Speaking at a press conference on the forthcoming Efficiency Award organised by NIBSS to reward and recognise outstanding stakeholders in the promotion of electronic payment. Ade Shonubi, Managing Director/Chief Executive Officer of the Nigeria Interbank Settlement System (NIBSS) said that, ‘the banks have spent over ₦400 million as incentives under electronic payment incentives scheme’. The electronic payment incentives scheme (EPIS) is an initiative of the Central Bank of Nigeria (CBN), Bankers Committee, and the banks in Nigeria to promote electronic payment in Nigeria.

For Nigerians that use their cards to pay for goods and services there has been series of activities to reward Point of Sale (PoS) usage in the last one year. One of the rewards gotten by PoS users is refund of some amount of money for using the PoS at the end of the month.

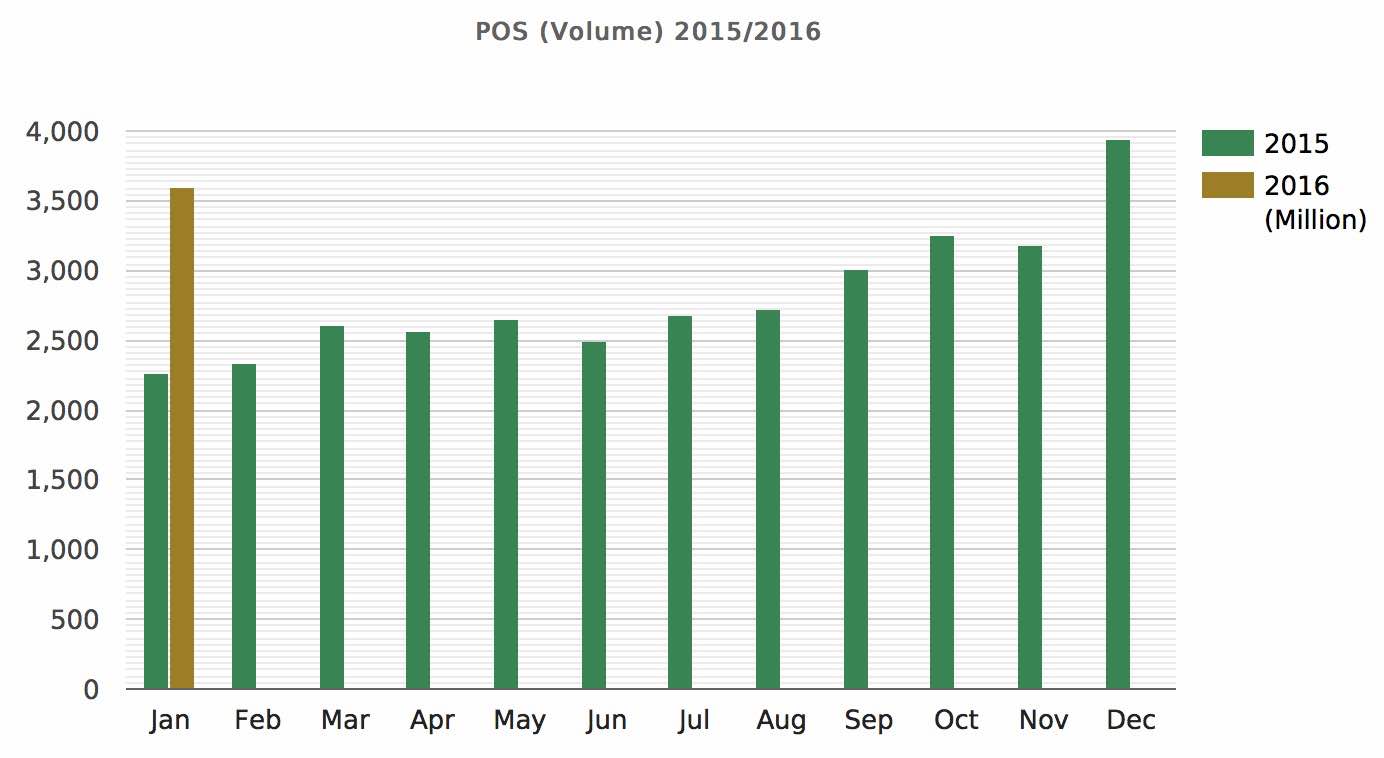

“In the month of December we had 18 million transactions on our platform. That is just for 1 month. On the average we do about 15 million transactions in a month. Before now it was much lower than that. So clearly the numbers are moving up.” – Ade Shonubi

Recently, we have inaugurated a loyalty scheme where you can collect points, so that as you use your card you get points and also those in the shops that are manning the devices, at the end of the month they can get some points to encourage them to push people to use their cards and other means of payments, Ade Shonubi explained.

