A veteran investor who bet on BTC at $65 now thinks the asset can double within a year. Meanwhile, a new Layer-2, Bitcoin Hyper, is courting early capital with a plan to make Bitcoin programmable at scale. The question for the rest of 2025 is whether a sturdier Bitcoin plus fresh utility can push Bitcoin dominance decisively higher.

A decade on from “you’re crazy”: the cycle case for higher Bitcoin dominance

In 2013, Pantera’s Dan Morehead told investors he was buying 30,000 BTC around $65 and urged them to “buy aggressively.” Twelve years later – after price targets met, an all-time high above $124,000 in August and an administration signaling friendlier rules – Morehead’s thesis hasn’t softened.

He still frames the market in four familiar phases tied to halvings (breakout, hype, correction, accumulation) and argues the cycle remains intact. His call that Bitcoin could trade above $117K by mid-August materialised; now he thinks a run toward $230K over the next year is plausible, with a longer-run path to seven figures.

What changes this time is the policy backdrop and market microstructure. Stablecoin legislation, a policy roadmap from the President’s Working Group and a shift away from blanket “security” designations for most assets have cooled the headline risk that dogged previous cycles.

At the same time, whales are less able to steer the tape than they were a decade ago; ETF rails and institutional treasuries have broadened the holder base, making day-to-day price formation less concentrated. Pantera itself, which once held roughly 2% of BTC supply, now allocates across funds, ventures and redemptions while still keeping about $1 billion in Bitcoin exposure.

Short term, there are still frictions. ETF inflows ebb and flow. Miner selling creeps higher after the halving. Some large wallets rotate into stables and selective altcoins to manage risk.

Yet the cyclical template – post-halving digestion, then trend resumption – keeps analysts focused on the probability that Bitcoin dominance pushes up as macro and regulation align. If rates ease and policy clarity persists, Bitcoin’s store-of-value narrative typically outcompetes riskier assets in the first leg of a renewed advance.

That sets the stage for a more interesting question: if Bitcoin dominance climbs, what could keep it there beyond a pure scarcity story?

Utility is the Missing Link: Where Bitcoin Hyper Fits

The criticism that has trailed Bitcoin for years is simple: unmatched settlement assurances, limited day-to-day utility. Seven transactions per second and no native smart contracts make it a superb vault, less convincing as a programmable platform.

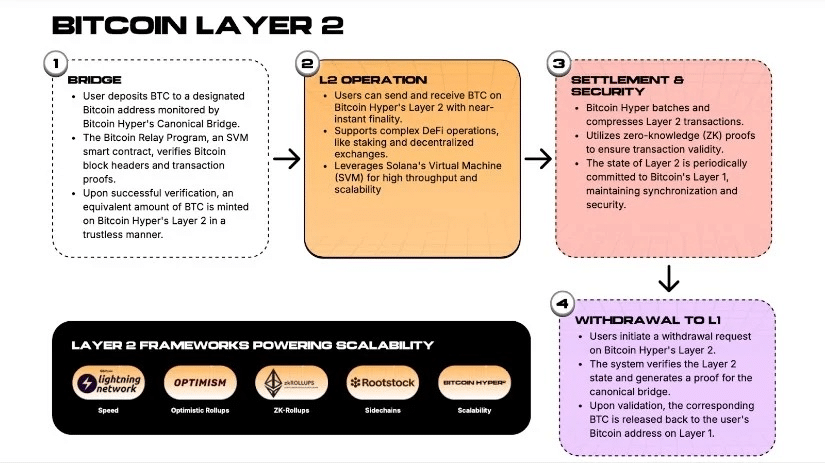

Bitcoin Hyper enters here, positioning itself as a Bitcoin-anchored Layer-2 that borrows execution from the Solana Virtual Machine (SVM), adds zero-knowledge rollup reporting for settlement and connects to L1 through a canonical bridge that locks BTC and issues a wrapped, L2-native representation.

The design objective is not to change Bitcoin’s base layer, but to route high-volume activity off-chain and settle back on L1. In principle, that unlocks the categories that have defined other chains since 2020 – DeFi lending, on-chain market making, gaming, NFTs, tokenised real-world assets – without asking users to abandon BTC as their unit of account or security anchor.

If SVM-grade throughput meets Bitcoin-grade finality, you get the familiar trade-off: milliseconds at the edge, minutes for final settlement, all while fees compress to near-zero at the application layer.

