Explosive income from Trump-linked tokens has intensified debate over governance, incentives and optics. As uncertainty mounts, traders are tilting toward meme assets with clearer mechanics and visible delivery, with Maxi Doge emerging as a focal point.

Eric Trump’s fundraising swing through Dubai, Europe and Asia encapsulates how the Trump family’s crypto ventures turned narrative heat into hard cash. The pitch, relayed to prospective buyers on the sidelines of major conferences, asked for sizeable allocations into World Liberty Financial’s governance token, positioning it as an entry ticket to a future-facing finance platform.

What followed was an eye-watering influx: hundreds of millions of dollars attributed to token sales, a quantum leap over receipts from golf resorts and traditional licensing. Trump coin, the family-branded meme asset, added a further stream of income as trading volumes surged.

Yet the same factors that powered the boom now drive the unease. The governance rights attached to WLFI are limited compared with many peer-to-peer platforms, where token holders often share revenue or control substantive parameters. Token trading began only after a holder vote, then moved into a staged-liquidity regime that allowed early sellers to offload restricted slices.

Prices spiked, then slumped, landing at levels that left latecomers nursing losses. In parallel, Trump coin’s fee haul shone a light on a familiar meme-coin paradox: the earlier and more active the market, the more the issuer benefits, while outcomes for retail vary widely.

“Legal But Unethical”?

Ethics specialists describe the crux as an optics problem: the overlap between a presidency that shapes crypto policy and a family enterprise selling crypto exposure. There is no allegation of explicit quid pro quo in the sales conversations that have surfaced, and secondary-market trading does not directly enrich the issuer.

Still, the impression of proximity lingers, reinforced by branding that places the president in a founding pantheon (however footnoted), as well as by the identities and legal histories of several large buyers. Even supporters concede that, absent the Trump name, the speed and scale of fundraising would likely have been different.

That context has practical consequences. As scrutiny increases, sophisticated capital tends to demand tighter disclosures, firmer protections for token holders, and delivery timelines linked to working products rather than to personalities. Where those elements are hard to parse, the market re-prices risk quickly.

From Governance Ambiguity To Simpler Meme Mechanics

The rotation that followed is not a flight from volatility – meme markets remain volatile by design, but a tilt toward projects where the investment case can be stated plainly and verified on-chain. Traders who once chased governance narratives are increasingly favouring meme tokens with capped supply, transparent staking maths, observable liquidity plans and a public cadence of listings and feature releases. In this frame, “safer” does not mean safe; it means fewer off-chain promises and fewer moving parts.

That is where Maxi Doge enters the picture. Framed deliberately as a meme with rules, the project pairs familiar Doge-adjacent branding with a presale that sets price steps in advance, a known total supply of 150 billion tokens and a schedule for initial liquidity via Uniswap before seeking additional exchange venues.

A dedicated MAXI Fund, carved out of supply, is earmarked for partnerships and listings – mundane, costly work that often decides whether a debut sticks.

What The Market Seems To Like About Maxi Doge

The Maxi Doge proposition leans on three pillars. First, a community engine: weekly trading competitions, AMAs and content drives designed to nudge on-chain activity at predictable intervals rather than relying solely on viral luck.

Second, staking with yields that compress as participation grows – expected behaviour that makes the maths legible to retail and desks alike. Third, clear supply and distribution logic, including vesting and treasury controls that professionals can model to unlock risk.

Crucially, the team’s roadmap emphasises execution milestones within its control – liquidity provisioning, audits, cross-chain wrappers – over lofty external dependencies. Cross-chain ambitions and NFT tie-ins are part of the plan, but they are framed as extensions, not prerequisites, which lowers headline risk if timelines slip. For traders rotating out of Trump coin exposure and governance tokens, that narrower scope is the appeal: there is less to interpret and more to verify.

The Limits Of The “Safer Meme” Thesis

Calling Maxi Doge “safer” only makes sense relative to the current governance-token debate. The project still carries the classic small-cap hazards: concentrated early holdings, sensitivity to listing delays, the possibility that social momentum fades and the structural risk that staking APYs compress faster than newcomers expect. Even with audits and bug bounties, smart-contract risk never falls to zero, and macro shifts can drain meme liquidity in a single session.

That said, the thesis behind the rotation is consistent: if the token rules are fixed, the unlocks are public, the initial pools are funded, and the delivery beats are hit on time, then execution rather than controversy will drive price discovery. For market participants who prize control over variables, that is a trade worth considering – even if outcomes remain uncertain.

How We Got Here: Liquidity, Optics And A Changing Narrative

Trump coin and WLFI’s revenue outperformance created a gravity well that drew in cross-border buyers and headline attention. When prices of governance tokens whipsawed post-listing and when questions about rights, unlock, and entailments multiplied, part of the market rebalanced toward assets with cleaner stories.

This does not mean the Trump coin disappears from watchlists; high-beta traders will continue to trade it around catalysts. It does mean that, for a growing cohort, the premium now attaches to simplicity.

In practical terms, desks watching the Maxi Doge rollout are tracking a handful of signals: depth on the first MAXI/ETH pool; early holder distribution across wallets; day-one slippage for typical retail trade sizes, staking participation as a share of circulating supply and the cadence of centralised exchange confirmations. They are also watching how the team communicates missteps – because bad news handled transparently is, paradoxically, a trust signal in meme-land.

What Could Derail The Rotation

Several factors could interrupt the flow into “simpler” memes. A major enforcement action that shifts the rules of the road for presales would raise operational costs and slow listings across the board. A sharp macro shock that drives liquidity back into Bitcoin and top-layer blue chips would starve smaller pools and widen slippage, hurting price discovery and, not least, a genuinely compelling delivery from World Liberty – shipping a useful, revenue-sharing product that materially improves token holder economics – could unwind the governance discount and pull capital back.

Until then, the path of least resistance favours tokens whose value proposition is demonstrably on-chain. The market appears willing to pay for clarity.

Risk Hasn’t Vanished, It’s Been Repriced

The Trump family’s crypto ventures have generated a substantial windfall and an equally substantial backlash, centred on optics, governance design, and fairness. That mix has prompted part of the market to prioritise transparency and execution over access and association.

Maxi Doge benefits from that repricing because it is built to be read at a glance: capped supply, visible staking, a roadmap anchored in deliverables and a community machine that operates on schedule rather than on scandal.

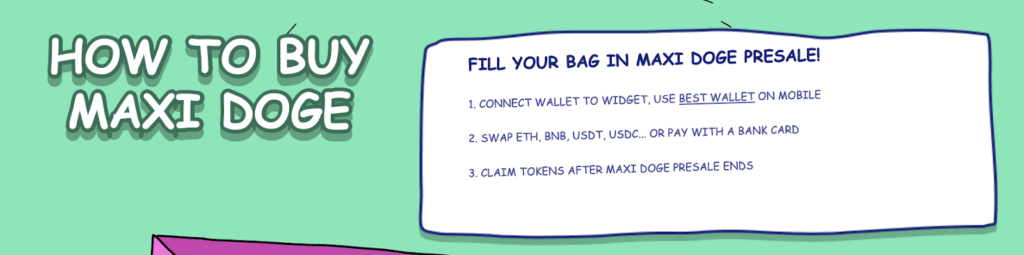

INVEST IN $MAXI BEFORE THE PRICE INCREASES

None of this guarantees success, but in a week when Trump coin discourse turned into a referendum on conflicts and concentration, a rules-first meme with measurable progress looks, to many, like the lower-drama allocation.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Cryptocurrency assets are highly volatile and speculative. Always conduct your own research and never invest more than you can afford to lose.