Accessing personal loans has taken a different dimension with a couple of service providers giving out collateral-free loans without the need a proof of employment or even a visit to a banking hall for some paperwork.

The repayment period for these ranges from 14 days to 6 months, depending on the providers. The maximum amount one can access initially is dependent on the provided information, and requested funds are transferred almost immediately.

Below are some of the providers of such personal loans in no particular other.

Carbon (previously Paylater)

- Requirements: Valid bank details and BVN

- Platform: Android, iOS

- Interest rate: 5% to 30%, depending on credit rating

- Loan tenure: 15 days to 6 months

- Multiple loans at a time: No

- Repayment channels: Debit Card, Quickteller and direct transfer

To access personal loans from Carbon, all you need is an Android or an iPhone device, an Internet connection, and valid bank details. Carbon gives users that repay on-time access to a higher credit limit. Users also get a refund of part of the interest charged when loan is repaid before due date. There is a validation charge of ₦100 on the initial loan.

Migo (previously KwikCash)

- Requirements: A mobile number and valid bank details

- Platform: USSD (*561#), web

- Interest rate: 15 – 25%

- Loan tenure: 14 – 30 days

- Multiple loans at a time: No

- Repayment channels: ATM, debit card, USSD and direct transfer/deposit

The entire process of borrowing starts and ends with *561#, from any Nigerian network.

You can access up to ₦100, 000 and you get the loan within 3 minutes. In case you are wondering what happens when you port to another network, you can choose to pay using any of the available payment channels.

Aella Credit

- Requirements: Valid bank details, BVN and employer registration (for in-network loans)

- Platform: Android, iOS

- Interest rate: 20% – 27% for out of network loan

- Loan tenure: One month

- Multiple loans at a time: No

- Repayment channel(s): Debit card

Aella Credit has two options: in-network — for users whose company is registered on the platform — and out-of-network, which caters to people whose company is not registered. The in-network option promises higher loan amounts at lower interest rates.

Part of the information requested on registration includes details of your next of kin, and there’s a processing fee of ₦30.

SnapCredit

- Requirements: Employer registration, valid bank details

- Platform: Web

- Interest rate: Function of the amount of loan and its tenure.

- Loan tenure: 1 to 12 months

- Multiple loans at a time: Yes

- Repayment channel: Monthly loan repayments are deducted from salary

SnapCredit serves as a medium for employers who do not want to give direct loans to their employees, by providing employees with instant access to money with no paperwork.

One outstanding feature of SnapCredit is that it allows you take another loan even with a running loan. However, you can’t borrow beyond your credit limit.

KiaKia

- Requirements: Work ID card, valid bank details

- Platform: Web

- Interest rate: 5.6% – 24%

- Loan tenure: 7 to 30 days

- Multiple loans at a time: No

- Repayment channel: Debit card, direct deposit

KiaKia makes use of a chatbot that takes you through the process of registration and other activities towards getting your personal loans. You must have a work identity card before you can access a loan on Kiakia. You can also choose to register as a lender.

FINT

- Requirements: Valid bank details, valid ID card, and bank statements

- Platform: Web

- Interest rate: 9% – 39%

- Loan tenure: 2 – 12 months

- Multiple loans at a time: No

- Repayment channel: Debit card, direct deposit

FINT is more of a marketplace that matches lenders with creditworthy borrowers. The minimum amount of personal loans given out is ₦60,000 and the interest rate is based on borrower’s risk score.

