In an eventful period for the cryptocurrency market, Ethereum (ETH) transaction fees have seen a significant 80% drop, offering a welcome reprieve to investors troubled by the historically high costs associated with the platform. This decline has come in tandem with a reduced market cap and interest in the meme-inspired altcoin, PEPE, once responsible for a fee surge amid its popularity peak.

Conversely, Binance (BNB), the native token of Binance, has suffered a noteworthy decline, reaching a three-month low in the wake of a lawsuit filed by the Securities and Exchange Commission (SEC). The market's flagship cryptocurrency has not been immune to the turbulence, registering a dip below the $26,000 mark. Amidst this market watch, Sparklo (SPRK), with its unique proposition in the crypto space, is witnessing a momentous leap forward.

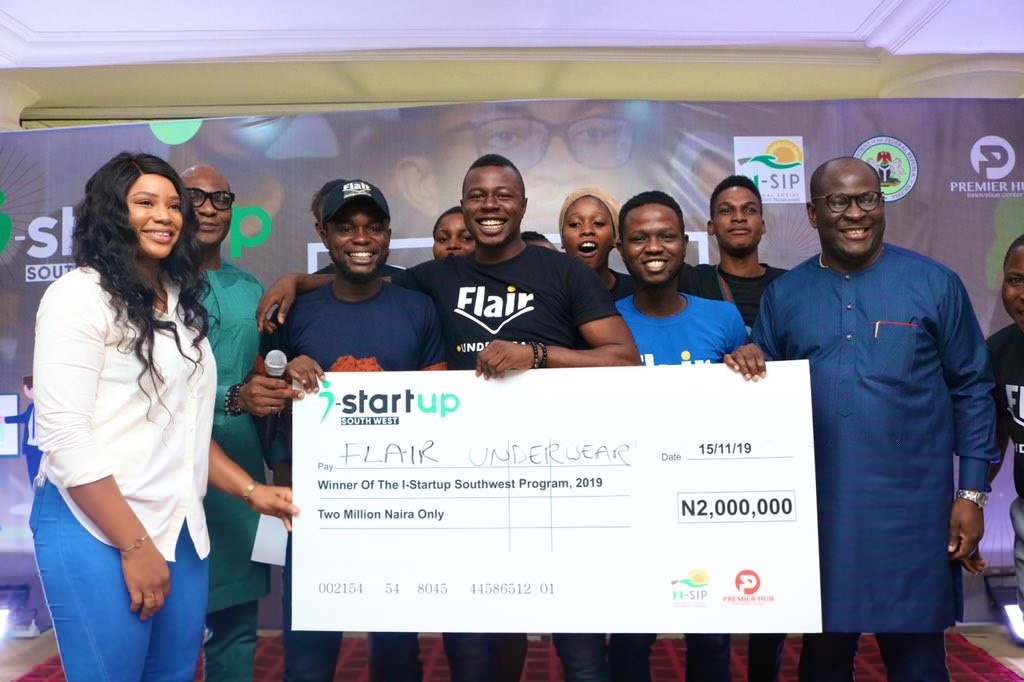

Remarkable Achievements Mark Sparklo's (SPRK) Progress in the Crypto Market

Sparklo has carved a unique niche in the market as a pioneer project catering to long-term crypto investors. The platform facilitates fractionalized trading and investment, enabling purchases of precious metals like silver, gold, and platinum.

Boasting of trust and security, Sparklo has taken steps to lock its liquidity for a century. Further assurances come from its KYC certification received from Block Audit Report, cementing its credibility. Built on the Ethereum blockchain, Sparklo has its native ERC-20 cryptocurrency, SPRK, at the heart of its ecosystem.

SPRK serves as the medium of exchange for the on-chain trading of precious metals. Besides, it provides a gateway to governance rights within the Sparklo ecosystem. To sweeten the deal, the second stage of Sparklo's presale offers SPRK tokens at an enticing $0.036 each, with a 35% bonus on all purchases.

Major Relief as Ethereum (ETH) Transaction Fees Take an 80% Nosedive, Coinciding with PEPE's Decline

The Ethereum (ETH) network breathes a sigh of relief as transaction fees take an 80% dip in a month, a respite for users troubled by escalating costs. Ethereum (ETH) decline runs parallel with the falling interest in the meme-themed altcoin, PEPE, once responsible for a spike in Ethereum (ETH) fees. During May's memecoin mania, Ethereum (ETH) gas fees soared to unprecedented levels since 2022, largely due to PEPE's swift rise, but now, the fees have dropped from a high of $27.62 on May 5th to $5.50 on June 4th.

Ethereum (ETH) Layer 2 scaling solutions too experienced surging transaction fees during the memecoin frenzy. Chains like Polygon zkEVM and zkSync Era using zero-knowledge proofs saw costs varying from $2 to $11, with temporary peaks touching $30. In contrast, PEPE's market cap has dipped from $1.15 billion to $450 million over the past month, indicating a downturn in interest and investor sentiment.

Binance (BNB) Plunges to a 3-Month Low in the Wake of SEC Lawsuit, as BTC Dips Below $26K

Binance (BNB), Bitcoin (BTC), and the broader crypto market have recently faced significant volatility. The lawsuit announcement by the US Securities and Exchange Commission (SEC) against Binance, the world's largest cryptocurrency exchange, triggered an immediate price drop in Binance (BNB) and BTC. Bitcoin, which had been trading sideways at around $27,000 for several weeks, saw a sudden dip below $26K, a low not witnessed since mid-March, following the legal developments.

This market turmoil resulted in liquidations worth approximately $300 million, predominantly from long positions. Even after recovering slightly from its multi-month low, Bitcoin is down by over 4%, and its market capitalization has plunged below $500 billion. Meanwhile, Binance (BNB), perhaps predictably, Binance (BNB) experienced the sharpest drop, declining by 8% in a day and reaching a near three-month low price. Other larger-cap altcoins like Ethereum, Ripple, Cardano, Dogecoin, Solana, Polygon, Litecoin, Avalanche, and Shiba Inu have all seen declines between 5-7%, signaling the widespread impact of the SEC's lawsuit on Binance (BNB). Amid the market upheaval, the total crypto market cap also shed over $50 billion, falling below $1.1 trillion.

Find out more about the presale with the links below;