A few years ago, the number of banks that existed in Nigeria were too few to warrant any inquisition as to who were under-served. But today, we’ve seen both government and private sector players making laudable moves to promote what has now come to be widely known as financial inclusion.

The benefits of financial inclusion are not only significant for individuals but for economies as well, as it is linked to a country’s social and economic development.

A 2016 report by Ericsson revealed that 53% of Nigeria’s population is in the banking system. Typically, what this means is that 4 out of every 10 Nigerians don’t own a bank account and therefore lack access to financial services that they need to improve their lives.

Nigeria is however not in isolation as an estimated 2 billion adults globally do not have a basic account, according to the world bank. That means at least 70% of the world’s population is financially excluded.

The challenges to financial inclusion are many, but chief among is the apparent difficulty of connecting rural areas to cheap and affordable banking services. While some rural dwellers believe that they do not have enough savings to open a bank account, or do not wish to incur potential associated banking fees (including the cost of transportation), other basically cite flimsy excuses — such as the risk of being robbed while moving money to the bank — in defense for not owning a bank account.

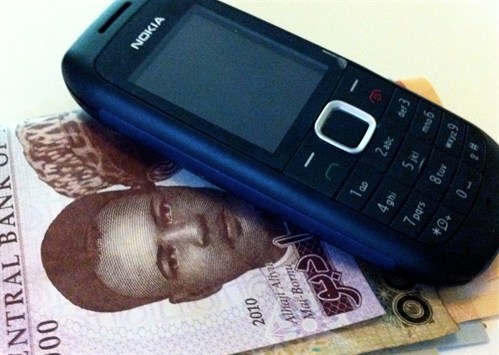

The Biometric Verification Number (BVN) enrolment report obtained from NIBSS revealed that there are about 86.5 million Nigerians with bank accounts. While that is encouraging, statistics from the Nigerian Communication Commission (NCC) leave plenty to actually worry about; as it shows that there are over 148 million mobile phone subscribers. Technically, about 60 to about 90 million Nigerians with mobile phones don’t have bank accounts and also do not have access to financial services.

So, as part of efforts to achieve the National Financial inclusion Strategy goal, the CBN in 2011 licensed 21 companies (comprising of 15 non-bank operators and 6 bank operators) to offer mobile payment services. Following this, the CBN introduced agency banking, which allows banks and mobile payment operators (MPOs) to render services through third parties in various locations.

But these measures are yet to produce the desired results in terms of massive attraction of the unbanked population into the financial sector.

Technically, financial services inclusion in Nigeria has come of age. And with the youth constituting a large part of the demography to benefit from such services, the only option to explore in terms of engendering interest is by making it digital.

Mobile services are seen as viable tools to provide basic financial services through mobile technology platform. Especially for the unbanked Nigerians in the rural areas, they help drive financial inclusion in the country.

While the Digital Financial Services (DFS) market is nascent in Nigeria, it is well-developed in other countries with large unbanked populations. Countries such as Cote d’Ivoire, Somalia, Tanzania, Uganda and Zimbabwe have more adults using mobile money accounts than traditional financial institutions.

It is said that about 60% of Africans live in the rural areas and DFS sure are an effective way to reach them cheaply. However, to get this running in Nigeria, a lot of capital is needed; especially from private sector players who are looking to be leading frontiers in the DFS market. In order to make any significant impact in the area of attracting the unbanked, mobile payment operators need to invest more.

The future is already taking shape and companies who will succeed are those who make the right changes to realign their business and ride the storm. We foresee a future where consumers will need banking services, but they may not turn to a bank to get them. This is without a doubt where things are headed, and players in Nigeria must begin to prepare and shape their business models in preparation for this reality.

Access to financial services can make a substantial positive difference in improving poor people’s lives to say the least. But we have to approach this with the 21st-century mindset.