIFM) service which has ‘OLX champs’ handle the buying/selling activities of anyone who subscribes for the service. In case you don’t know about OLX champs, the champs take care of the selling process from ad upload to promoting the ad, to finding a buyer, and to the point of meeting a potential buyer to initiate a sale.

For the buyer that engages the service of DIFM, the OLX champ helps you get the best value for your money by making a purchase on your behalf. The DIFM only comes at a cost to the person engaging the service.

Efritin entered the Nigerian market with a verification process which was carried out at no extra cost to the seller. Come to think of it, the verification exercise appeared to help the platform to stand out, but Efritin eventually pulled the plug.

The verification exercise was cool but there was always the question of the sustainability of the model since neither the seller nor the buyer was paying for the process.

And there’s a big question I’d love to have answered — how are classifieds sites capturing the value, or is there really a plan to capture the value they are creating for themselves?

Classifieds sites in Nigeria run TV ads and campaigns for customer acquisition. About capturing the value from the acquisition, can we assume that monetisation model implementation is to come after getting a healthy user base?

Nonetheless, I can state the obvious. If we are not going to pay to use a platform at the initial stage, we are probably not going to pay to use it in the future — we will just find an alternative.

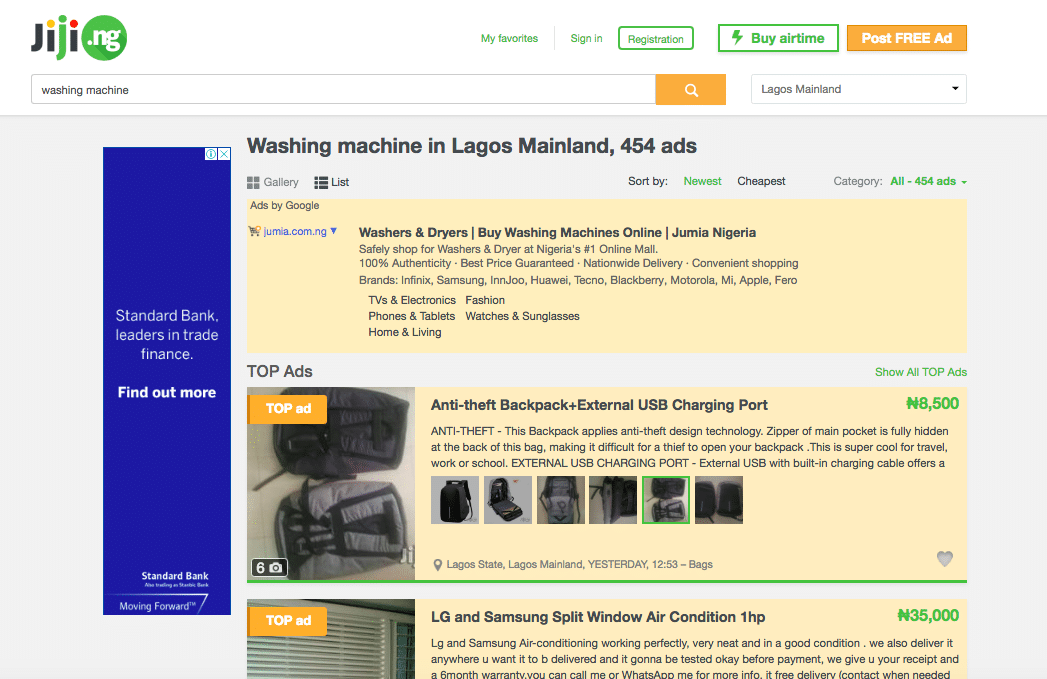

During the course of putting this together, I checked out Jiji and did a search; I discovered that over 90% of every page of the search results were boosted ads. I wonder how this is working out for all parties concerned, especially the buyers and the sellers who can’t afford to boost their postings.

Where is the money?

Seventy-six million Nigerians online as at 2017 is a huge figure. However, a given market is not only about the population of potential customers but also about other non-human factors that determine the bankability of the market.

Suggested Read: Why we should not glorify Nigeria’s internet penetration figures

Past and present players in classifieds in Nigeria have had similar revenue models which include promoted postings, display ads, and getting commissions when buyers or sellers use their in-house agents.

The online classifieds business is the best business idea to start earning money, but it is clear that this is only applicable to the buying and the selling parties alone. Is classified a business for Nigeria then?

Craigslist, which is probably the biggest global player in classifieds serving 570 cities in 70 countries, charges to post jobs and apartment rentals on its platform in some cities.

For Craigslist, which is yet to make a profit in its over two decades of existing, profit-making is not a central goal for the company and revenues from job listings are just to cover operating costs.

Nigeria already has a fair share of popular classifieds exiting the country, but single-niche classifieds in Nigeria seem to be getting it right. Should the advice then be — don’t do ‘general-merchant’ classified sites?

If classifieds sites in Nigeria should go the way of Tolet’s commission-based model for successful deals, then the competition is limited to the classified players as eCommerce is not into used products.

May the market be in your favour if you are looking at entering the online classifieds space in Nigeria.