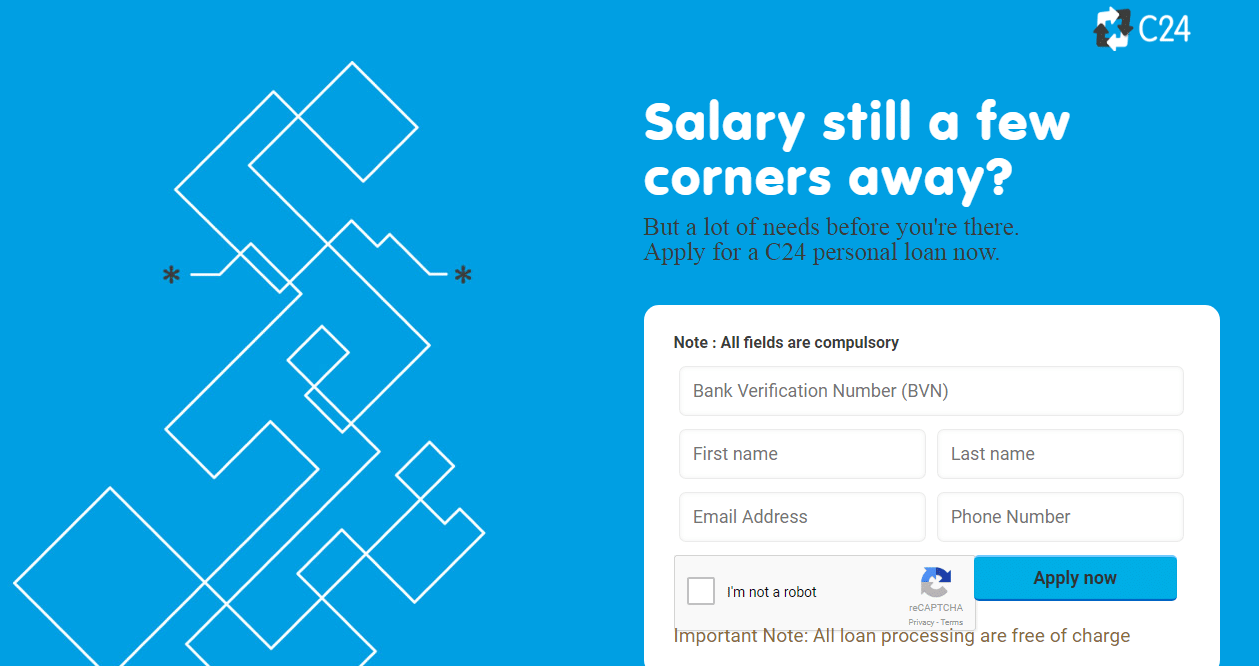

C24

- Requirements: Physical documents, valid bank details

- Platform: Web

- Interest rate: 4% and above

- Loan tenure: 1 to 9 months

- Multiple loans at a time: No

- Repayment channel: Debit card, direct deposit

C24 offers collateral-free personal loans but application requires you submitting some documents at their office or having them pick it up from yours. Documents required include means of national identity, proof of employment, direct debit mandate, post-dated cheques, bank statement and a passport photograph.

Zedvance

- Requirements: Valid bank details

- Platform: Web, Android

- Interest rate: 7.5% to 58%

- Loan Tenure: 1 to 12 months

- Multiple loans at a time: No

- Repayment channel: Cheques, direct debit/deposit

Zedvance offers both nano and salary loans. The nano loan doesn’t require much documentation while the salary loan requires proof of employment, means of identification and utility bill.

Loan tenure can be up to 18 months for the salary account.

Branch

- Requirements: A Facebook Account, BVN and valid bank details

- Platform: Android

- Interest rate: 20%

- Loan tenure: One month

- Multiple loans at a time: No

- Repayment channels: Debit card, auto-debit, mobile banking app.

Branch makes use of some information on your phone to make lending decisions. This includes handset details, SMS logs, call logs and contact list. Loans on Branch are repaid in four weekly installments.

Sharp Sharp by Credit Direct

- Requirements: No guarantor, physical documents, personal bank details

- Platform: Web

- Interest rate: 3.4% monthly

- Loan tenure: One month and beyond

- Multiple loans at a time: No

- Repayment channel: Direct debit

Sharp Sharp provides personal loans to both salary earners and entrepreneurs. Loan tenure can be up to 12 months. It also offers loans to young salaried employees in the private sector as well as those on their national youth service year.

QuickCheck

- Requirements: Facebook account, valid and active phone number, bank details and source of income

- Platform: Android

- Interest Rate: 1% daily

- Loan tenure: 5 to 30 days

- Multiple loans at a time: No

- Repayment channel: Debit Card, Direct Deposit

Applying for a loan on QuickCheck require that you have a source of income, even selecting employment status options like student, unemployed or retired as your employment status. And aside accessing loan, phone airtime can also be purchased using the app.

PayConnect

- Requirements: Government approved ID card, staff ID and salary account with a commercial bank in Nigeria

- Platform: Android

- Interest Rate: 28% – 31%

- Loan tenure: One month

- Multiple loans at a time: No

- Repayment channel: Direct Debit

To access loan from PayConnect, you have to be a employee of a vetted organisation with which you must have been working with for not less than 6 months. You need to present 3 months statement of account and you will also need the approval of your employer to access the loan.