Importantly, this isn’t the first scaling attempt. The Lightning Network delivered meaningful progress for peer-to-peer payments but struggled with routing UX, liquidity management and always-on node requirements that limited mainstream penetration.

Rollup-style L2s are the next swing: push state transitions to a fast lane, prove them succinctly and reserve L1 for final settlement and dispute resolution. Bitcoin Hyper is one of several entrants proposing that model for Bitcoin rather than Ethereum.

If Bitcoin dominance doubles, what drives the second half?

Morehead expects altcoins to outperform over a multi-year horizon as regulatory fog lifts. That view is compatible with a near-term rise in Bitcoin dominance if the first impulse of any new risk cycle is “buy the benchmark, then rotate.” The strategic nuance is what sustains dominance once rotation begins.

A plausible answer is utility gravity: if the most liquid asset suddenly becomes the most useful collateral inside an L2-driven economy, capital may prefer to stay in BTC terms rather than bridge out to other L1s.

This is the bet behind Bitcoin Hyper. If developers can port SVM applications with minimal refactoring and if a canonical bridge makes moving in and out of wrapped BTC straightforward, you can seed an app layer quickly.

That could capture users who already hold BTC in size but were reluctant to traverse multiple chains for DeFi or trading. It also aligns with institutional risk frameworks: custody BTC in cold storage, allocate a sleeve to L2 for yield or market-making and settle back to L1 as policy dictates.

It’s also why early-stage capital is circling the project’s presale. The headline number – roughly $15 million raised and counting – doesn’t validate a technology roadmap on its own, but it does reflect a narrative investors understand: the next leg of adoption requires more than price. It requires a way to make Bitcoin do things.

Headwinds Worth Watching

None of this is predetermined. Bridge infrastructure, even canonical designs, still concentrate liquidity and can become high-value targets. Proving systems matter, but operational security and circuit-breaker design will be scrutinised. Borrowing the SVM is sensible for speed and developer familiarity, but performance in the wild depends on congestion, relayer incentives and MEV-resistance as volumes rise.

A friendlier stance from regulators helps, yet supervisory focus can shift. If L2 protocols fall under money transmission or market-infrastructure rules in some jurisdictions, compliance overhead could alter rollout timelines.

Even with better rails, user behavior is sticky. Ethereum and Solana ecosystems have multi-year head starts, entrenched liquidity and cultural gravity. A migration path needs more than performance – it needs compelling reasons for users to switch.

These are the same questions any new infrastructure layer must answer. The difference is that solving them atop Bitcoin changes the denominator for the rest of the market and, by extension, the debate about Bitcoin dominance.

What a Stronger, Smarter Bitcoin Could Mean For 2025–2026

If the macro script holds – rate cuts, policy clarity and improving liquidity – Bitcoin can plausibly lead risk assets again. Historically, that’s when dominance jumps. The flywheel that could keep it aloft is utility. Should Bitcoin Hyper (or a peer) deliver credible, low-friction programmability anchored to L1 security, the utility gap narrows.

In that world, treasury buyers don’t have to choose between cold storage and on-chain yield – they can do both with governance-approved workflows. Retail users can transact in BTC-denominated apps without bridging into unfamiliar assets. Developers who built on SVM elsewhere can bring proven playbooks to a Bitcoin-settled environment.

None of that guarantees that Bitcoin dominance will “double,” and it certainly doesn’t guarantee that any specific presale will fulfill its roadmap. It does, however, frame a cleaner thesis: dominance tends to rise when Bitcoin is both the safest and the most useful asset in the room. Price cycles and halving math start the move; credible Layer-2s can help sustain it.

JOIN BITCOIN’S RISE WITH BITCOIN HYPER

The first chapter of 2025 has reminded markets why Bitcoin remains the anchor: deep liquidity, regulatory momentum and a cycle template that still maps to reality.

The next chapter asks whether the anchor can also be the engine. Bitcoin Hyper is part of that conversation – a Layer-2 attempt to turn BTC from pure vault into programmable collateral. If it and similar efforts succeed, the case for structurally higher Bitcoin dominance grows stronger.

As always, separate narrative from execution. Track the data that matters – ETF flows, miner balances, L2 throughput, bridge safety, developer adoption and let those signals, not slogans, guide your allocation decisions.

Disclaimer: This article is for informational purposes only and does not constitute financial or investment advice. Cryptocurrency investments are highly volatile and carry significant risk. Always conduct your own research and consult with a licensed financial advisor before making any investment decisions.