Last month, we were curious about which apps are the most popular among Nigerian internet users. So we created polls on Facebook, Instagram and Twitter asking which apps our followers open first thing in the morning.

#TPpoll: What app do you open first thing in the morning?

Kindly vote and RT.Reply with your answer if it isn’t one of the options.

— Techpoint Africa (@TechpointAfrica) July 25, 2017

By the end, the usual suspects — WhatsApp, Twitter and Facebook — took the lead. It is interesting that even as interwoven as they are into our daily lives, we neglected to include banking apps in the poll. Perhaps because we were constrained by the Twitter’s 4-option limit and a need for the poll to be equal across board. Or maybe because by their very utilitarian nature, we assume that banking apps don’t count on the popularity scale.

So when exactly a week ago, I was invited to the launch of a new UnionMobile app, I went expecting the usual. On the contrary, I came away quite surprised. Carlos Wanderley, Head of Retail Banking, told us how, for the past two years, Union Bank has run focus groups across the nation to better understand what customers really want.

The result is an updated app that is trying to be many things asides a regular mobile bank that lets you send and receive money, check balance, recharge, etc. The new UnionMobile also wants to be:

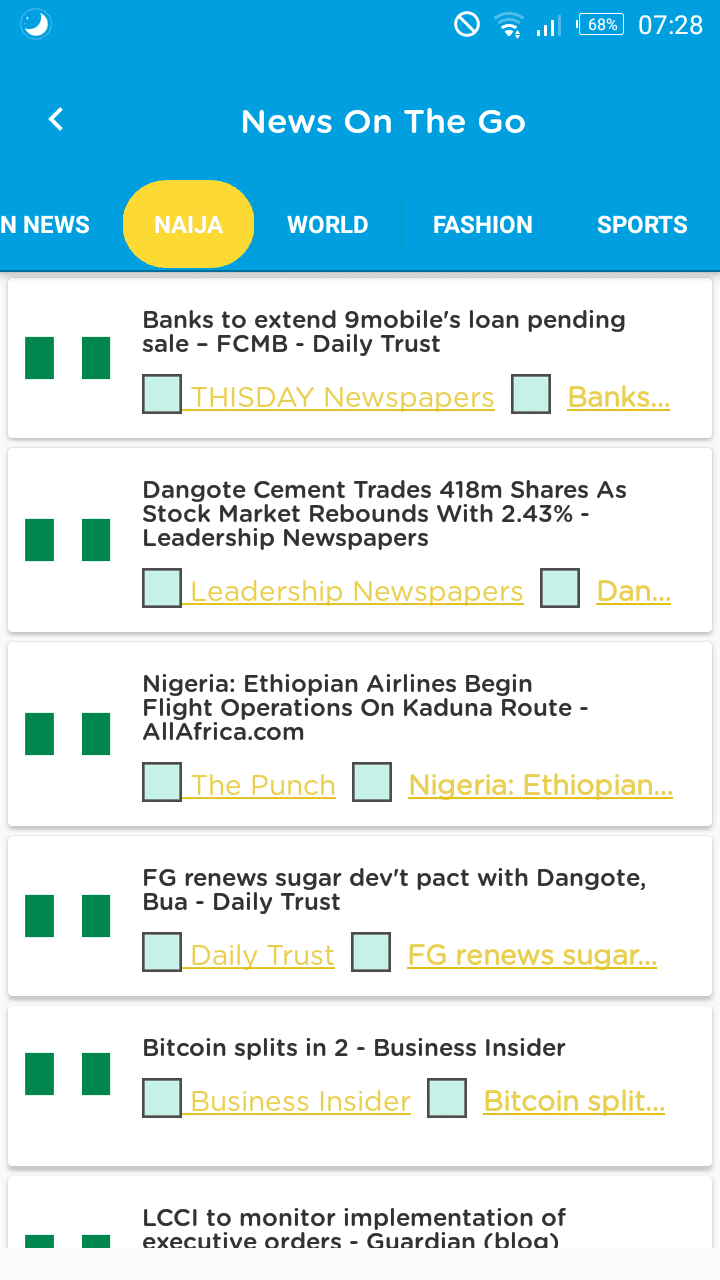

A news app

A weather forecaster

A deals an coupons platform

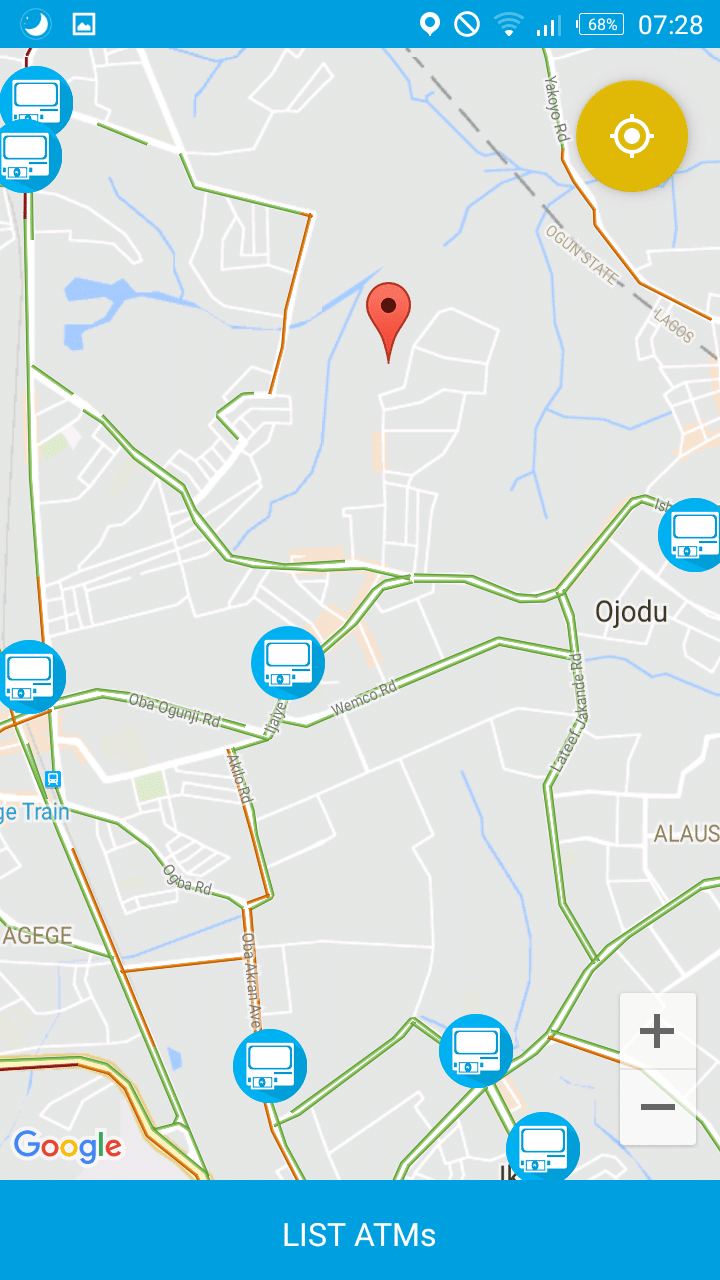

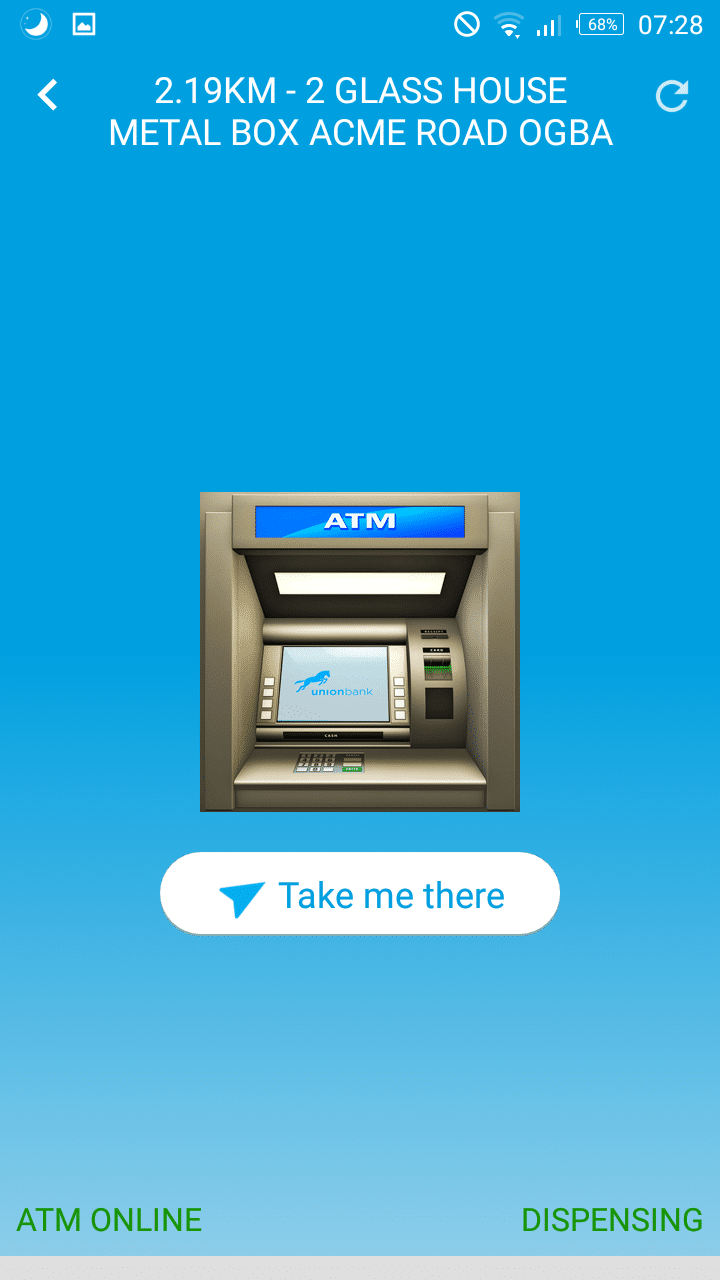

And an ATM locator

It can even tell you which ATMs are online and dispensing cash

All the above features are open even to non-Union Bank customers, as they do not require any login. Quite an interesting approach to banking customer acquisition.

There’s also a *826# (get it? 8am to 6pm, during which most of your daily hustle is done ) USSD code that replicates most of the functionality on the app.

But what I find really interesting is the ‘Locate An Agent’ feature, which is essentially an Uber for Banking, of sorts.

Locate An Agent

Targeted primarily at SMEs (especially shop owners), Locate An Agent enables anyone, well, locate an agent within a 5km radius to help them withdraw and deposit money or open a bank account (for non-customers) without leaving the comfort of their locality. The feature is supposedly available nationwide.

I was a bit curious as to the sustainability of this approach is, especially from a logistical and security standpoint. According to Folorunsho Orimoloye, Head of Alternate Channels at Union Bank, there are currently over 700 agents serving the whole of Nigeria.

As for security (of funds), there is a ₦25,000 threshold on cash deposits via Locate An Agent and all agents are equipped with apps that enable them fund your account immediately. What happens to your cash after that is Union Bank’s risk to bear.

Can Union Bank pull this off efficiently? That’s left to be seen. I am yet to try out the service for myself — a bulk of my experience is limited to the demo I played around with during the event — but I have since downloaded the app. I plan to test out the ATM locator and probably try using Locate An Agent to open a Union Bank account and, if I’m feeling up to it, I might publish a review.

Meanwhile, if you want to give it a shot at being the first app you open every morning, UnionMobile is available for download on Android and iOS.