FairMoney

- Requirements: Facebook account, bank details and proof of employment

- Platform: Android

- Interest rate: 20-30%

- Loan Tenure: one month

- Multiple loan at a time: No

- Repayment channel: Direct debit

To access loan facility on FairMoney, you have to upload a selfie showing you holding an ID card. Other requirements include letter of employment or company details for self-employed. There’s a ₦50 charge to verify the debit card associated with linked account. You also give details of your next of kin.

Sokoloan

- Requirements: BVN, bank details, and a valid means of identification.

- Platform: Android

- Interest rate: 4.5% – 34%

- Loan Tenure: 2 to 6 months

- Multiple loans at a time: No

- Repayment channel: Direct debit

To access loan facility on Sokoloan, you must be over 20, live in Lagos, and you need to provide your cell phone number, BVN and bank details. Sokoloan states that customers can apply for loans ranging from ₦5000 – ₦100,000 but first-time borrowers will likely start closer to the lesser amount.

Page Financials

- Requirements: BVN, bank details, proof of employment in Lagos or Ibadan

- Platform: Android, iOS, Web

- Interest rate: 2.99 – 5% monthly

- Loan Tenure: 1 to 12 months

- Multiple loans at a time: No

- Repayment channel: Direct Debit, Remita, NUBAN cheques, online payments

To access loan facility on Page financials, you have to be in full-time employment in Lagos or Ibadan, but all bankers nationwide are eligible to secure this loan. To get a loan on the platform as an employee, your employer must be verified on the Page Financials’ database or request that your employer be verified and added on their database.

While first-time customers cant get less than 2.5% interest rest, returning customers can get less.

OKash

- Requirements: BVN, bank details, Valid ID card,

- Platform: Android

- Interest rate: 25%

- Loan Tenure: 2 to 12 months

- Multiple loans at a time: No

- Repayment channel: Direct debit

To access the loan facility on OKash, all that your BVN, bank details and Valid ID is required. The loans typically range from ₦3000 – ₦50,000 and repayment tenures which were previously as low as 15 days are now a minimum of 6 months

Quick Credit (Guaranty Trust Bank)

- Requirements: BVN, a Guaranty Trust Bank (GTBank) Account

- Platform: Web, GTBank online and mobile banking platforms: GTWorld, GTBank Mobile App and Habari App

- Interest rate: 1.33% monthly

- Loan Tenure: 6 to 12 months

- Multiple loans at a time: No

- Repayment channel: Direct debit

To access GTbank’s Quickcredit loan facility, you must have an account with GTBank and must have a regular income. Users can access loans from ₦10,000 – ₦5 million with a repayment period of six months to one year.

QuickBucks (Access Bank)

- Requirements: BVN, bank details

- Platforms: Android, iOS

- Interest rate: 4% (reducing balance method)

- Loan Tenure: 1 to 12 months

- Multiple loans at a time: Yes

- Repayment channel: Direct debit

Aside from the 4% monthly interest rate, there’s a 1% and 0.15% for management fee and credit life insurance respectively which are deducted immediately a loan is disbursed.

The QuickBucks Payday loan is accessible to any salary earner. Beyond the payday loan of one month tenure, one can also access salary advance of three months tenure, small ticket personal loan of 6 months, device financing loan of 12 months tenure, among others.

Palmcredit

- Requirements: BVN, bank details, phone numbers

- Platform: Android

- Interest rate: 4% – 4.7% per month

- Loan Tenure: 3 to 6 months

- Multiple loans at a time: No

- Repayment channel: Direct debit

Palm Credit’s loan facility can be accessed by anyone who is 18 years and above. The maximum amount that the platform can offer is ₦100,000.

Specta

- Requirements: BVN, bank details, and a valid means of identification.

- Platform: Android, iOS and Web

- Interest rate: 25.5% – 28.5%

- Loan Tenor: up to 12 months

- Multiple loans at a time: No

- Repayment channel: Direct debit

Specta is a product of Sterling Bank. Except for SpectaBasic, which requires applicants to have a Sterling Bank account, all Specta packages are accessible to people who don’t own an account with the bank.

Specta loans are available to salary and non-salary earners. Aside from the interest rate, loans on Specta attract a 1% management fee and a 2.5% insurance fee. Failure to repay a loan as and when due attracts a monthly fee of 1%.