Investors who understand the workings of market cycles within crypto will be more profitable than those who do not. Bitcoin (BTC) and Ethereum (ETH) prices have been trading flat after recent rallies, which means only one thing, altcoin season has begun. New projects have huge potential to rip, and one, Collateral Network (COLT), has already been forecast to gain 3,500% in its presale.

Bitcoin (BTC)

Bitcoin (BTC) has thrived in the past months as the failings of fractional reserve banking have been highlighted to the world. With decreasing confidence in the dollar, more and more people have begun to look to Bitcoin (BTC). This application-specific hard money may unseat gold as the world’s reserve currency in the coming decade.

Bitcoin (BTC) began in 2009 following the global financial crisis, and the same landscape which birthed Bitcoin (BTC) is helping it gain traction currently. Bitcoin (BTC), after surging upwards, has stalled as money floods into altcoins such as Collateral Network (COLT), and investors would be wise to rotate. Price predictions from analysts vary enormously, with some predicting that Bitcoin (BTC) will trade as high as $180,000 in 2025, whereas more conservative estimates put Bitcoin (BTC) trading between $77,000 and $92,000 in 2025.

Ethereum (ETH)

With the Shanghai upgrade for Ethereum (ETH) scheduled on the 12th of April, many investors have grown increasingly cautious about holding Ethereum (ETH). The Shanghai upgrade will enable Ethereum (ETH) staking withdrawals, and analysts predict that Ethereum (ETH) withdrawals will unleash heavy sell pressure.

However, more bullish analysts and capital fund managers such as Chris Burnisky predict that Ethereum (ETH) withdrawals going live with lead to a greater influx of staked Ethereum (ETH). Regardless of the upgrade, traders should be cautious and, instead of holding Ethereum (ETH), should take advantage of altcoin season and projects like Collateral Network (COLT), which continue to rip to the upside.

Collateral Network (COLT)

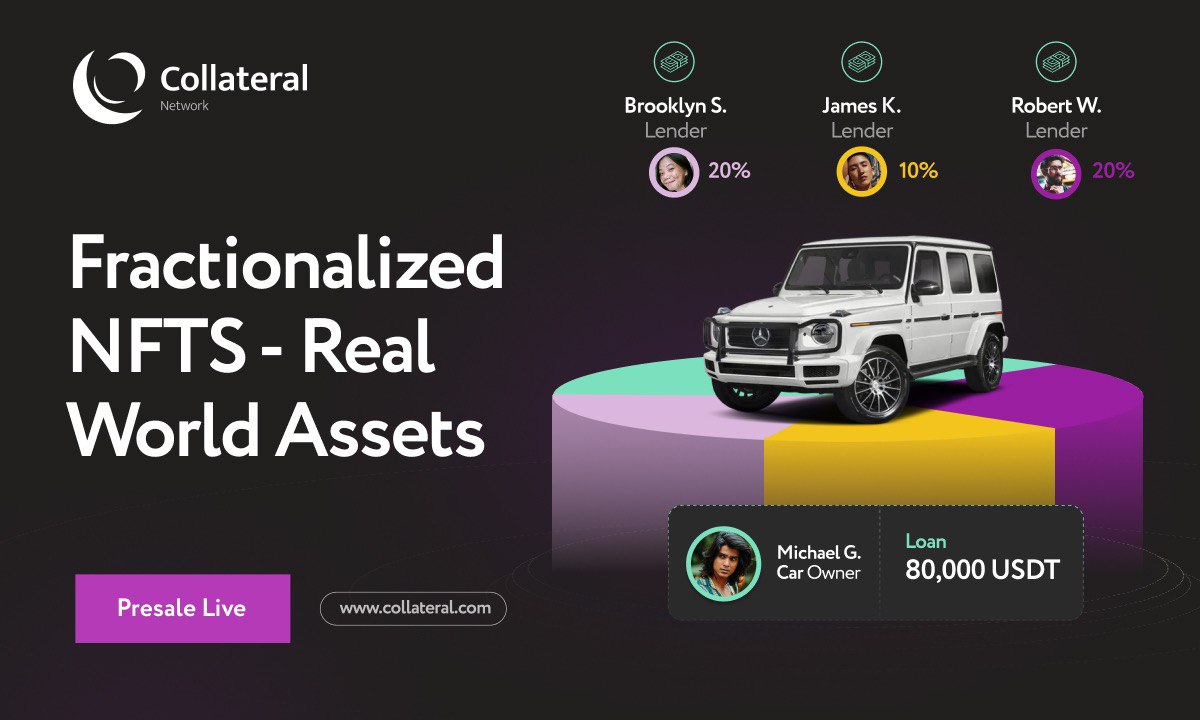

Collateral Network (COLT) has generated a buzz not seen in the crypto landscape for a long time. This challenger lender unlocks liquidity for real-world assets. The growth and integration of real-world assets into DeFi have been an expected growth driver amongst venture-capital firms for several months. Collateral Network (COLT) makes this possible through its use of 100% asset-backed NFTs.

Asset owners can collateralize their assets with Collateral Network (COLT), anything from real estate and vintage cars to fine art and luxury watches. Collateral Network (COLT) mints an NFT 100% backed by the asset, which then becomes liquid. The holder can access the crowdsourced liquidity through fractionalizing the NFT.

The COLT token powers this entire ecosystem and grants discounts to borrowers and lenders, and also enables access to the auction where distressed assets will be sold off. On top of this, it can be staked for passive income, making it a DeFi token with excellent utility cases.

Collateral Network (COLT) aggressively expands liquidity flows and lending potential within DeFi. For this reason, analysts have already forecast a 3,500% growth in its presale. Still, many expect it will rally much harder when it launches on centralized exchanges, and early holders could see a 100X on their initial investment.

Find out more about the Collateral Network presale here:

Website: https://www.collateralnetwork.io/

Presale: https://app.collateralnetwork.io/register

Telegram: https://t.me/collateralnwk

Twitter: https://twitter.com/Collateralnwk