Editor’s note: The original headline, which read “Nigeria almost a cashless economy with increased PoS usage at 62%” has been changed to reflect the actual interpretation of the statistics.

. . . .

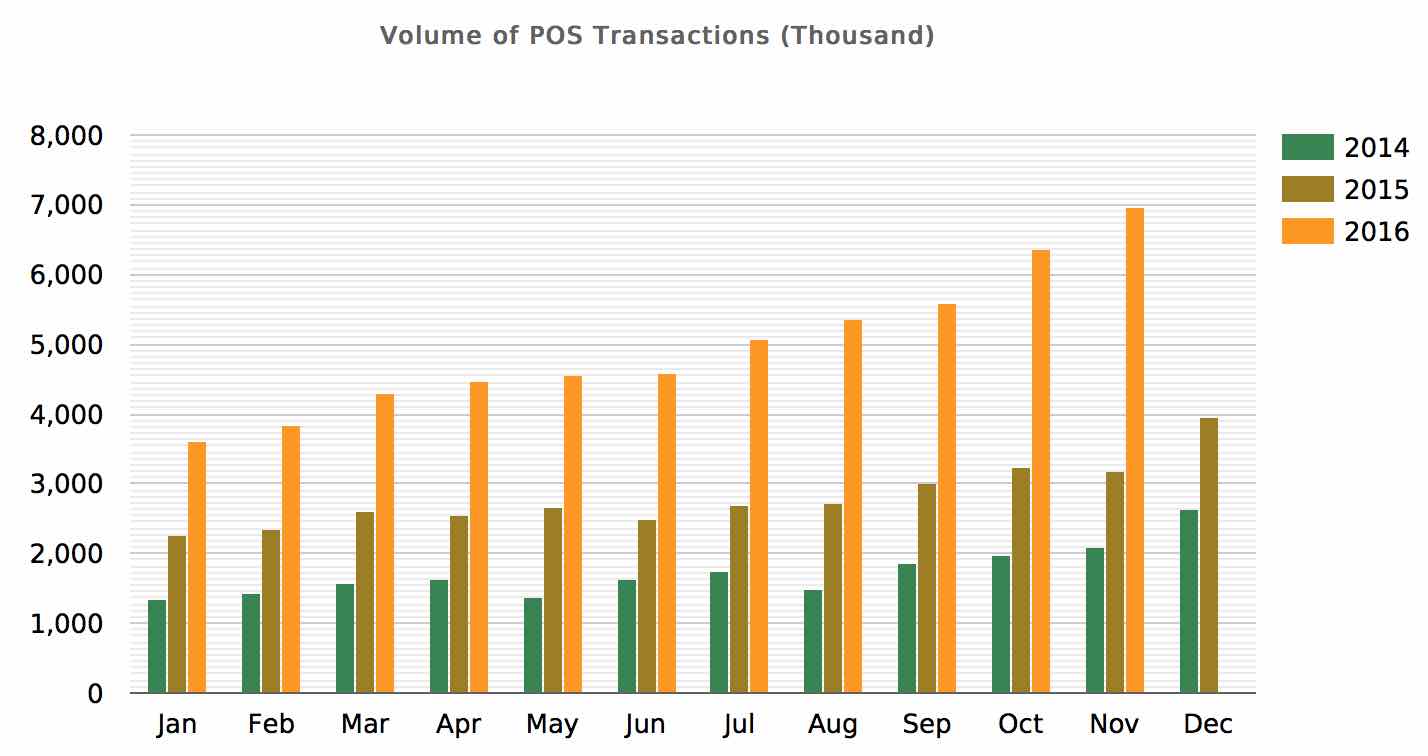

The year 2016 spotted another milestone in Point of Sale (PoS) usage in Nigeria. According to a report by Nigeria Inter-Bank Settlement System (NIBSS), PoS usage based on transactions increased by 62% in 2016 compared to 33,720.93 transactions carried out in 2015.

The data put together by NIBSS further reveals that a total of ₦651.38 billion worth of transactions were carried out via the PoS from January to November 2016. In retrospect, only ₦448.52 billion worth of transactions were carried out via the PoS in 2015.

The value of transactions carried out via the PoS has been on the rise since mid 2016. It was recorded in the NIBSS report that ₦55,292 billion worth of transactions were carried out in June, 2016 while ₦81.15 billion worth of transactions in November, 2016.

It can be presumed that last year’s festivities had a considerable impact on the transactions carried out in November, 2016 via the PoS. 6976.52 transactions worth ₦81.146 billion was recorded in the month of November, 2016 alone. The increase in PoS usage and the volume of transactions done monthly reveals progress in the area of Nigeria becoming a more cashless economy.

Following the Central Bank of Nigeria’s (CBN) decision to deregulate the Merchant Service Charge (MSC) on electronic transactions, the e-payment space is definitely going to see some changes this year.

“With the introduction of the Cash-Less Nigeria Project and the release of the Guidelines on PoS Card Acceptance Services, the CBN outlined the Merchant Service Charge (MSC) and the modalities for its operation in the payments system. This had enhanced the issuance and utilisation of cards transaction in the country and brought structure to the compensatory mechanism for parties involved in the transaction.” – Dipo Fatokun, Director, Banking and Payment System Department (BPSD), CBN.

The CBN in November, 2016 released the policy that regulates PoS usage in Nigeria. The fee paid by merchants for payments customers make to them through PoS has been reviewed and will be effective from May 1st, 2017. The policy is expected to resolve the limitations with the MSC regime and further help achieve the Payments System Vision 2020.

Image credit: Nigeria Inter-Bank Settlement System