“So when we talk about the adoption, when we look at the numbers, it has been going up in terms of transactions per month. So we feel part of what has helped is this incentives scheme and the awareness that goes with it.” – Ade Shonubi

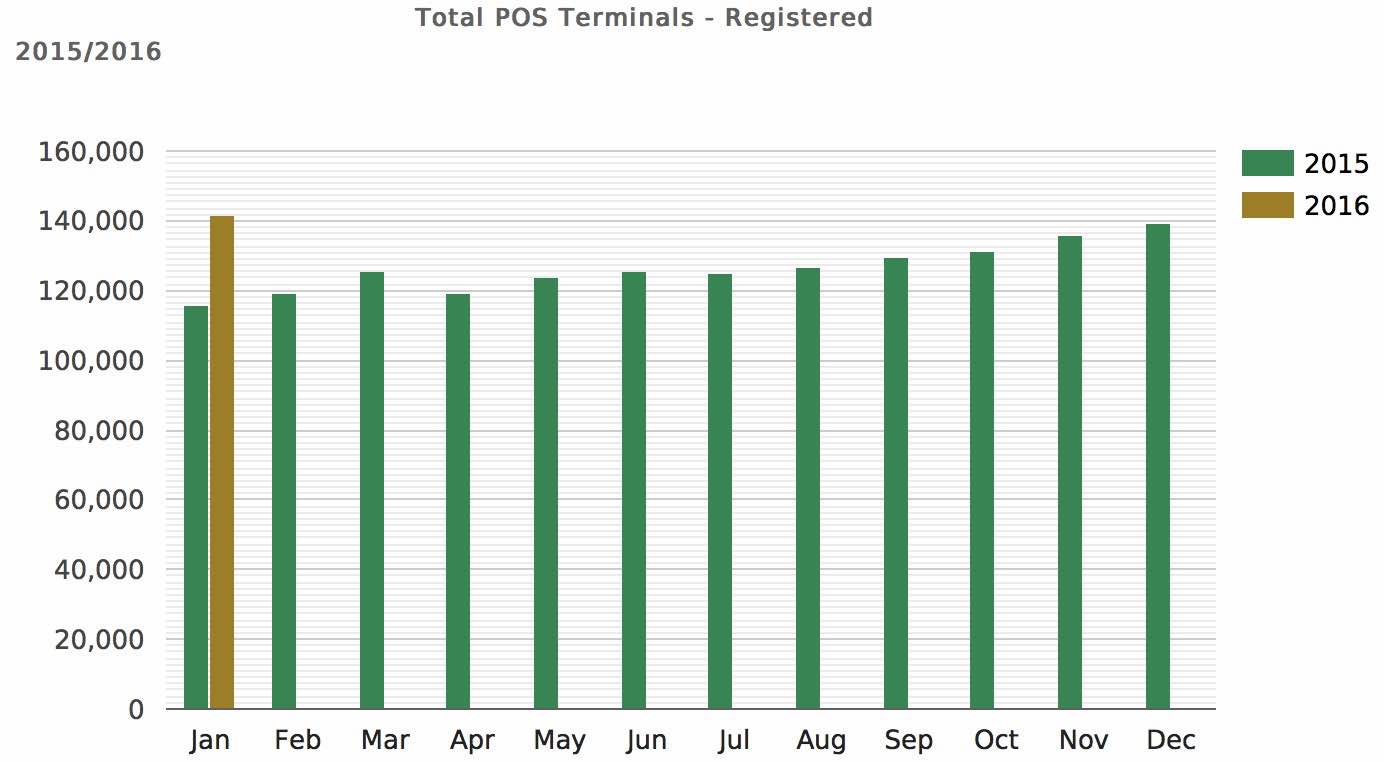

Ade further revealed that, “in terms of volume in January 2015, our instant payment platform was doing 4.2 million transactions per month, by December it was 8.3 million, almost double. PoS transactions was about 2.5 million in January 2015, it ended the year at 3.9 million.

The increase in PoS usage and the volume of transactions done monthly reveals progress but there are still challenges as regards PoS usage with respect to adoption. This week various financial institutions will be recognised, those who over the last 12 months, in 2015, have been active in the electronic payment space. The ceremony will take place on Thursday to recognise all financial institutions involved.