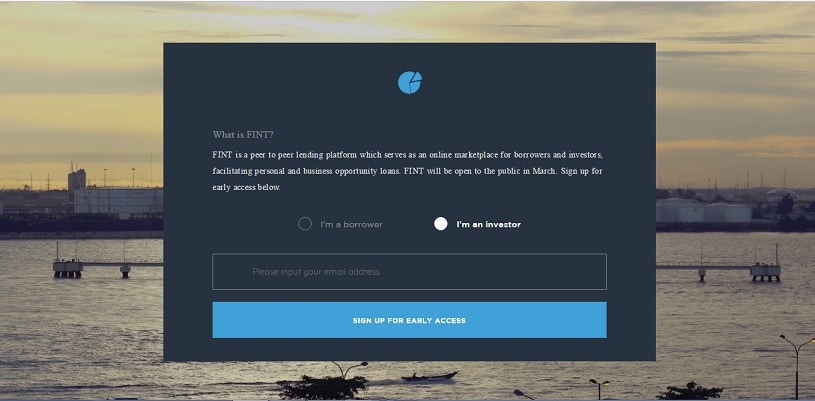

The brainchild of Chiwete John-Njokanma, FINT is a peer-to-peer lending marketplace that provides business owners with access to affordable credit. FINT connects borrowers to investors who are looking to make attractive returns from investing in such loans.

How it works

Upon visiting the site, users can indicate whether they are in need of finance or want to invest. Those who want to borrow are screened through a national credit agency, xds Credit Bureau, and an in-house proprietary risk algorithm that determine the borrower’s credit-worthiness and interest rate (believed to be in the range of 24% -37%) respectively.

Once accepted, the borrower’s loan request is uploaded on the online platform to reach full funding in a given time period, whereby one or more investors(individual or institutions) invest, based on their portfolio demands and investment criteria. Investors earn returns from monthly loan repayments (principal + interest) made by the borrower over the span of the specified loan period.

Thoughts

With only a small percentage of the Nigerian population having access to personal loans, it is no news that the Nigerian perception of credit availability is deplorable.

Following its mandate to provide borrowers with the opportunity to apply for loans of ₦60,000 to ₦2 million (for periods of 6, 12, 18 and 24 months), FINT’s effort is laudable.

The only concern here may just border on the issue of trust with convincing investors to put their money on the platform. Despite this challenge, FINT is aiming to facilitate $100 million in loans to allow Africans pay for basic needs like healthcare, shelter, education etc by 2025.

To get started with FINT, you are just a click away from the website.

Photo Credit: majjed2008 Flickr via Compfight cc

Discover new startups every weekday by 9am (WAT) | Pitch your startup here.