Anyone seeking for a loan to finance a project will probably have the bank as one of the go-to places. This is because facilitating loans is well within the primary duties of any bank. If everything goes according to plan, the bank even stands to reap interest on such a loan.

Meanwhile, in Nigeria, where things hardly go according to plan, one’s effort to secure a loan from the bank may likely not yield a positive result.

In a blog post last week, Jason Njoku narrated his unfortunate experience with a popular Nigerian bank. Despite operating Iroko’s account with the said bank, it was not enough to secure him a much-needed housing loan. Reacting to this, Jason decided to clear 99% of Iroko’s money from the bank before closing the account.

Given Iroko’s recurrent transaction volume both within Nigeria and from the diaspora, it is evident that the bank had lost a credible customer.

Underlying this event, however, are the major loopholes inherent in our credit system. Asides landed property collaterals, many Nigerian banks do not have a system for sizing up the creditworthiness of a loan recipient. Suffice to say, they even overlook some key variables that should form part of the evaluation process for giving out a loan. Consequently, most Nigerian banks seem to lend on what the “bankers” think is right and not based on empirical data.

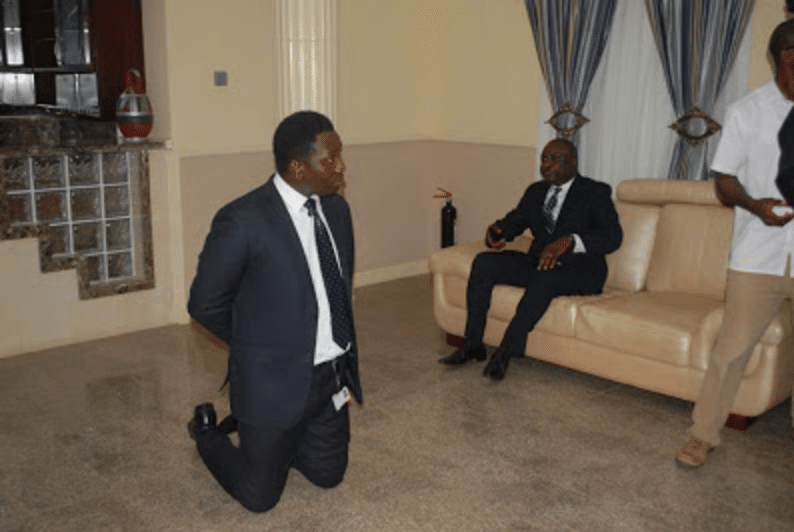

Last year, the media aide of Governor Ayo Fayose circulated a picture of a Zenith bank staff kneeling before the Ekiti State Governor. Asides painting an ugly image of the value system in our banking sector, the picture in the context also spoke of a class divide — where a few elites have unhindered access to social amenities (including loan facilities) while the masses are accorded no such regard.

This couldn’t have been a better call to build trust in our credit system as more people keep losing trust. To build a proper credit system, the banking sector needs to accord a level of importance to data. With available data, for instance, the Nigerian banking sector can easily access risk level, calculate interest rate and generally, make an informed decision. This applies both in the cases of a personal or business loan.

It is not enough to say that owning a business should automatically guarantee a smooth sail with a loan application but, the lack of data — for informed decision-making — is a disservice to the overall objective of building a credible banking system.

It’s hard to really explain how the World Bank’s Doing Business index for 2017 managed to rank Nigeria in the 44th place when the loan application process remains fraught with many bottleneck procedures. For instance, most startups in Nigeria primarily fail because they do not have access to funding. Perhaps if the emphasis wasn’t on irrational judgment, more startups would get funded by Nigerian banks — or secure a loan the very least.

The truth is, as it stands, it is a lot easier to for a camel to pass through a needle eye than it is to secure loans from a Nigerian bank to fund your startup — and this cannot improve without recourse to data.